Back in May, Jennifer Davis received a written notice from her landlord: In 30 days, her rent would go from $1.4k to $1.8k — a 25% jump.

Davis, a single woman in her 40s living in Austin, Texas, was used to small market adjustments each year on her one-bedroom apartment. But $400 seemed excessive.

“Nothing about the building or the unit changed,” she told The Hustle. “They basically just said, ‘The market’s hot.’”

For many Americans, it’s a familiar tale.

In the past year, nearly every essential good or service — food, utilities, transportation — has escalated in price. But hikes in rent, typically the biggest monthly expense, have hit especially hard.

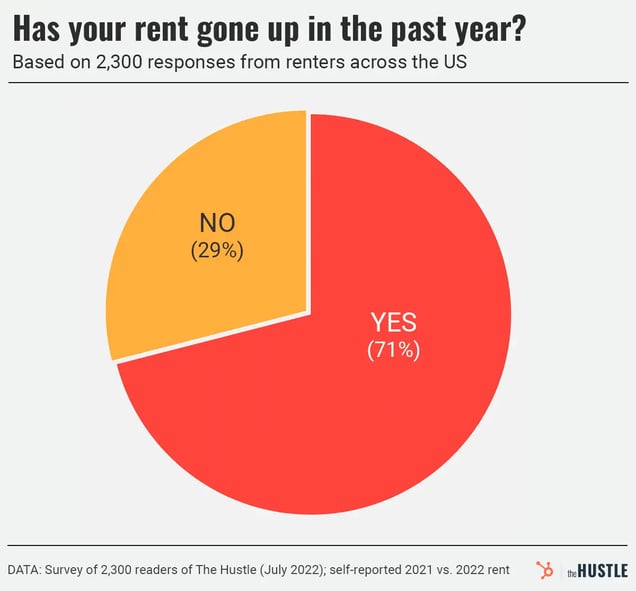

The Hustle recently ran a survey of 2.3k renters and 740 landlords to gain more insight into how much rent has gone up in the past year, and why landlords are boosting up their rates.

Among our findings:

- 71% of renters had rent hikes in 2021-2022

- The average increase was 14.6% (or $275/mo)

- In certain hot spots (Miami, San Diego, Austin), average rent went up 25%+

- 4 out of every 10 renters spend more than 30% of their gross income on rent

- More than half of all landlords cite market demand as the reason for rent hikes

Who got rent hikes in the past year?

Our survey is just a tiny sample size of the 44m renters in the US, so this data shouldn’t be taken as a definitive representation of the rental market at large. The Hustle’s audience is also largely comprised of young professionals who live in nonrural (city or suburban) areas.

That said, these figures still provide a useful snapshot of what the market is like for a certain segment.

Of our respondents:

- 73% rent an apartment/condo (27% rent a single-family home)

- 71% rent a dwelling that is 2-bed or smaller

- 63% don’t have any roommates

- 66% have been in their rental for 3 years or less

- 90% have not had a late payment in the past year

Across the board, 7 out of 10 renters who responded to our survey said their rent went up in the past year (July 2021 to July 2022).

Zachary Crockett / The Hustle

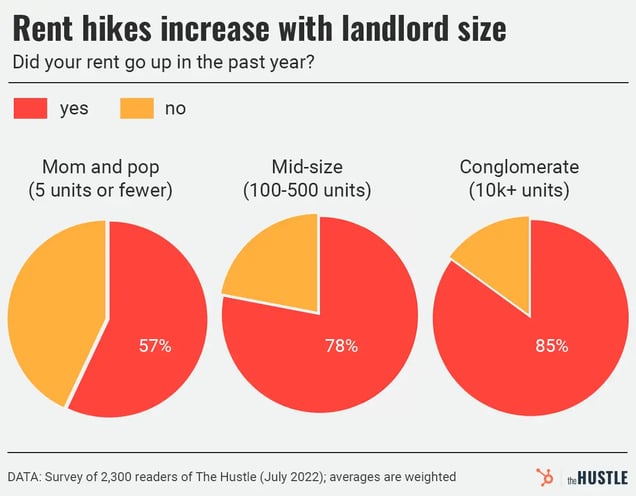

The likelihood that renters got a rent hike varied by the type of landlord they have, scaling up with size.

While 57% of renters with a mom-and-pop landlord (those who own 5 units or fewer) reported a rent increase, that figure jumped up to 85% for renters with a big conglomerate landlord (10k+ units).

Zachary Crockett / The Hustle

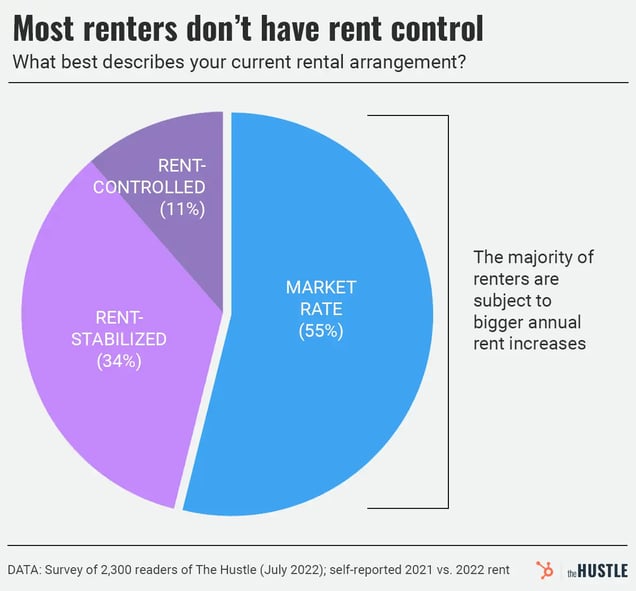

Rent hike likelihood is also variable based on the type of local policies renters have in place.

Only ~11% of the renters in our survey have rent control (rent is locked at a certain price and generally doesn’t go up much over time). An additional 34% have rent stabilization (rent can only go up a small fixed amount each year).

The majority of our surveyed renters — 55% — aren’t protected by either of these measures and are subject to market-rate rents.

Zachary Crockett / The Hustle

Only 20% of renters in rent-controlled units reported a rent hike in the past year, compared to 80% of renters in market-rate units.

How much of a rent hike are we talking?

In the words of political activist Jimmy McMillan: “The rent is too damn high.”

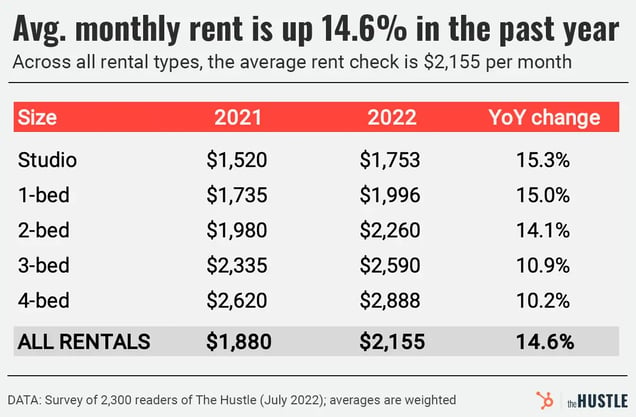

Across all renters, the average reported rent was $2,155, up from $1,880 last year. That works out to a year-over-year increase of $275 per month, or 14.6%.

In our survey, the average studio clocks in at $1.7k, a one-bed runs ~$2k, and a two-bed sets renters back ~$2.3k. Larger units (three- or four-bed) saw comparable dollar amount increases, but the percentage increases were proportionally smaller.

Zachary Crockett / The Hustle

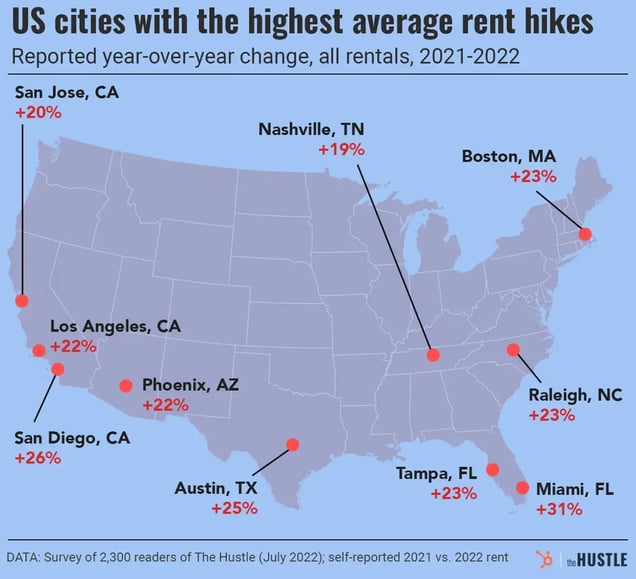

Though our sample size was a bit too small to do a full city-by-city analysis, certain cities with 25+ responses saw considerably higher rent hikes than the overall average.

Cities that were migratory hot spots during the pandemic seemed to see the biggest jumps.

Renters in Miami, Florida, topped the list with a 31% average bump in rent, but places like San Diego (26%), Austin, Texas (25%), and Phoenix (22%) weren’t far behind.

Zachary Crockett / The Hustle

Some renters in our survey experienced rent hikes so high that they decided to move out and try their luck elsewhere:

- Jacqueline (Atlanta, Georgia): “I had to move suddenly because my prior landlord tried to extort a wholly unwarranted 40% increase at my lease renewal.”

- Braden (Austin, Texas): “Management raised the rent on our two-bed by 60%, which is absolutely nuts for a year-over-year increase. We told them to shove it and moved out.”

- Caitlin (Dallas, Texas): “We locked in a lease at $1.8k, and the landlord tried to increase it to $2.5k when it was up. We were able to agree on $2.1k for another six-month lease extension, then we are moving out.”

- Minerva (Fairfax, Virginia): “My corporate landlord wants to raise rent from $2k to $2.8k per month, forcing me and my family of four to move out. The building is in decay and they are not providing any improvements to the unit.”

Others — mainly tenants of mom and pop landlords — have been largely sheltered from from predatory increases:

- Dana (NYC, New York): “I was SHOCKED my landlord only raised rent by $100/mo when the going rate for our house this year in Austin probably jumped $700.”

- Aaron (Sacramento, California): “My landlord only raised rent by 4%. I have been there a long time, and she wants to prioritize good tenants over short-term profits.”

- Gabby (Baltimore, Maryland): “My landlord felt very guilty about asking for more money and was willing to waive it if we had a huge problem with it because we’re ‘good tenants.’ Would absolutely recommend mom-and-pop landlords.”

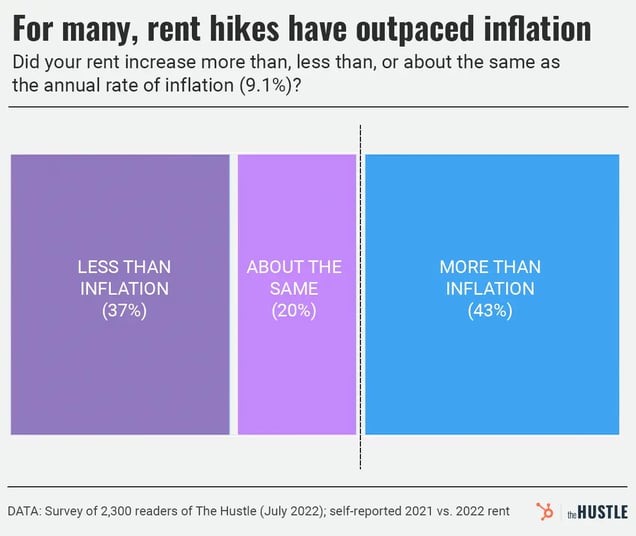

But for 43% of the respondents in our survey, rent has increased at a steeper rate than year-over-year inflation (9.1%).

Zachary Crockett / The Hustle

The rate of rent hikes has also outpaced the rate of increased earnings.

While 71% of renters saw a rent hike in the past year, only 54% reported a pay bump to compensate for those increased living costs.

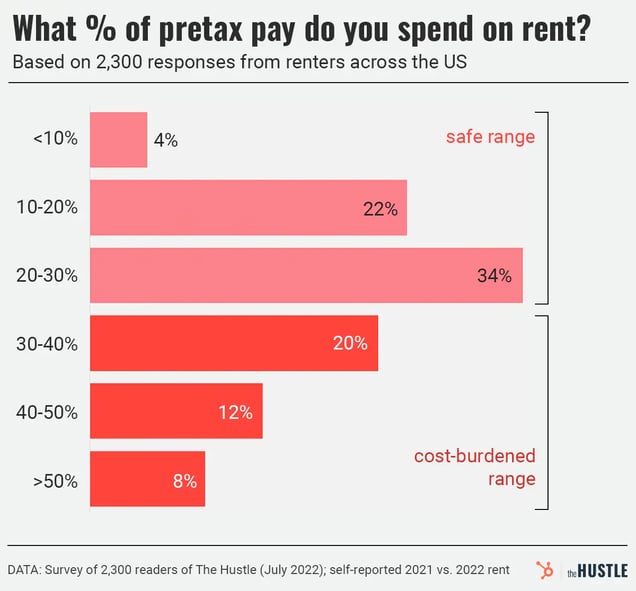

Most financial advisers recommend that no more than 30% of gross (pretax) income should be spent on rent. A federal amendment found that anyone who spends more than this is “cost-burdened.”

So, if you earn $100k per year ($8.3k gross per month), you should only be spending ~$2.5k/month on rent.

But per our survey, 4 out of every 10 renters spend more than 30% of their gross income on rent. Nearly 1 in 10 spends 50%+.

Zachary Crockett / The Hustle

This shouldn’t be much of a surprise given the financial challenges that younger generations face. Millennials now collectively carry over $1T in debt, and 47% live paycheck-to-paycheck.

Why the hikes?

What do landlords have to say about this? We asked 740 of them, ranging in scope of ownership from one to five units to 50+ units.

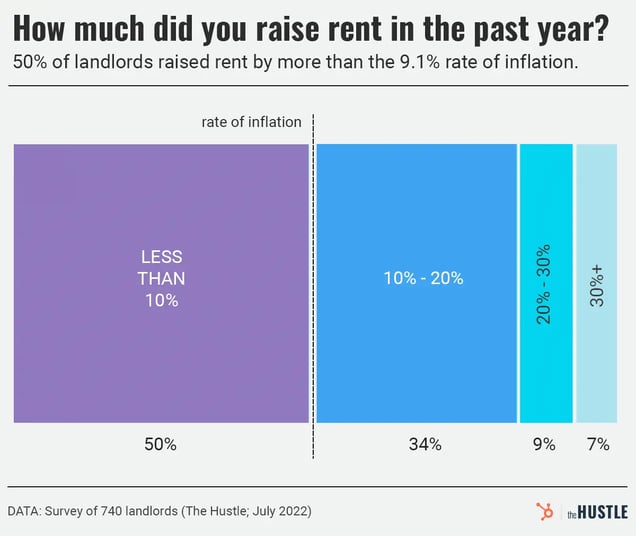

Of the landlords surveyed, a slightly lower percentage (68%) say they issued a rent increase than what renters themselves reported. Among the hikers, there was an even split:

- 50% say they issued rent increases equal to or less than the rate of inflation

- 50% say they issued rent increases above the rate of inflation

Roughly 1 in 6 landlords say they hiked rent by 20% or more year-over-year.

Zachary Crockett / The Hustle

They provided a few different justifications for this:

- Tim: “The market dictates the rent, not the landlord. It’s simple supply and demand.”

- Michelle: “I raised 50% because landscaping cost us a fortune with increased labor, gas, and material prices. Small landlords like me shouldn’t be lumped in with the big corporate entities.”

- John: “[Conglomerate] rental companies take inventory out of the sales market and then increase rent. I base my rents off their comps.”

- Scott: “We don’t take on the risk of owning rental properties as a charity enterprise, and we don’t always have years where we make money. It’s a business investment plan.”

- Darla: “Improvements cost a lot of money. Water heaters used to be $450. Now they are $1,295.”

- Kylie: “The costs of everything went so high [these] past two years that it was impossible not to raise rent — insurance, taxes, the cost of keeping staff. We’re not taking any all-inclusive trips to Bali; we’re trying to barely remain profitable.”

- Ryan: “Insurance and property taxes have increased ~30% YoY [in the] last 3 years. My net income has decreased even though my rents have gone up.”

- Sara: “I own in a hot market and can do what I want.”

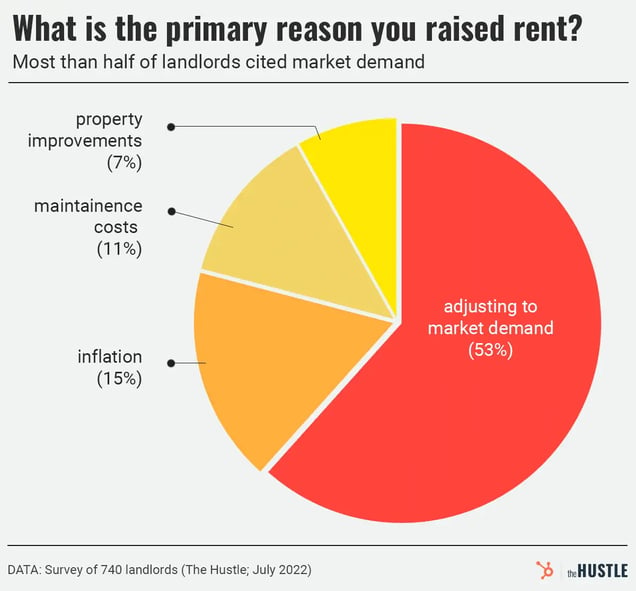

When asked to identify the main reason they raised rent, more than half of landlords cited market demand, rather than expense-related reasons (inflation, maintenance costs, property improvements).

Zachary Crockett / The Hustle

If there’s any silver lining to this, it’s that the rental market does appear to be cooling off just a touch — at least for now.

Some experts, like Crystal Chen of the rental marketplace Zumper, say that in light of inflation and talk of a possible recession, many renters appear to be tightening their budgets by moving in with roommates, sacrificing on space or location, or moving back in with family.

“They’re sending a clear message to property owners that they’re not willing, or able, to pay sky-high rents,” she said.

Among those messengers: Jennifer Davis, the renter in Austin who saw a 25% hike this year.

“I just told my landlord I’m leaving,” she says. “But now I have to fight to get my security deposit back.”