Earlier this year, Ryan Klein had a near-death experience.

While cleaning out a gutter at his California home, the 32-year-old IT professional took a misstep and tumbled 10 feet off a ladder into a fortuitously placed wintergreen shrub.

Sprawled out on the ground, gazing up at the cerulean sky, a terrifying thought crossed his mind.

“I realized that my wife didn’t have access to my cryptocurrency,” he told The Hustle. “If I’d died that day, that money would’ve just disappeared.”

The following weekend, Klein took action: He wrote down his private keys and account passwords, typed up detailed instructions on how to access his holdings (~$77k worth of various coins), and entombed the information in a small safe in his closet.

Klein is one of a growing number of crypto investors who are beginning to give serious thought to the afterlife of their bitcoin.

And a burgeoning digital asset inheritance industry is taking note.

The dead man’s crypto dilemma

If Klein had died that day, it’s likely that one of two things would’ve happened to his assets:

- If he had a will, they’d be distributed to whomever he legally designated to be his successor(s).

- If he didn’t have a will, a decedent (typically a spouse) would apply for probate, and then his state would’ve designated an administrator to dole them out according to a formula.

A will stipulates who gets what, but it generally doesn’t include a comprehensive list of a deceased person’s assets. It’s the job of an executor — someone designated in a will, or appointed by a court — to track everything down.

Traditional investments (say, a savings account at a bank) are relatively easy to find, access, and delegate with a death certificate and other legal documentation.

But crypto poses some unique challenges.

Zachary Crockett / The Hustle (GIF via Skeleton Party)

Unlike traditional bank accounts, which are registered under a legal name and subject to oversight, digital assets like Bitcoin and NFTs don’t have a central regulatory authority.

Crypto investors maintain their own assets using digital wallets that are only accessible via a password or a private key — a 256-bit long string of alphanumeric characters that is only known to the account holder.

Without these private keys, there is little hope of heirs ever accessing a dead loved one’s crypto holdings.

Had Klein died without sharing his private key with his wife, it’s likely his crypto holdings would’ve been stuck in permanent purgatory on the blockchain.

By one estimate, ~20% of all bitcoins are “lost,” meaning the wallets containing them haven’t been accessed in 5+ years. This works out to ~3.7m bitcoin, or ~$140B in capital (as of publication) — and that doesn’t include the 10k+ other cryptocurrencies on the market.

A significant percentage of this lost crypto is thought to be the result of investors dying without leaving behind a pathway of access to heirs.

There have been a few high-profile cases of this nightmare situation:

- In 2018, Gerald Cotten, the CEO of the crypto exchange Quadriga, unexpectedly died at age 30, allegedly taking with him the private keys to $250m worth of his clients’ cryptocurrency.

- Also in 2018, Mathew Mellon, a businessman who’d turned a $2m investment in the cryptocurrency Ripple into a reported $500m+, died without telling anyone where his private keys were stored. His wallets have yet to be located.

- In 2013, a 26-year-old Bitcoin miner named Matthew Moody died in a plane crash, leaving behind no way to access thousands of dollars’ worth of crypto. Years later, his father is still trying to recover the funds.

Despite these tales, many crypto investors haven’t given much thought to the afterlife of their bitcoin.

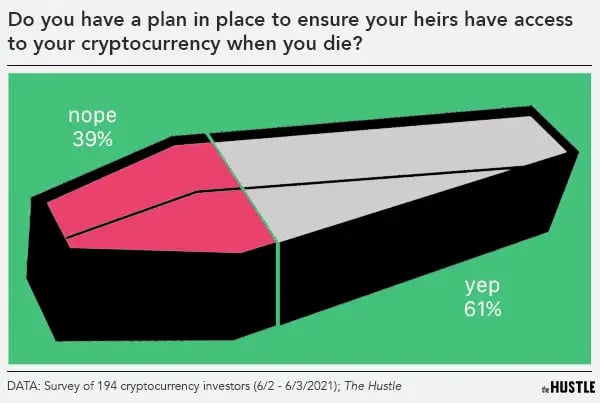

In a survey of cryptocurrency investors conducted by The Hustle, nearly 40% of respondents reported having no plan in place to pass on their cryptocurrency to an heir.

Zachary Crockett / The Hustle

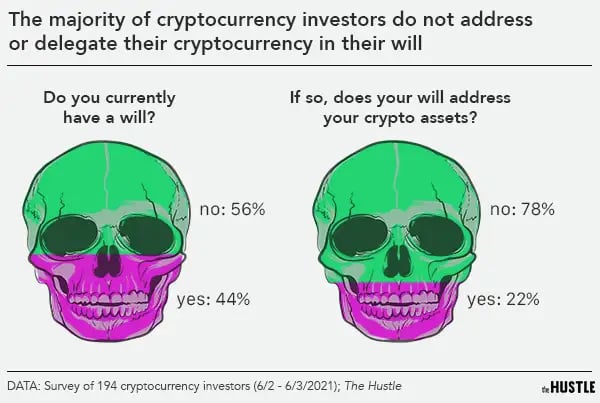

Crypto investors skew on the younger side (the average holder is 38) — and surveys suggest that this demographic doesn’t give much thought to wills, trusts, and the logistics of inheritance.

Even among those surveyed who do have wills, only 22% include digital assets.

Zachary Crockett / The Hustle

“Cryptocurrency investors overwhelmingly tend to be male millennials who aren’t thinking about the next stages in life,” says Daniel Maegaard, a prolific 30-year-old crypto and NFT investor whom The Hustle profiled earlier this year. “Most are focused on immediate gratification.”

But in the wake of a pandemic and a 2021 cryptocurrency boom, the YOLO crowd is beginning to take mortality a bit more seriously.

To my dear mother, I bequeath my Dogecoin

When Erin Bury’s uncle-in-law passed away a few years ago, he left behind nothing — no key documents, no account information, no will.

The ensuing treasure hunt to piece together his assets was so painstaking that it inspired the Candian entrepreneur to launch Willful, a digital estate planning service that aims to reimagine the outdated inheritance process.

In the past year, Willful has seen a swell in interest from younger investors looking to pass on their crypto holdings.

Bury recommends a simplified process for passing down crypto:

- Write down a detailed list of your crypto assets, where they’re located, and how to access them.

- Store this information in a secure place (or multiple places).

- Assign a digital executor to access and delegate your crypto.

- Create a will to specify who gets what.

For all of the complexities of crypto and blockchains, the prevailing method for sharing account information is surprisingly old-school.

“Most people just write down everything on a piece of paper and put it in a safe,” says Bury.

Zachary Crockett / The Hustle

Many Hustle readers who responded to our survey have opted to keep things analog:

- Alice Riley-Ryan (recruiter, New York): “I wrote out my master password on a piece of paper that I store at my parents’ house. I’ve walked them through the necessary steps to access my crypto in case of an emergency.”

- Lauren Garcia (grad student, California): “I have 2 sets of laminated papers with keys in different locations so my mom can access and cash out my Dogecoin.”

- Jack O’Brien (engineer, New York): “I have a notebook on my desk with instructions.”

- Lawrence Phillipp (retired military, Arkansas): “My long-term girlfriend has my Coinbase password and will log in and immediately sell off my bitcoin when I die. It’s not elegant, but neither is death!”

Some combine paper copies with digital backups.

Fernando Gutierrez, a 44-year-old entrepreneur in Switzerland, first started investing in crypto in 2013. By 2017, his holdings grew to the point where he felt the need to set a long-term plan.

In addition to keeping 2 paper copies of his keys in secret locations, he built his own dead man’s switch, a device that automatically sends a message containing access instructions to his wife if a certain interval of time passes between his online activity.

Willful’s CEO opts to store her own list of digital assets and instructions in a Google Drive folder titled “When I Die.” She also uses the password manager 1Password to share login credentials with her husband.

The Hustle

But others, like Maegaard, don’t feel comfortable sharing private keys with anyone — even family members and loved ones.

“I’ve opted for maximum security, which means no one else has access to my crypto assets,” he says. “In the event of an accident, the crypto assets on my hardware wallets would be lost forever.”

For Maegaard, whose assets are worth millions, the risk of exposing his private keys is greater than the risk of an untimely death.

The rise of crypto inheritance platforms

Legal experts say there is some validity to these fears.

“To put private keys on a USB, or a piece of paper and pass it on — that’s fraught with potential issues,” says Parker Taylor, an attorney who specializes in estate law.

“There’s no oversight from a court or a 3rd party like you have with a bank. What if you give access to a beneficiary and they just walk off with all the crypto? What if your lawyer or trustee changes? There are all sorts of things that can happen.”

In recent years, a number of services have popped up offering crypto investors more secure alternatives for passing on digital assets:

- TrustVerse uses AI and private smart contracts to store keys and passwords.

- Safe Haven allows users to store private keys on the blockchain and set in place their own distribution parameters.

- Clocr has a digital safety vault that “shreds” passwords and distributes pieces of it to multiple locations.

- Casa splits up access between multiple keys stored on a separate devices that can be distributed to various trusted parties, so that no single person has the ability to access your crypto.

Casa’s CEO, Nick Neuman, tells The Hustle that signups to the platform’s “diamond” tier — a $5k/year plan that includes an inheritance protocol — have nearly doubled in the first 6 months of 2021.

“We’re seeing an influx of relatively younger crypto investors who just had kids and are starting to think more deeply about legacy,” he says.

The Hustle

Most of these platforms are focused on the security protocols surrounding the safe transfer of private keys and account information.

But accessing the crypto introduces a second layer of complexity.

Under the Revised Uniform Fiduciary Access to Digital Assets Act (RUFADAA), it’s technically illegal to log into a dead person’s account.

Coinbase, Binance, and other popular cryptocurrency exchanges have their own systems for dealing with dead holders that are similar to what a bank might require.

To access a Coinbase account, for instance, a beneficiary must provide the platform with a death certificate, a will, and other documentation, then wait to be approved for a transfer of funds.

“The laws are not evolving as fast as the technology,” says Patrick Hicks, the head of legal at Trust & Will, an online will-planning service.

What about taxes?

Let’s say you’ve cleared all of these hurdles. What becomes of your assets after you die?

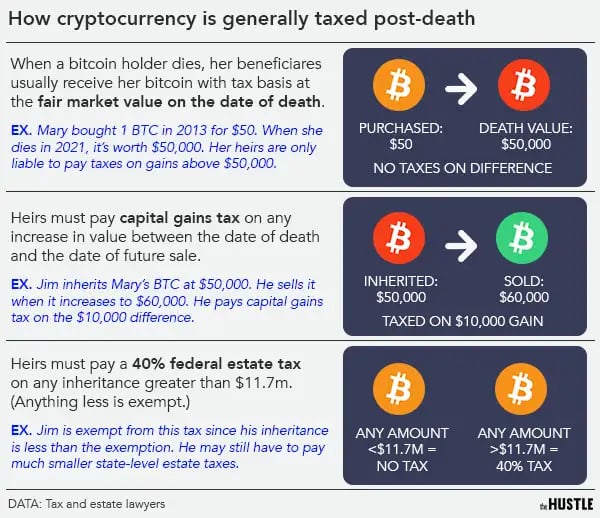

When your heirs inherit your crypto, it’s treated as property and is generally taxed like any other asset: 1) It’s valued as of the date of death; 2) It’s subject to capital gains tax on any gains from the date of death; 3) Under current law, any amount over $11.7m is subject to a 40% estate tax.

Zachary Crockett / The Hustle

Let’s say you bought a bitcoin in 2013 for $50, and by the time you die, it’s worth $50k. If your heirs sell it for $60k, they’ll only pay capital gains tax on the $10k difference. And because the inheritance is less than the $11.7m exemption, they’ll also pay no federal estate tax.

“One of the benefits of dying, if you will, is that taxes on your bitcoin are mostly forgiven for your heirs,” says Hicks.

Of course, all of this is all a lot to think about — and for some folks, it’s simply not worth the procedural slog.

“When I die,” one reader told us, “my bitcoin dies with me.”

Editor’s note: Thanks to our Trends analyst Julia Janks for the idea to look into this topic.