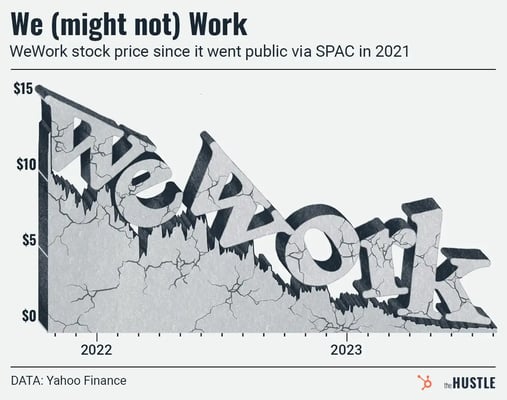

WeWork has cheated death 2x before — in 2019 and 2021 — but this time feels different.

The coworking company told its investors this week there is “substantial doubt” it can stay afloat. To say its stock has plummeted would be disrespectful to the word “plummeted.”

- The cost of a souvenir WeWork share this morning would make a parking meter scoff — just 18 cents.

How’d we get here?

Hubris certainly played a role: The exploits of its founder, Adam Neumann, are literally already a TV show.

- Neumann pushed an unsustainable rate of growth and expanded the company’s focus before getting its core business in order — with a would-be empire of schools, apartments, gyms, and even Martian colonies in mind instead.

Covid didn’t help matters, but WeWork’s first brush with death came before the pandemic. The company spent wildly on leasing, renovating, and outfitting prime real estate around the world — but never attracted enough customers to pay for it.

As a result, WeWork has lost $15B since the end of 2017, per The New York Times. Once valued at $47B, its closing valuation on Thursday was just $274m.

Can this be salvaged?

If so, don’t expect the company to look the same as it does today; WeWork’s only path back to viability includes major cost reductions.

It’s still seeking a new CEO to lead the way there, per Reuters. The last man to fill the seat, Sandeep Mathrani, departed in May. Three board members also exited this week.

Plus, customers “are canceling memberships at a faster clip than expected,” per The Wall Street Journal.

In nature doc terms, a defenseless WeWork has nowhere left to hide — the lion is gonna pounce, it’s gonna be a gruesome scene, and here we all are, unable to look away.