Look Ma, no code! Low-code platform Quick Base sells majority stake for $1B

Vista Equity partners is buying a majority stake in coding for dummies platform, Quick Base, putting the software company at a billion dollar valuation.

Published:

Updated:

Related Articles

-

-

Why gaming giant Unity dropped billions on an acquisition

-

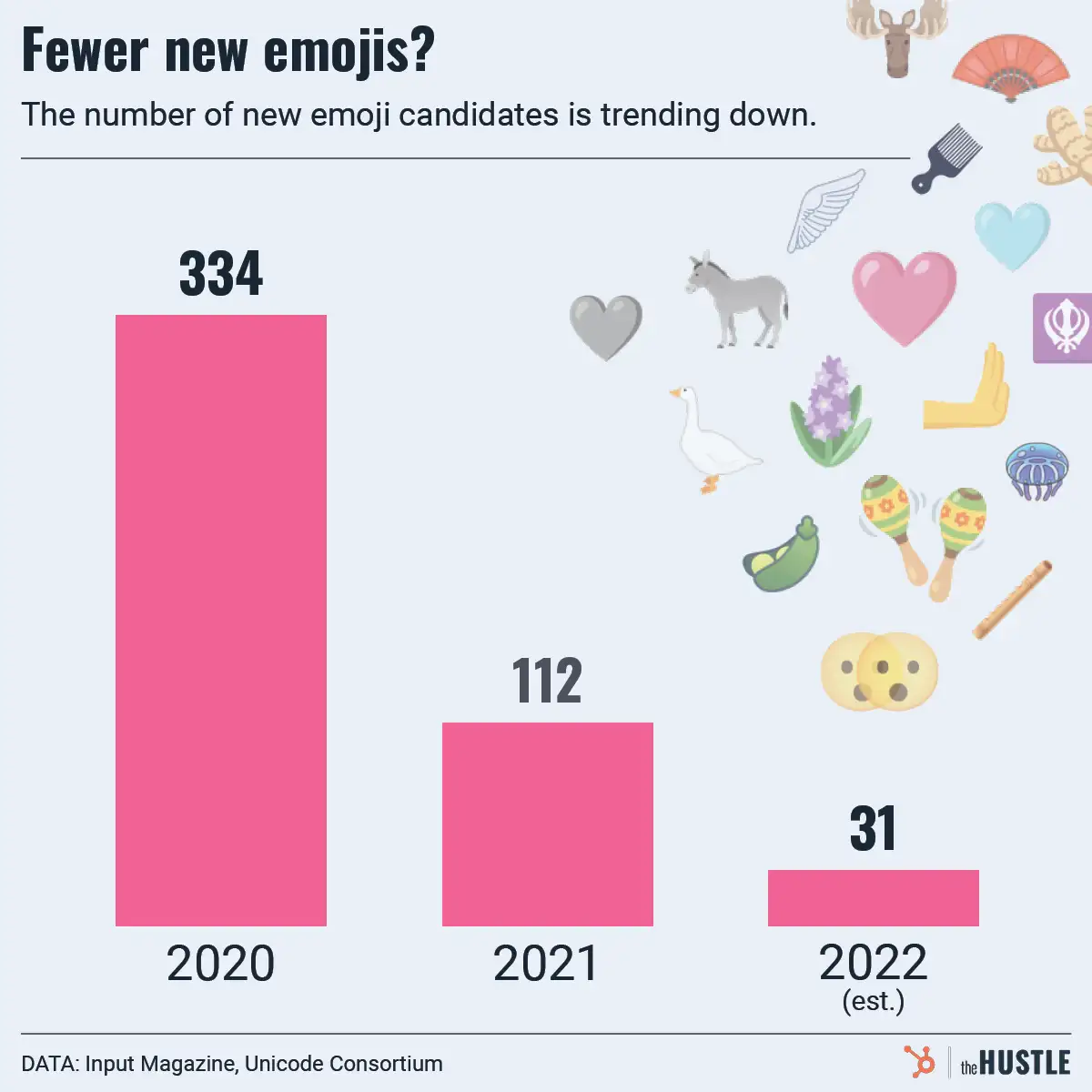

Emoji growth is slowing. Why?

-

What’s going on with ‘hacktivists’ and Ukraine?

-

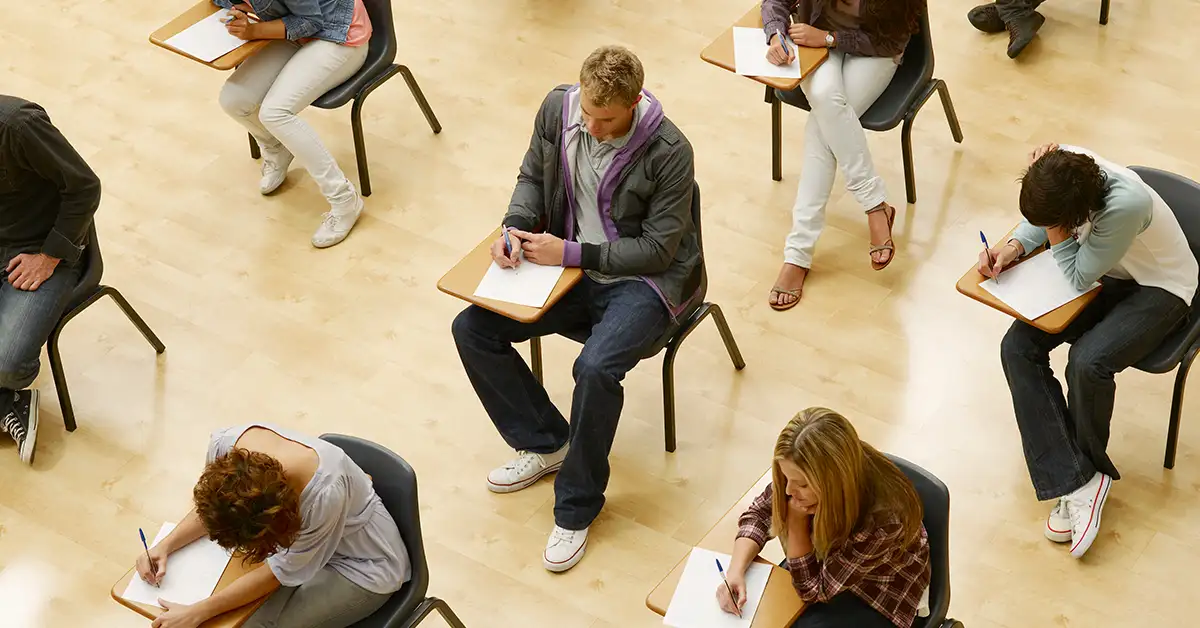

Exam software is booming, but is it ethical?

-

Sure, out-of-office messages are fine. But what if they were carols?

-

Autodesk’s platform play, explained

-

By the numbers: 50m pounds of syrup, child care’s 1% profit margins, and more

-

Adobe’s next act: Web-based, AI, and NFT products

-

Loom and the rise of asynchronous video