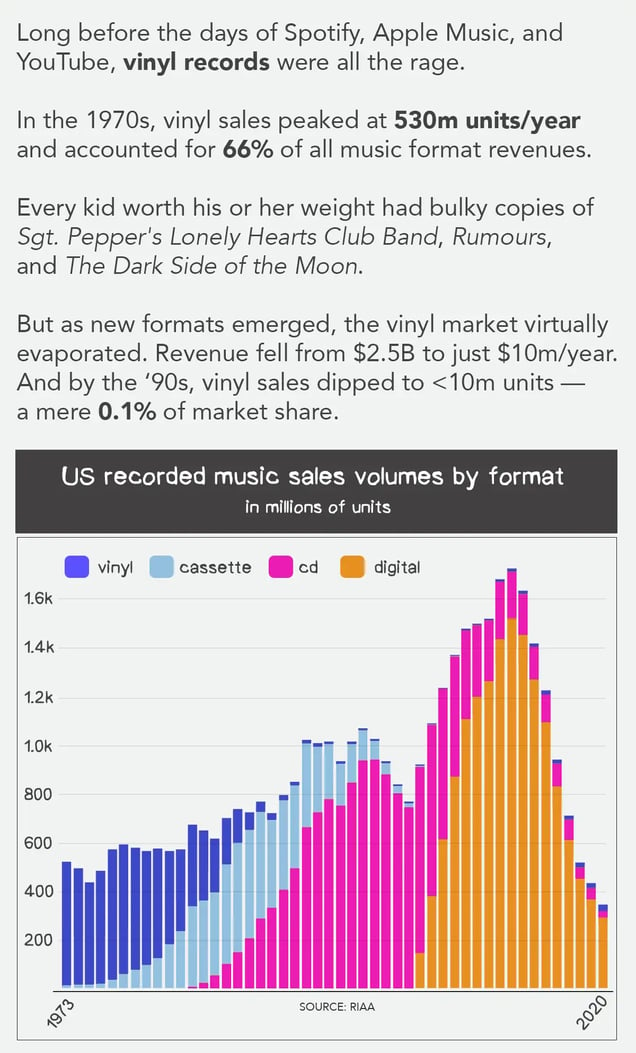

Long before the days of Spotify, Apple Music, and YouTube, vinyl records were all the rage.

In the 1970s, vinyl sales peaked at 530m units/year and accounted for 66% of all music format revenues.

Every kid worth his or her weight had bulky copies of Sgt. Pepper’s Lonely Hearts Club Band, Rumours, and The Dark Side of the Moon.

But as new formats emerged, the vinyl market virtually evaporated. Revenue fell from $2.5B to just $10m/year.

And by the ‘90s, vinyl sales dipped to <10m units — a mere 0.1% of market share.

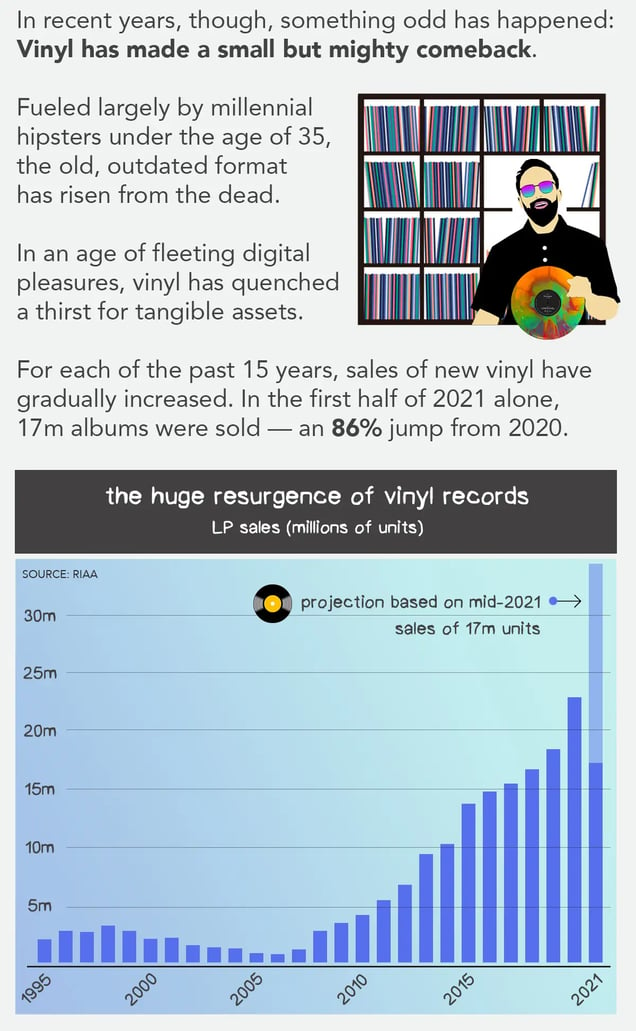

In recent years, though, something odd has happened: Vinyl has made a small but mighty comeback.

Fueled largely by millennial hipsters under the age of 35, the old, outdated format has risen from the dead.

In an age of fleeting digital pleasures, vinyl has quenched a thirst for tangible assets.

For each of the past 15 years, sales of new vinyl have gradually increased. In the first half of 2021 alone, 17m albums were sold — an 86% jump from 2020.

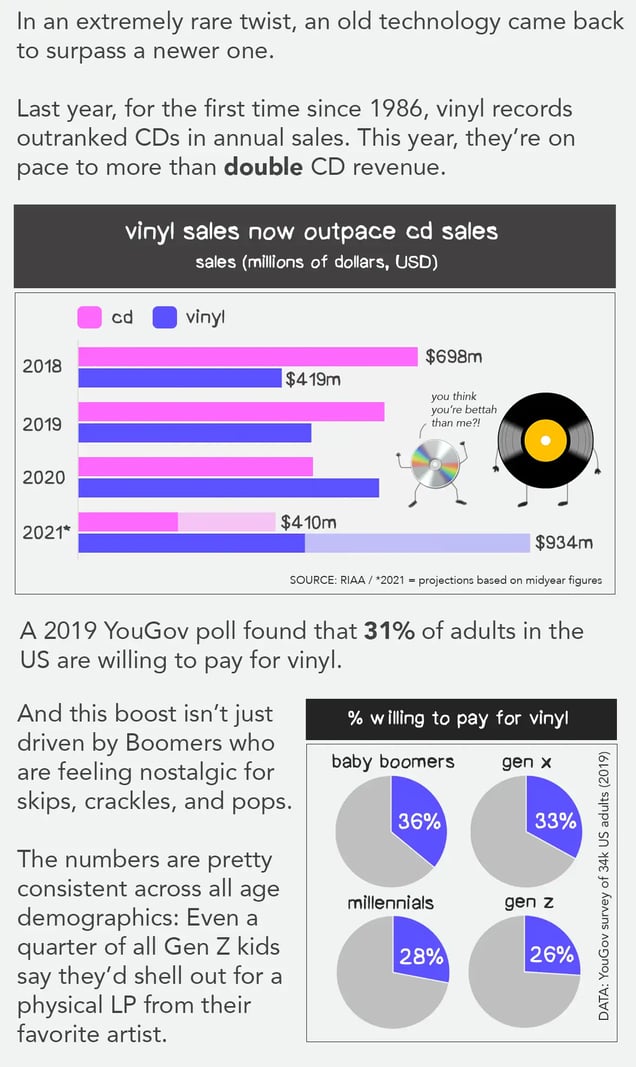

In an extremely rare twist, an old technology came back to surpass a newer one.

Last year, for the first time since 1986, vinyl records outranked CDs in annual sales. This year, they’re on pace to more than double CD revenue.

A 2019 YouGov poll found that 31% of adults in the US are willing to pay for vinyl.

And this boost isn’t just driven by Boomers who are feeling nostalgic for skips, crackles, and pops.

The numbers are pretty consistent across all age demographics: Even a quarter of all Gen Z kids say they’d shell out for a physical LP from their favorite artist.

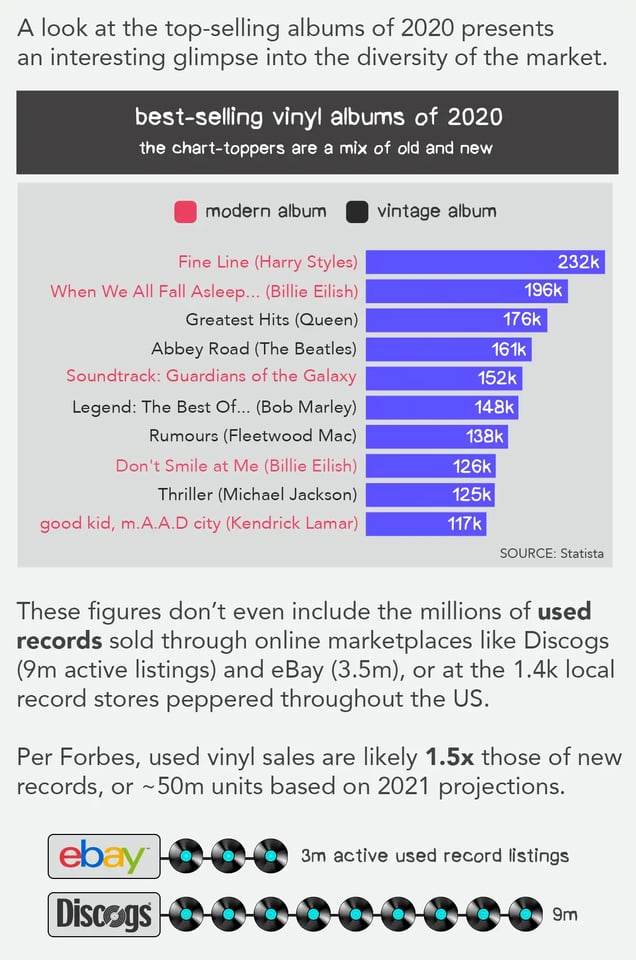

A look at the top-selling albums of 2020 presents an interesting glimpse into the diversity of the market.

These figures don’t even include the millions of used records sold through online marketplaces like Discogs (9m active listings) and eBay (3.5m), or at the 1.4k local record stores peppered throughout the US.

Per Forbes, used vinyl sales are likely 1.5x those of new records, or ~50m units based on 2021 projections.

For modern-day indie artists, it’s a welcome boom.

A vinyl record costs ~$7 to manufacture, and a band typically sells it directly to fans for $25 — good for $18 in profit.

By contrast, streaming services only pay out a fraction of a penny for each listen.

A band would have to amass 450k streams on Spotify to match the profit of 100 vinyl sales.

But manufacturing a record is an intensive process:

- A master disc is created by imprinting digital files onto a lacquer plate with a lathe machine.

- The master disc is copied onto a stamper via a process called electroplating.

- The stamper is sent to a pressing plant, where copies of the record are made with vinyl pellets.

- Album jackets are printed, wrapped, and shipped for distribution.

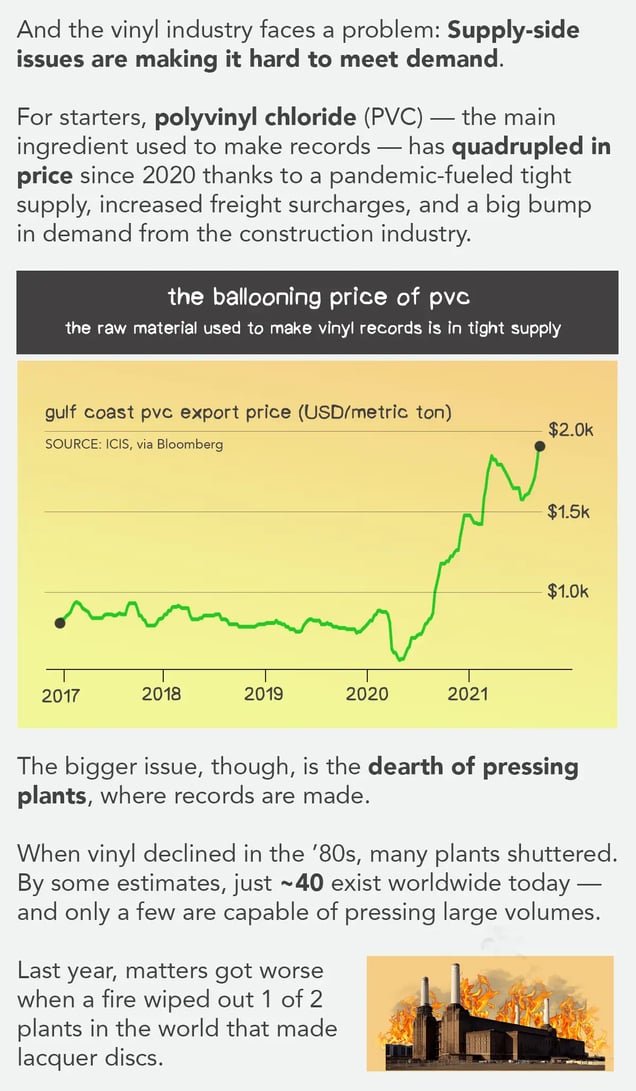

And the vinyl industry faces a problem: Supply-side issues are making it hard to meet demand.

For starters, polyvinyl chloride (PVC) — the main ingredient used to make records — has quadrupled in price since 2020 thanks to a pandemic-fueled tight supply, increased freight surcharges, and a big bump in demand from the construction industry.

The bigger issue, though, is the dearth of pressing plants, where records are made.

When vinyl declined in the ’80s, many plants shuttered. By some estimates, just ~40 exist worldwide today — and only a few are capable of pressing large volumes.

Last year, matters got worse when a fire wiped out 1 of 2 plants in the world that made lacquer discs.

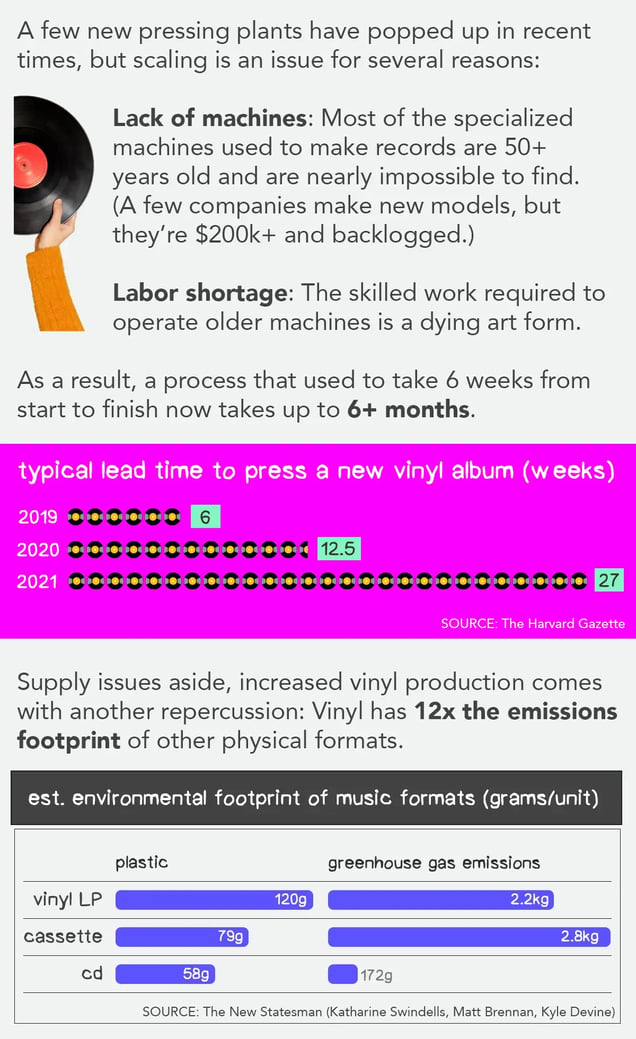

A few new pressing plants have popped up in recent times, but scaling is an issue for several reasons:

- Lack of machines: Most of the specialized machines used to make records are 50+ years old and are nearly impossible to find. (A few companies make new models, but they’re $200k+ and backlogged.)

- Labor shortage: The skilled work required to operate older machines is a dying art form.

As a result, a process that used to take 6 weeks from start to finish now takes up to 6+ months.

Supply issues aside, increased vinyl production comes with another repercussion: Vinyl has 12x the emissions footprint of other physical formats.

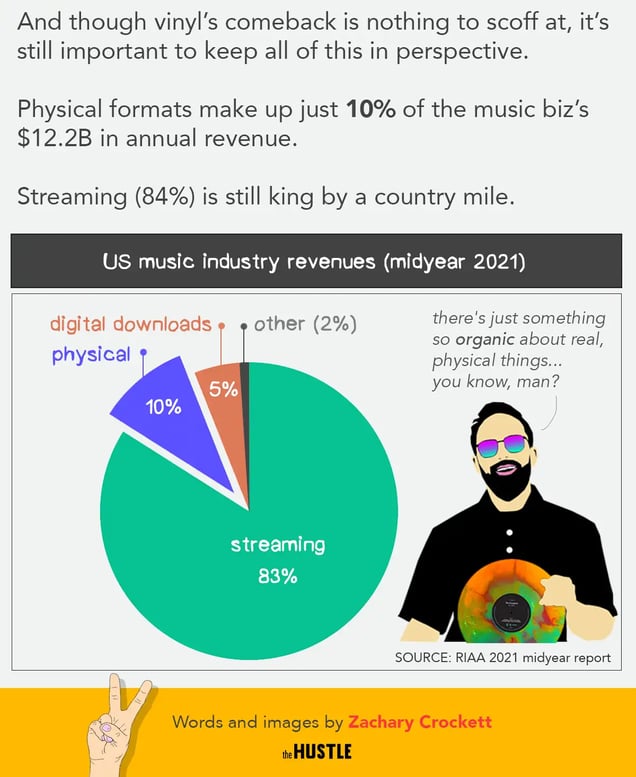

And though vinyl’s comeback is nothing to scoff at, it’s still important to keep all of this in perspective.

Physical formats make up just 10% of the music biz’s $12.2B in annual revenue.

Streaming (84%) is still king by a country mile.