Finally, on Nov. 30 — 1,470 days after Elon Musk’s 2019 unveiling of the Cybertruck — the first trucks will be delivered to customers.

Great news for the Tesla faithful, right? Eh. Sure.

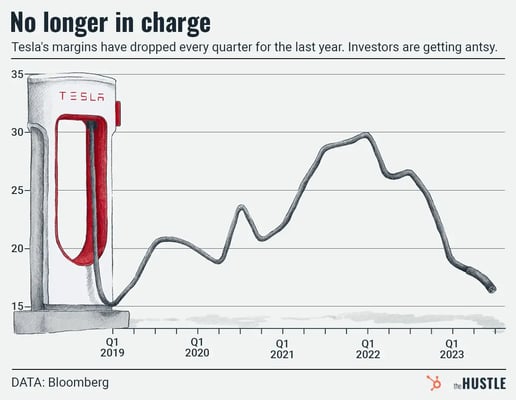

Last week’s earnings — “Worse than the last set, which were not good at all,” per Bloomberg — have soured the mood around the EV company, where years of explosive growth are finally descending back to reality.

It’s a pretty harsh reality

Investors have long rallied around Tesla’s potential as a high-margin tech company that just so happens to make cars, only to watch it continually slide closer toward being, welp, just your average car company.

Like other automakers, Tesla is “now only modestly profitable, and getting less so,” per Fortune.

- The numbers are stark: Tesla’s operating margin has been more than halved over the last year. Same with its operating profit, which has dropped $1.9B.

This heaps more pressure on the Cybertruck. Though, even if it dazzles, it’ll likely remain a sore spot for a while, per Bloomberg:

- With production challenges ahead, Musk said it may take another 18 months before the truck helps the bottom line.

- The boss himself even admitted that Tesla “dug our own grave with Cybertruck.”

Looking for a bright spot?

It isn’t easy right now:

- New car sales ain’t it — up against high interest rates and tight consumer budgets, Tesla’s aggressive price cuts still haven’t sufficed to lift sales.

- Neither is production, as the company will delay construction on a crucial Mexican factory.

But here’s one: Unlike other treacherous points in the company’s history, it has the cushion to get things turned around.

Tesla’s got some wins in reserve — its storage battery unit is doing well, and it just swayed another big fish (Toyota/Lexus) to adopt its charging connector.

And, oh yeah: It still has $26B in the bank, a whole $26B more than we’ll ever have. So there’s that, too.