For investors, Tesla’s price cuts are kinda like parallel parking in New York City — tough to watch, impressive when nailed.

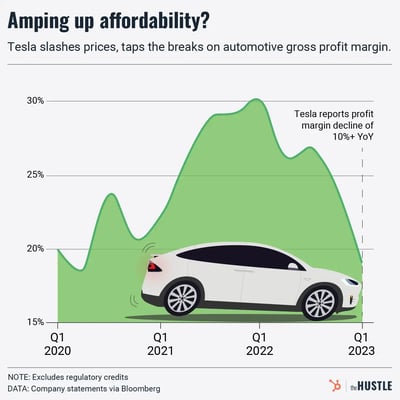

Whether the automaker has nailed its latest cuts, which Elon Musk says will “enable affordability at scale,” remains to be seen.

Driving a hard bargain

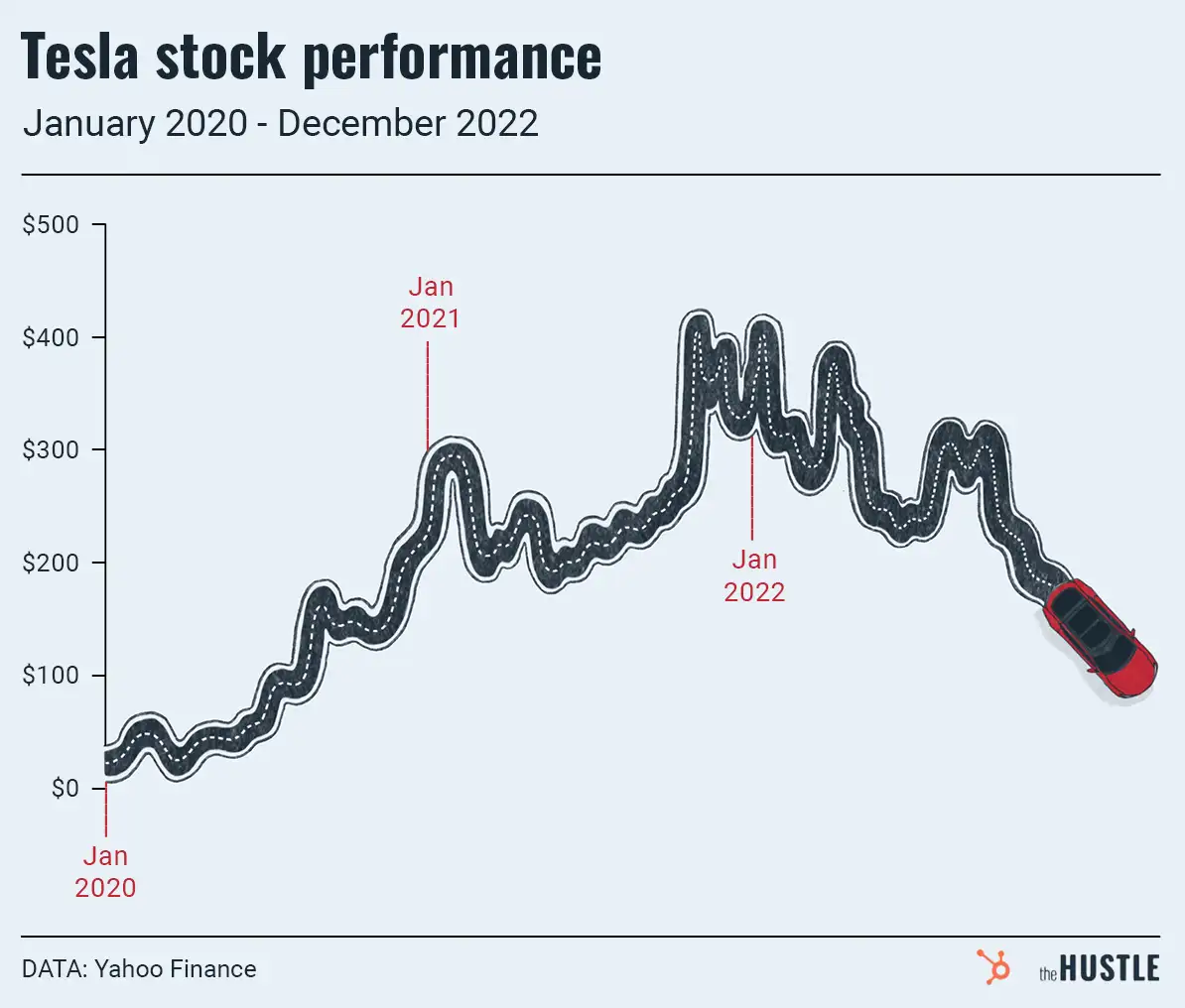

Last week, Musk assured investors Tesla remains the only automaker capable of selling cars for “zero profit” today, thanks to high-margin driverless software that will allow its cars to appreciate in value (and which was supposed to debut years ago).

- Already in 2023, the company’s Model Y has seen its price drop $20k+, or 30%, to ~$47k — $759 below that of the average US vehicle.

You’re unlikely to find anyone looking to buy a Model Y who’s going to complain about this — because that would be odd.

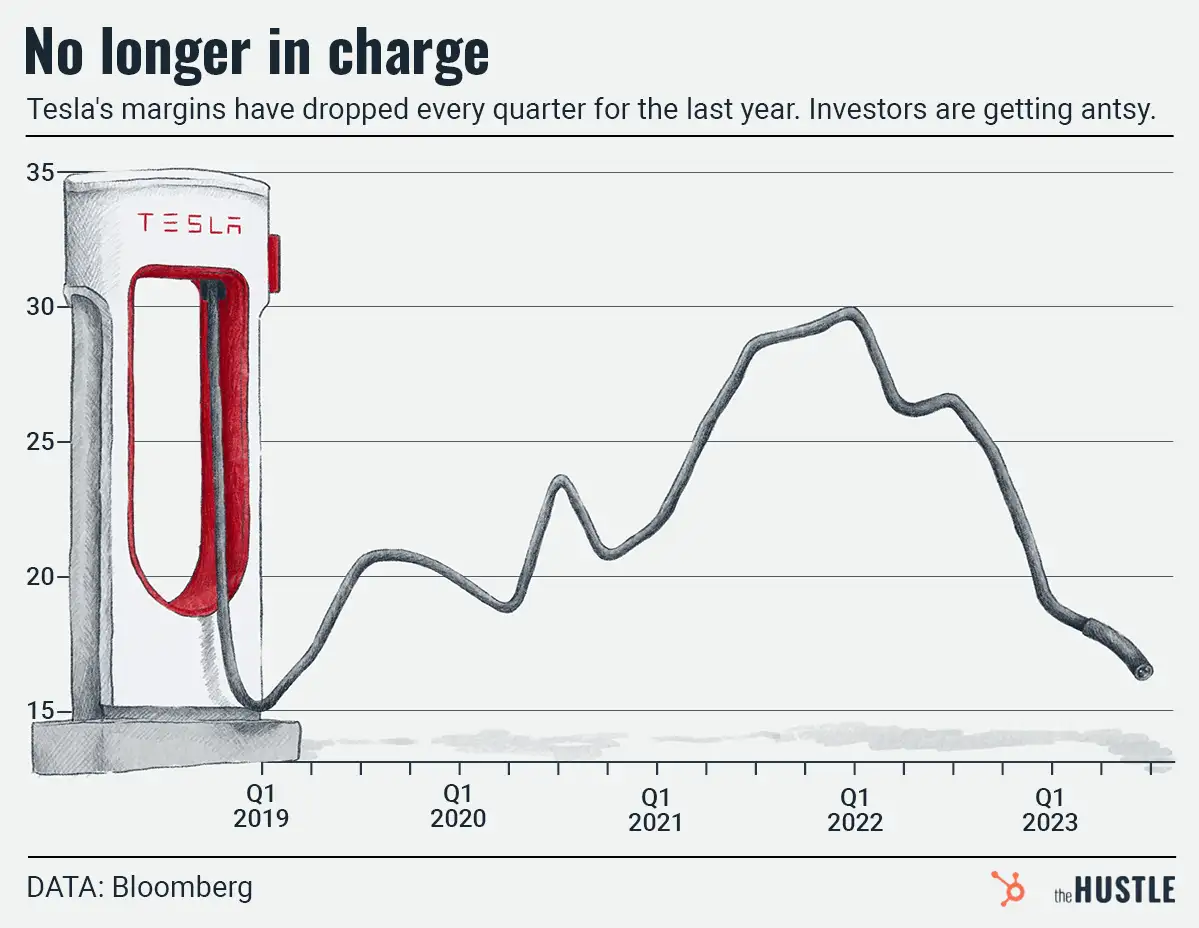

But head over to Wall Street, and you’ll find a whole bunch of folks questioning its impact on Tesla’s profit margins, which, while still strong at 19% in Q1, was the company’s lowest in 11 quarters.

Shifting gears

Some analysts wonder whether these cuts will challengeTesla’s competition enough that they’ll be forced to slow pricey EV pivots, or worse yet, go out of business.

- “We are trying to resist,” Luca de Meo, CEO of French carmaker Renault, recently said in regard to Tesla’s cuts.

Whatever the case: Remember, there’s always the option to get a Hongguang Mini, General Motors’ $4.5k Trojan horse that outsold Tesla’s Model 3 in China last year.