Stanley Druckenmiller (Source: Bloomberg / Getty Images)

***

You can also listen to this interview on Spotify, Apple or your favorite podcast player.

***

Stanley Druckenmiller is widely considered one of the greatest investors ever.

Born in Pittsburgh in 1953, he studied English at Bowdoin College before starting work towards an Economics PhD at the University of Michigan. In 1977, he dropped out of the PhD program and joined the Pittsburgh National Bank as a retail investment analyst.

After learning the ropes, Druckenmiller founded his own investment firm in 1981 — Duquesne Capital Management. He established such a strong track record that hedge fund legend George Soros recruited him to work at the Quantum Fund, which he did from 1988 to 2000.

As the Quantum Fund’s lead portfolio manager, Druckenmiller helped Soros pull off one of the single greatest trades: In 1992, the pair “Broke the Bank of England” with a bet against the British Pound that netted a $1B pay day.

Following his long partnership with Soros, Druckenmiller built Duquesne Capital to a peak of $12B of assets under management. In 2010, he returned all of his investors’ money and converted Duquesne into a family office.

Why?

Druckenmiller no longer wanted to deal with the “stress” of maintaining such an exceptional trading record.

And the record is almost peerless: over more than 4 decades of investing, Druckenmiller has never recorded a down year (his fund even notched a return of +11% in 2008). During one stretch, he compounded assets at 30%+ a year for 30 straight years. Today, he has a net worth of $5B+.

To find out more, The Hustle recently spoke with the trading legend. The conversation was set up by Toggle AI, an investing AI startup that Druckenmiller counts among his investments.

Druckenmiller tells us:

- What makes a great investor

- How he makes an investment decision

- Whether we are in another tech bubble

- What career advice Druckenmiller has for 20-year olds

- What he thinks of crypto (Bitcoin, Ethereum and Dogecoin)

- Which Big Tech firm will be the first to reach a $5T valuation

And a whole lot more. Enjoy.

[This conversation took place on May 11th, one day after Druckenmiller wrote an op-ed for The Wall Street Journal stating that the US Federal Reserve’s current monetary response to the pandemic is too aggressive. He says the Fed is keeping emergency measures (e.g., low interest rates, hundreds of billions in monthly bonds purchases) in place even as the economy is recovering. This loose monetary policy is creating conditions for a rapid rise in inflation.]

***

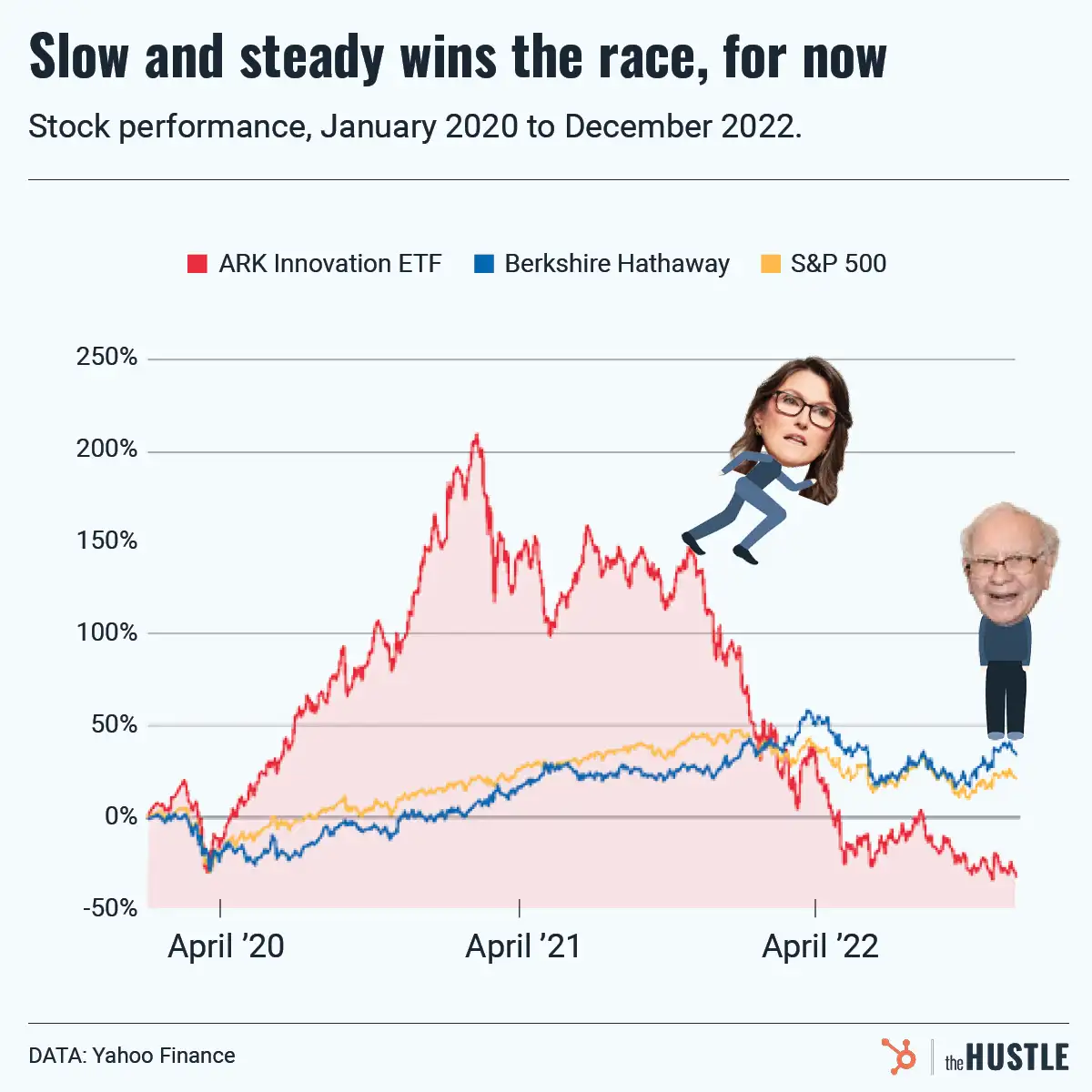

On the parallels between the recent tech sell-off and the Dotcom Bubble

Takeaway: Like the Dotcom Bubble, current tech valuations are “speculative”. However, Druckenmiller believes today’s high-growth tech stocks — particularly those involved with digital transformation (e.g., cloud stocks) — will be able to grow into these valuations within 3-4 years.

—

Stanley Druckenmiller: I’m seeing some similarities and I’m seeing some differences [with tech stocks today and during the Dotcom Bubble at the turn of the century].

Number one: valuations in both periods go to what I would call “speculative levels”.

Monetary policy was part of the issue in 1999, when [Fed Chairman] Alan Greenspan decided he would run an experiment and let unemployment go to lower levels than it had historically been.

It’s nothing like the crazy stuff we’re doing now, but that helps set it up for what was really going on back then.

Think about the fact that Netscape really didn’t really exist until 1995. So, other than some nerdy professors back in the early 80s, no one even had email, right? The internet was just sort of being built and the big winners in 1999 were companies like Sun Microsystem and Cisco, that were building the guts of the internet.

The growth was so rapid as this went on and valuations — combined with some easy money — got baked in.

But think of the internet infrastructure like the railroads 150 years ago. Think of the tech stocks like a company selling railway ties and building the guts of the internet.

When you’re building the railroad, your sales are going up +50, +60 or +70% a year. But once the railroad is built [you don’t need the railway ties anymore]. Your growth not only doesn’t go up 70%, it goes down because on a rate of change basis, you don’t need any more railroad ties.

None of us — me included — saw that in early 2000. A lot of these companies with estimates of +50-70% growth for the next 2-3 years had businesses that were literally about to collapse. So the NASDAQ went down 95%. Not 30%, but 95%. Because you had this combination of inflated values, way over-estimated earnings and then an earnings collapse.

Today, you have something similar and something different. Monetary policy is absolutely insane. We had no quantitative easing (QE) back then. And our [interest] rates weren’t 0%. They were 4% or 5% when they probably should have been 6% or 7%. No comparison.

So we have an asset bubble. Now that’s not just in tech stocks, it’s in everything. I know some of the [young] backers of Dogecoin might disagree.

If you’re an asset, you’ve been moving.

From 1995 to 2000, you had an incredible wave while the internet was being built. What you have now is this incredible wave of digital transformation, particularly moving onto the cloud.

I used to say 2-3 years ago in some interviews that we’re in the bottom of the first or second inning in terms of digital transformation. And this is a 10-year runway.

Well, COVID sort of jumped you from the bottom half of the first first inning to the sixth inning. I think [Shopify CEO Tobi Lutke] said we went from 2019 to 2030 [in terms of e commerce sales] in one year.

I think the difference now is if you haven’t moved to the cloud, you’re dead because who you’re competing against, they can just beat you because the technology is so important.

So, now full disclosure, I didn’t see what was coming in 2000. But I [have a difficult time coming up] with a scenario that this digital transformation thing is going to collapse and these SAAS companies are going to go away.

The biggest problem you have now is the overall bubble and asset prices. The good news is if we had this conversation 2 months ago, the good [SAAS stocks] were like 45-50x sales. Not earnings but sales. They’re down to — there’s a range — I’d say now 10-25x sales for the good ones.

So if the problem is price and — in my opinion — that is the problem: a lot of that has been wrung out. And I think if you hold these names for 3-4 years, they could easily grow into their valuations.

[In comparison] if you held the names in 2000, a lot of these companies you still would have lost 90% of your value, right? So those are the similarities and those are the differences.

***

On the potential for a strong value stock comeback

Takeaway: There is likely more money to rotate out of growth stocks into value stocks. The Big Tech names (e.g., FAAMG) should not be seen as growth stocks, though, and actually offer decent value at current prices.

—

Stanley Druckenmiller: The other similarity is back then, I remember a lot of value managers virtually going out of business in 2000. Julian Robertson — one of the greatest investors of all time — was long value and short these crazy tech names.

He basically threw in the towel and said he couldn’t take it anymore and stopped managing money in the early 2000s. But what happened in the next 3-5 years was incredible. Companies like Phelps Dodge copper companies went up 6-8x times for the old industrial stuff. So everything Julian was long, went up many fold and the tech stocks went down a lot.

We do have some similarities today because these COVID companies are beneficiaries of so much demand pulled forward. They got too high and had too much ownership.

And as [the economy] is reopening, there’s also an ownership problem where there’s probably more money that needs to rotate out of the secular [tech] growers into reflation names. But I do want to say, very differently from [the Dotcom bubble]: I do think these things are secular growers and they’ll probably be fine long term.

Amazon at $3200 is not a bubble stock. Not whatsoever. It’s basically decent value. I don’t just mean Amazon, but a lot of the big FAAMG names.

***

On which of the FAAMG names might first reach $5T

Takeaway: As a total guess, Amazon followed by Microsoft.

—

Stanley Druckenmiller: What a great question. I’ve always answered [this type of question] with Amazon and Microsoft.

I’ve never really believed Apple had the innovation to take you the next level and it is mainly a hardware company. They obviously have morphed into the services app company.

Apple doesn’t get talked about as much as a monopoly company, but its behavior — charging a 30% rent to all these little companies — seems extreme. Amazon and Microsoft basically don’t raise prices.

So before I give my first guess: I have no idea.

If you put a gun to my head or we’re going to Vegas:

- #1 would be Amazon

- #2 would be Microsoft.

Google could have a big pop, ironically, if the government breaks them up because their core search business is literally the best business I’ve ever seen.

But they keep trying all this experimental stuff that challenges shareholder value. But those guys are so rich. They’re more interested in changing the world right now and good for them.

***

On the biggest risks to the equity market

Takeaway: The biggest risk is if rising inflation forces the US Federal Reserve to raise interest rates.

—

Stanley Druckenmiller: Without a doubt: inflation strong enough that the Fed responds to it.

No doubt about it. This bubble has gone long enough and it’s extended enough that the minute they start tightening, the equity market should go down a lot.

Particularly with so much of the cap weighted in growth stocks, which would be hit the worst.

And our central case is that inflation occurs, but we’re open-minded to something like ‘07-’08 when you never really got to the inflation because the bubble popped. So, inflation never got to the manifestation stage.

The second one in terms of geopolitical stuff: I’m worried about Taiwan. I think it’s probably not a worry until after the [Beijing Winter Olympics in 2022]. I don’t think Xi Jinping wants to deal with sanctions and boycotts. This is not some little thing where Yemen is fighting Saudi Arabia.

If you were to get worried about the United States and China, that could be an exogenous event that could get nasty. That’s our central case but — as you know — I tend to change my mind.

***

On the long-term effects of the retail trading and Wall Street Bets

Takeaway: Retail traders will remain a force, but with investments in less “radioactive names” than GameStop.

—

Stanley Druckenmiller: When I started in the business [in the mid-1970s], retail dominated institutions. You got most of your information from your brokers.

The amazing thing for current retail investors is that they have access to things like Toggle, so they’re actually much better informed than the retail investors were in the late-80s and early-90s.

And with the internet, we have tools and [ways to] congregate.

The big risk is retail is all loaded up in this stuff. Don’t confuse a genius with a bull market. [Retail investors could] lose enough money that they’re scarred.

I always thought the Japanese investors would come back to the market in 5-10 years after the [Japanese asset bubble] burst. That was 1990 and they still haven’t come back.

So, I worry but I think — my guess — is the after effect of Wall Street Bets is here to stay and they’ll probably migrate away from some of the more radioactive names like GameStop.

But I think it’ll actually end up being some core healthy information moving through the sharing network.

***

On how Toggle or other investing tools could have been used in the 1980s

Takeaway: Druckenmiller believes in having a multi-disciplinary approach to investing (e.g., fundamentals and technicals). A product like Toggle — which creates financial analytical tools for hedge funds and retail alike — is another useful tool for an investor to have in the toolkit.

—

Stanley Druckenmiller: When I started in the business, Fed watching was considered unique. I used Ned Davis [Research] and other technical services.

I felt I had a huge advantage over the general public.

Toggle is used to predict price moves but — even more interesting because of its mathematical capabilities — the tool can analyze thousands of securities.

I only have 16 hours a day and I’m not that fast of a reader.

So, if you had a tool like that back then, it would have been like my advantages times 5.

[When it comes to investing], I like a multi-disciplinary approach. My first boss taught me technical analysis. So, I use fundamental analysis and technical analysis. If there are 1000s of securities out there and my portfolio is only going to have 15-20, I’m never going to buy something that doesn’t have a great chart and fundamentals.

Toggle is just one more fantastic screening mechanism that gives me discipline. So, right now, I have a triple screen to buy, hold or sell a security. To the public who doesn’t have access to information that I have as an institutional investor, something like Toggle is value add. Maybe even more valuable than it is for me and I find it valuable.

***

On making concentrated, high conviction bets

Takeaway: The best investors (e.g., Warren Buffett, Carl Icahn, George Soros) make concentrated bets in high conviction plays. They don’t practice the business school teaching of “diversification”.

—

Stanley Druckenmiller: When I’ve looked at all the investors (that) have very large reputations — Warren Buffett, Carl Icahn, George Soros — they all only have one thing in common.

And it’s the exact opposite of what they teach in a business school. It is to make large concentrated bets where they have a lot of conviction.

They’re not buying 35 or 40 names and diversifying.

I don’t know whether you remember that Icahn a few years ago put $5B into Apple. I don’t think he was worth more than $10B when he did that.

[In 1992] when I went in to tell Soros that I was going to short a 100% of the fund in the British pound against the Deutschmark, he looked at me with great disdain.

He thought the story was good enough that I should be doing 200%, because it was sort of a once-in-a-generation opportunity.

So, [these investors] concentrate their holdings. This is very counterintuitive.

In my thinking, [concentrating your bets] decreases your overall risk because where you tend to be in trouble is if you have 35 or 40 names.

If you start paying attention to one. If you have a big massive position, it has your attention.

My favorite quote of all time is maybe Mark Twain: “Put all your eggs in one basket and watch the basket carefully.”

I tend to think that’s what great investors do.

***

On knowing when to sell

Takeaway: If the reason you bought a security changes, then you should sell. Conversely, just because a stock falls XX%, it doesn’t mean you have to sell if the thesis remains (Druckenmiller *never* uses a stop loss).

—

Stanley Druckenmiller: The other thing to me [that makes a good investor] is you have to know how and when to take a loss. I’ve been in business since 1976 as a money manager.

I’ve never used the stop loss. Not once. It’s the dumbest concept I’ve ever heard. [If a stock goes down 15%] I’m automatically out.

But I’ve also never hung onto a security if the reason I bought it has changed. That’s when you need to sell.

If I buy X security for A, B, C, and D reasons and those reasons are no longer valid, [I sell].

Whether I have a loss or a gain, that stock doesn’t know whether you have a loss or a gain.

You know, it is not important. Your ego is not what this is about. What this is about is you’re making money.

So, if I have a thesis and it doesn’t bear out — which happens often with me, I’m often wrong — just get out and move on.

Because I said earlier: if you’re using the most disciplined approach, you can find something else. There’s no reason to hang on to any security where you don’t have great conviction.

***

On managing emotions while investing

Takeaway: Fighting emotions is a lifelong battle in investing. It doesn’t matter how long you’ve been in the game.

—

Stanley Druckenmiller: You just have to be disciplined and you’re constantly fighting on emotions. Look, I’m not going to lie to you. My first boss had the saying, “the higher they go, the cheaper they look.”

There’s something weird and I know everybody watching this has this experience.

It doesn’t make any sense, but when a security goes up, every bone in your body wants to buy more of it. And when it goes down, you’re fighting and making yourself not sell it.

It’s just the nature of the beast.

And you have to constantly remind yourself why you own that security.

And just because it’s going down, that doesn’t necessarily mean you should sell it. If it’s going down, it definitely means you should reevaluate your thesis, but it doesn’t mean you should sell it.

And you cannot get crazy when it’s going up.

***

On the biggest investing mistake he’s made

Takeaway: Druckenmiller lost $3B by buying in at the top of the Dotcom Bubble. Even with 20+ years of investing experience at that point, he couldn’t stomach watching others make money while he was on the sidelines.

—

Stanley Druckenmiller: This was one of my biggest investing mistakes.

Somebody asked me what I learned from this and I said, “Nothing. I already knew it.”

In January of 2000, after riding that tech boom to a T and making billions of dollars in 1999, I sold everything.

I had a couple of internal portfolio managers at Soros who didn’t sell out. They had smaller portfolios but made 30% after I sold.

And I just couldn’t stand it anymore. And I’m watching them make all this money every day. For two days, I’m ready to pick up the phone and buy this stuff back.

I pick up the phone and I buy them.

I might have missed the top of the Dotcom Bubble by an hour.

I ended up losing $3B on that trade alone. I had made more of the year before, but you know $3B is a lot of money.

It was all because I got emotional and dropped every tool of discipline I’ve ever had. And somebody says, what did you learn from [the trade]? And I just said, “I learned nothing. I learned that 25 years ago.”

So you can talk about not being emotional, but it takes incredible discipline.

***

On figuring out what actually makes a stock go up or down

Takeaway: A lot of people can do fundamental analysis, but finding out what *actually* makes a stock move requires more digging.

—

Stanley Druckenmiller: It varies from stock to stock.

Toggle actually helps me find things that I didn’t even know moves the stock. But if it happens over and over again, you figure it’s not random.

[Back when I was an analyst in Pittsburgh, my boss asked me to] analyze retail and I’d come in with my earnings estimate on K-Mart.

He asked, “yeah, but what makes the stock go up?”

I said, “what do you mean?”

He says, “everybody knows what you just told me. Keep looking.”

Finally, I came back with [new analysis]. This may have changed, but if you graph the change in food and energy prices over top the retail index, it’s like clockwork. Food and energy prices go up, retail stocks go down.

It’s not rocket science here. If you take discretionary spending and you increase the cost of it, [there’s less money to spend]. I watched that and it worked for 10-12 years. And then for some reason it stopped working.

I completely endorse analysis of fundamentals. Looking at the balance sheet, trying to figure out a couple years from now, what people are going to think about this company or are the earnings going to be different.

But then there’s all the weird stuff. Like I just mentioned, the beauty of Toggle is it comes up with stuff that sometimes I don’t even quite understand. But frankly, I don’t care if the stuff works. I’m going to go with it.

I’m very open-minded. I don’t need to totally understand something if I’ve seen it work over and over again. Most of these things I understand.

I might get a notice one day from Toggle that XYZ looks good. Then I can do my fundamentals. Then I can look at the chart. So it’s not only a discipline in terms of buying and selling. It can also be an idea generator.

***

On Bitcoin

Takeaway: Bitcoin was a solution in search of a problem. It found one: Fed Chair Jerome Powell and his very loose monetary policy.

—

Stanley Druckenmiller: So, I’ve evolved on this.

If you’ve done your homework, you’d know that 5-6 years ago I said more than once, “crypto and Bitcoin are a solution in search of a problem.”

What the hell are these people all looking for? We already have [a currency]. It’s called the US Dollar.

For the first move in Bitcoin — I think from like $50 to $17,000 — I just sat there aghast.

And by the way, consistent with our earlier conversation, I wanted to buy it every day.

It was going up and — even though I didn’t think much of it — I just couldn’t stand the fact that it was going up and I didn’t own it.

Fast forward: I never owned it from like $50 to $17,000, I felt like a moron. Then it goes back down to $3000 again.

Then a couple of things happened.

So, solution in search of a problem. I found the problem: When we did the CARES act and Chairman Powell started crossing all sorts of red lines in terms of what the Fed would do and wouldn’t do.

The problem was Jay Powell and the world’s central bankers going nuts and making fiat money even more questionable than it already has been when I used to own gold.

Then the second thing that happened is I got a call [from billionaire hedge fund manager] Paul Jones and he says, “do you know that when Bitcoin went from $17,000 to $3000 that 86% of the people that owned it at $17,000, never sold it?”

Well, this was huge in my mind. So here’s something with a finite supply and 86% of the owners are religious zealots. I mean, who the hell holds something through $17,000 to $3000? And it turns out none of them — the 86% — sold it. Add that to this new Central Bank craziness phenomenon.

[A few years pass] and it goes up to $6,000 in the middle of the last spring.

I got to buying some just because these kids on the West Coast are already worth more than I am, and they’re going to be making a lot more money than me in the future. For some reason, they’re looking at this thing the way I’ve always looked at gold, which is a store of value if I don’t trust fiat currencies.

Then the thing that Paul told me [about the 86%]. Then, the fact that it’s been around 13 years. It has become a brand, right? So it’s funny. I tried to buy $100m of Bitcoin at a price of $6,200. It took me 2 weeks to buy $20m. I bought it all around $6,500, I think.

And I said, “this is ridiculous.”

You know, it takes me two weeks [to buy $20m]. I can buy that much gold in 2 seconds.

So like an idiot, I stopped buying it. The next thing I knew, [Bitcoin] is trading at $36,000.

I took my costs and then some out of it and I still own some of it. My heart’s never been in it. I’m a 68-year old dinosaur, but once it started moving and these institutions started upping it, I could see the old elephant trying to get through the keyhole and they can’t fit through in time.

I own this company called Palantir and I see it announced that its going to start accepting Bitcoin and they may invest it. That’s happening all over the place.

And you know, this thing is never going to have more than 21m [units]. It’s a fixed supply.

***

On Bitcoin vs. Ethereum

Takeaway: Bitcoin has likely won the “store of value” battle for crypto. Druckenmiller sees Ethereum as potentially a Yahoo or MySpace: an early-mover technology that was replaced by a better product (Google, Facebook).

—

Stanley Druckenmiller: I think Bitcoin has won the store of value game because it is:

- a brand

- it’s been around for 13-14 years

- It has a finite supply,

Is it going to be gold? I don’t know. It’s sure as hell doing a good imitation of it the last year or two.

Is it going to beat the other cryptos in terms of digital gold store value? I would say it’s going to be very, very tough to unseat.

Then you go to what I call the commerce facilitators: obviously, the lead in smart contracts and that kind of stuff would be Ethereum.

I’m a little more skeptical of whether it can hold its position.

It reminds me a little of MySpace before Facebook.

Or maybe a better analogy is Yahoo before Google came along. Google wasn’t that much faster than Yahoo, but it didn’t need to be. All it needed to be was a little bit faster and the rest is history.

One of the ways we’ve always invested in the private sector is to try and figure out where the engineering kids from Stanford, Brown and MIT are going.

So many of them are in love with crypto and that’s where they’re going.

I’m worried about the talent. That’s like 23-28 years old. Somebody — we don’t even know who they are yet — might come up with a payment system.

For [blockchain payments, smart contracts], there’s a chance that it hasn’t even been invented yet.

[As for Bitcoin] as long as Jay Powell keeps acting like he’s been acting, I think gold and Bitcoin — and Bitcoin seems to be high-beta gold — are going to have the wind behind them.

***

On Dogecoin

Takeaway: It’s all a joke to Druckenmiller. He just starts laughing when he sees it go up. He won’t short it because he doesn’t “like putting campfires out” with his face.

—

Stanley Druckenmiller: [Dogecoin] is just like NFTs. It’s a manifestation of the craziest monetary policy in history. And I think since there’s no limit on supply, I don’t really see the utility of [Dogecoin] right now.

It’s just this wave of money in the Greater Fool Theory.

Now having said that, I wouldn’t short it because I don’t like putting campfires out with my face. So I just try and pretend Doge doesn’t exist. I think so little of it, it doesn’t even bother me when it goes up.

When Bitcoin used to go up, I’d go crazy because I didn’t own it.

When Dogecoin goes up, I just start laughing.

Don’t go long and don’t go short. I mean, you know, unless you like going to Vegas, then I guess it’s okay.

***

On career advice for 20-year olds

Takeaway: Try different careers until you find something you’re passionate about. Druckenmiller said he would participate in the investing industry even if he only made $50k a year. Prioritize happiness over money.

—

Stanley Druckenmiller: The number one necessary condition would be something I was passionate about.

Particularly in the [investing] business, the people that love it like me are so addicted to it and so intellectually stimulated by it.

If you’re not passionate about it and only in it for the money, you have no chance of competing with these people.

They’re going to outwork and out execute you.

If you’re American — and this isn’t true for everyone — but you’re probably going to spend 60-70 hours a week working. If you don’t love it, you’re going to blow all that time?

That’s not going to be great for your happiness quotient.

I was just lucky. I followed my passion. My mother-in-law says I’m an idiot savant, and I wouldn’t be good at anything else.

I would do this job for $50,000 a year. I really would. I just, I just love it.

And I hate to see young people get trapped in something. I would also say, keep an open mind. I started Bowdoin College as an English major.

I took Economics just so I could read the paper intelligently. I went to get a PhD in Economics and I went there and I said: “These people are crazy. They’re trying to shove the economy into a math formula. It doesn’t make any sense.”

Then I worked construction for six months. I got kind of a weak upper body, so that didn’t work for me. Then I went to the bank and I found out what I was just in love with.

So, try stuff out. And if you’re not really engaged during the day and you’re not happy, move on to something else.

Because there’s something out there for everybody. But I would not let money be the driver. What I call the happiness quotient is the most important question in your life.

***

On when (or if) he will retire

Takeaway: Druckenmiller wants to have a connection to the investment markets every day so he doesn’t ever see fully retiring.

—

Stanley Druckenmiller: A lot of people when they retire, they start messing around in the stock market.

I think a lot of my performance has been because I’m flexible in terms of the assets I use.

I’m not afraid to just play in bonds or currencies or this or that.

But my real passion is in macro.

I think history would say in macro, I’m probably an A+. But, in equities I’m probably a B-.

Equities are much more labor intensive.

As you know, there’s only one Japanese Yen or Euro.

My dream to the question of “would you hand off the family office” would be to find a successor to run the equity part and let me fiddle around in the macro.

[I’d get to] act like the old talking head sage.

But, I think I would die if I couldn’t have some connection with the investment markets during the day.

I’m not very good at golf.

I like doing stuff I’m good at and I think that’s part of what we’re talking about with passion. No one likes being a loser. So yeah, I think I’ll probably go to my grave doing this stuff.