I can’t even get my one landlord to fix my sink, and now it turns out they may actually be a 100-headed landlord Hydra?

Per Wired, the hot new thing is “fractional investment,” or allowing multiple investors to buy shares of properties. Investors then do nothing except collect their share of the rental income.

It’s not entirely new

There have long been Real Estate Investment Trusts (REITs), akin to mutual funds — Fundrise, founded in 2010, has 387k+ investors across a $7B real-estate portfolio.

But fractional investment startups are on the rise as technology has made it easier to scout properties and streamline landlord responsibilities.

Arrived Homes, which accepts investments as low as $100 in vacation rentals and rental homes, has funded 240+ properties worth $89m+.

- “The Brookwood,” which sounds like a haunted school for wayward teens, is actually a three-bed Atlanta-area home that rents for ~$1.9k/mo. and has ~1.1k investors.

- “The Oasis” is a colorful Nashville vacation rental that 864 investors funded at ~$733.6k.

Similar companies include Here, which specializes in vacation rentals, and Landa, which offers homes and apartment buildings.

On the one hand…

… these models allow people to invest in property without accumulating debt, and earn passive income as their portfolios appreciate. In 2022, Arrived paid out $1.2m in dividends.

Yet there’s something a little dystopian about a rental experience that involves hundreds of unconnected people, who themselves may be unable to afford a home. Arrived told Wired that ~40% of its investors are renters.

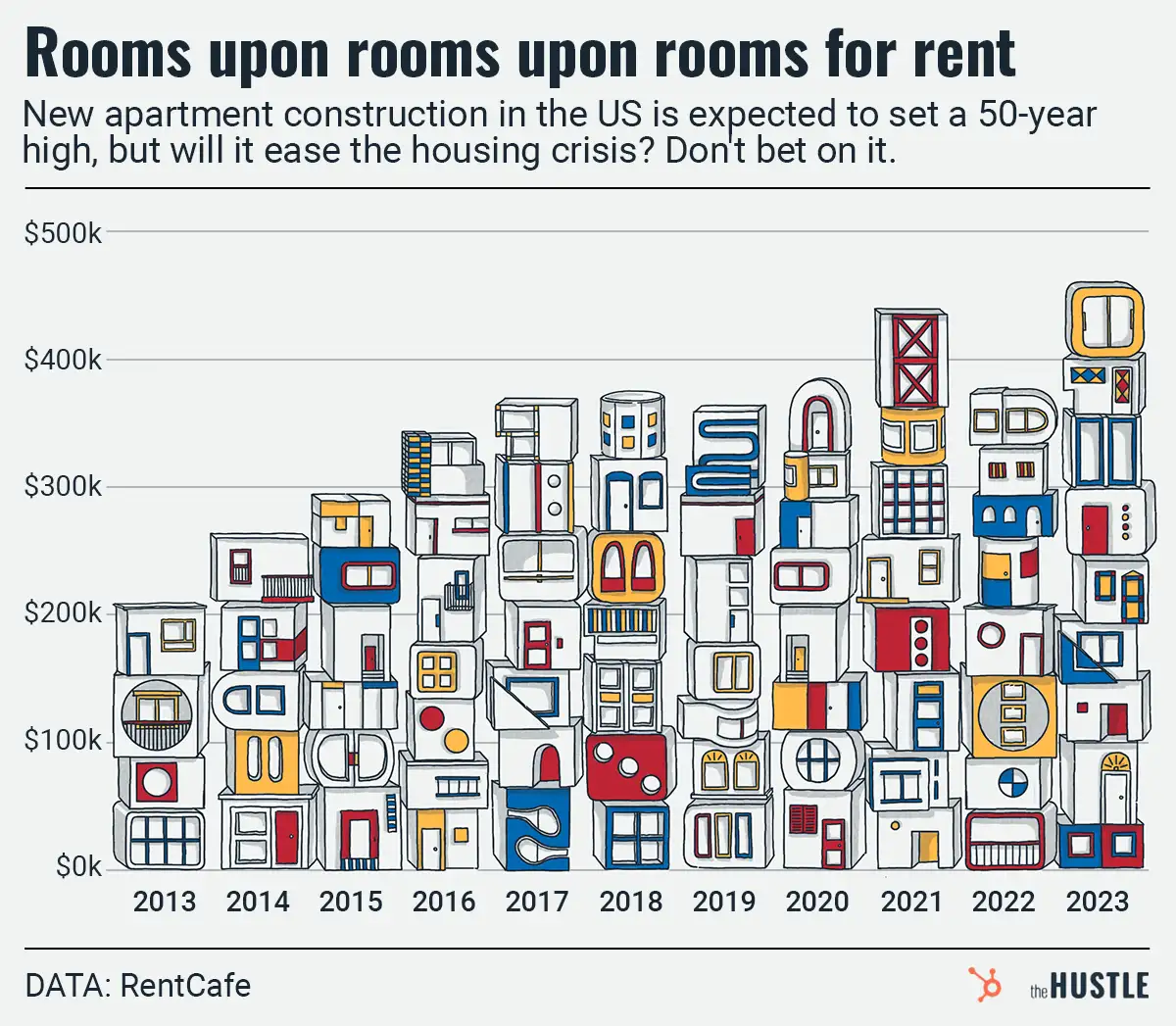

Plus, every home that becomes a fractional investment property is a home someone can’t buy to live in amid an unaffordable housing crisis. In Q1 of 2022, investors bought 28% of single-family homes, up 9% YoY.

Meanwhile: Fractional investment startup Pacaso’s customers buy larger shares of vacation homes, which they can later use. Many of Pacaso’s properties are located in tony Newport Beach, California, where a ban is being considered as residents complain of party houses.