Billd, the Austin fintech startup that works with materials suppliers across the US to extend short-term loans to contractors, announced it has raised $60m in a Series A funding round.

Billd will use the capital raised to “expand product capabilities” and scale operations.

Construction is expensive

Although New York City building costs are the highest in the world at over $362 per square foot, funds for building materials and labor are notorious for not coming through on time.

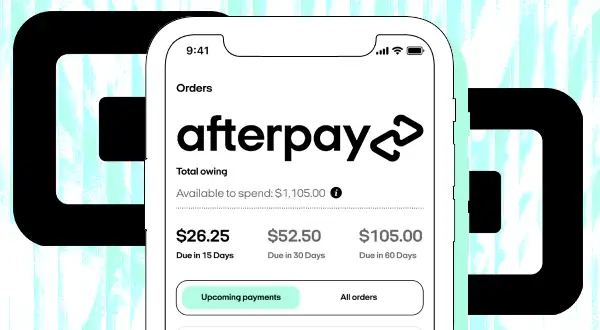

Construction suppliers usually expect payment for building materials within 30 days, which, as VentureBeat notes, is far shorter than the average 60 to 90 days it takes for contractors to receive payment for their work.

Billd’s solution is 120-day terms: Contractors get a range of financing options on material orders, which suppliers can approve the same day while getting upfront payments from Billd on behalf of the contractor.

More like Bob the Build-ers

The construction industry is hot right now: Analysts estimate the global construction industry to be around $10T, so it’s no surprise that investors are eager to construct deals.

In 2018, North American construction startups raised $220.7m, up 348% YoY, and, according to CB Insights, architecture, engineering, and construction companies attracted $1.38B in investment last year.

“The construction industry has by far some of the worst supply chain [financing] of any industry,” Billd CEO Chris Doyle said. “Billd provides subcontractors solutions so they can take that extra project, grow their business, and simplify their process.”