If sports teams can get slapped into power rankings every day, then why can’t our Big Tech behemoths — Alphabet, Amazon, Apple, Meta, and Microsoft — get the same treatment?

They, too, deserve inconsequential power rankings based on arbitrary, super-subjective criteria.

That’s what we’ll do here, going simply by who’s got the best vibes headed into 2024…

1. Apple (Revenue: $89.5B in most recent quarterly earnings; Market cap: $3.06T as of 12/20)

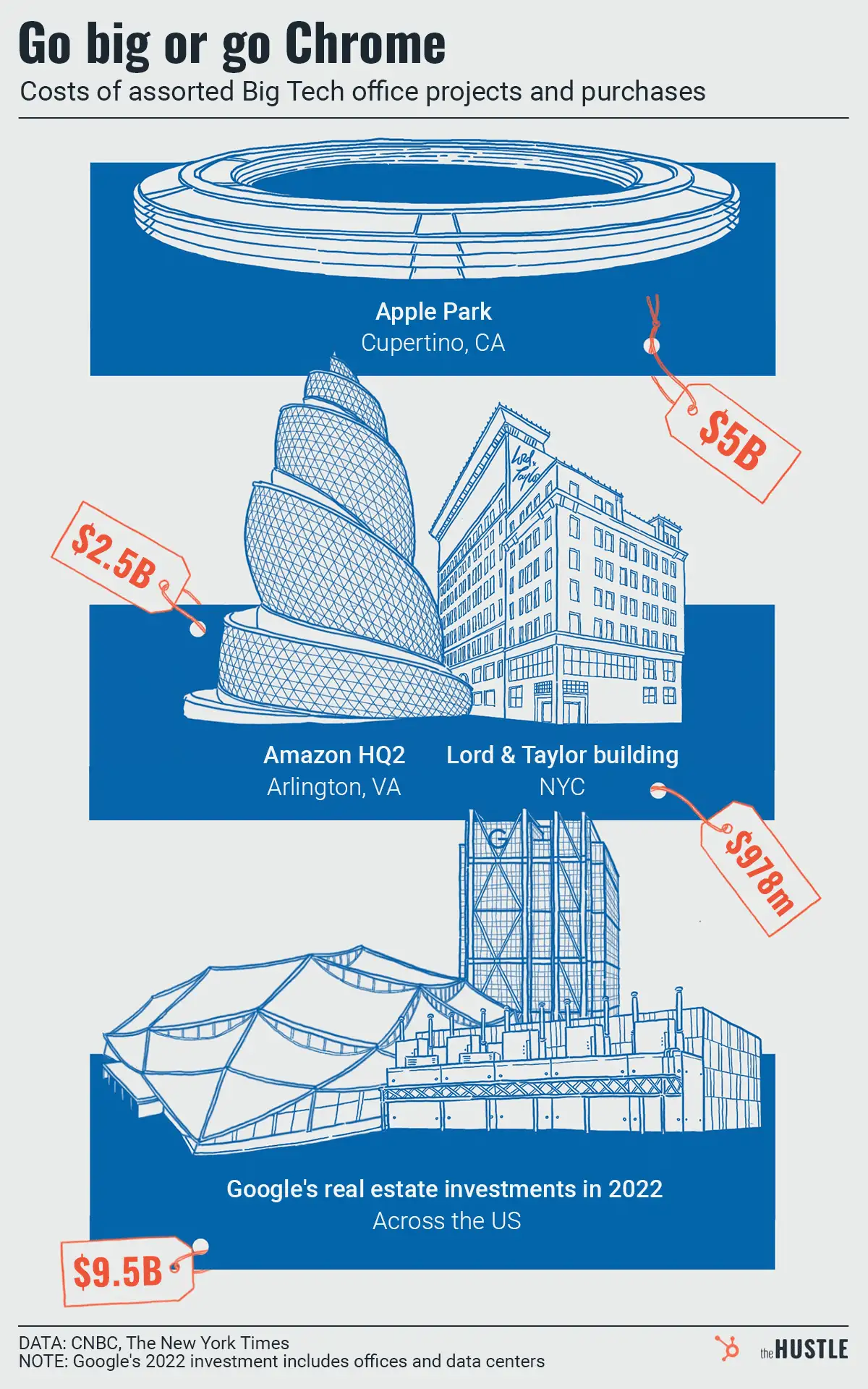

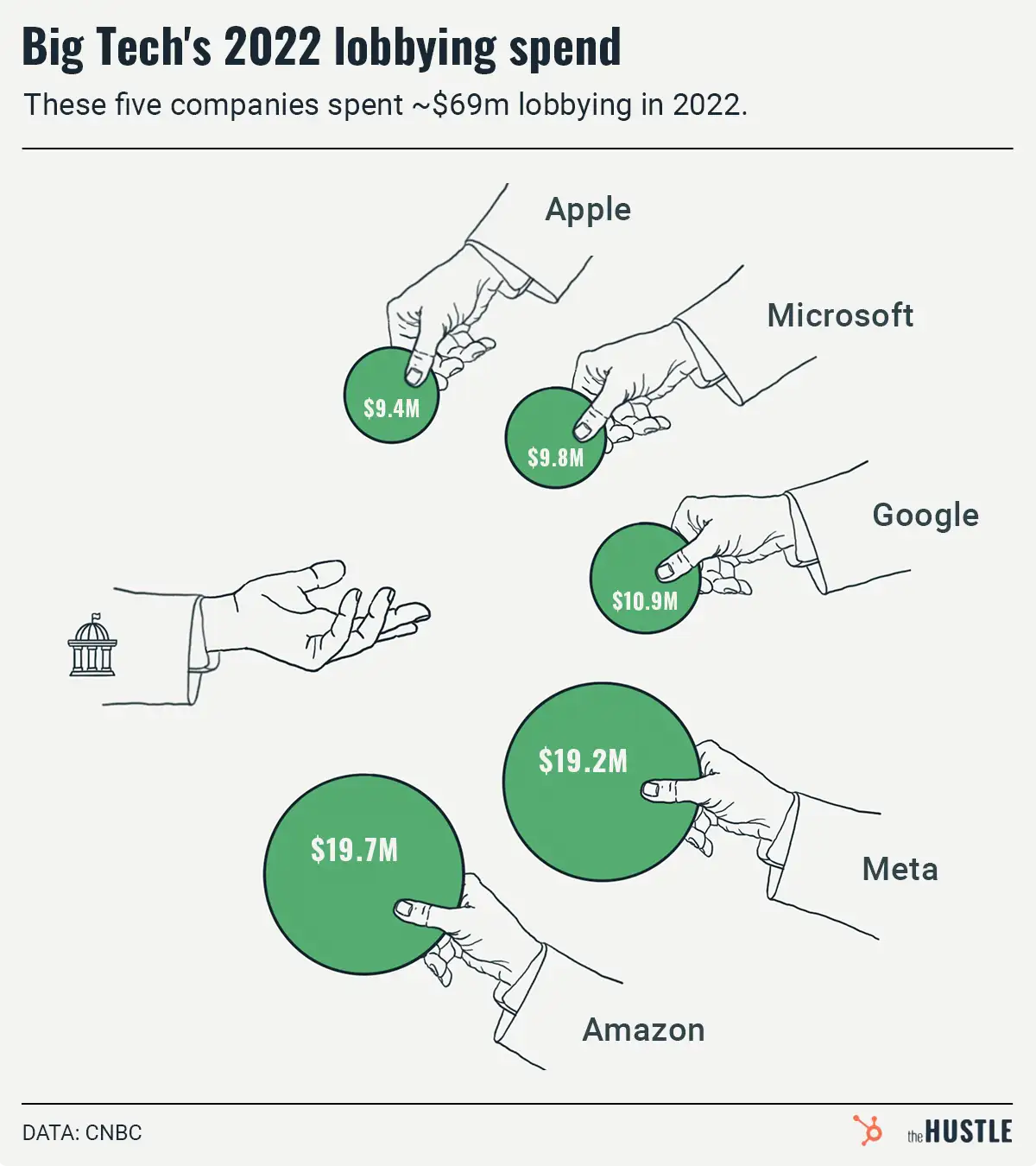

It’s hard to argue with the numbers — Apple remains the world’s most valuable company, and by a pretty wide margin. Its market cap exceeds the GDP of Italy, Brazil, and Canada. Humanity runs on its tech. Also, big step down here, but Apple TV+ shows like “The After Party” and “Hijack” are super-underrated. Vibes have been excellent to date, but good energy can turn ugly quick: If the Vision Pro doesn’t hit, uh oh. If its next iPhone launch is met with a shrug, bigger uh oh. And if it can’t catch up on AI, there is no “uh oh” big enough. Its grasp on No. 1 feels tenuous.

2. Microsoft ($56.52B revenue; $2.78T cap)

It’s amazing what one good investment can do. Microsoft’s ~$13B commitment to OpenAI moved it atop the AI leaderboard, which, in 2023, was the leaderboard that mattered most. Its ChatGPT-infused products must deliver in 2024 to keep that perception going. But this is about current vibes — and when you’ve got an investment with $100B potential, vibes tend to be pretty immaculate.

3. Alphabet ($76.69B revenue; $1.76T cap)

Don’t mistake Alphabet’s middle-of-the-pack placement; the Google parent is perennially one good headline (or bad headline from its competitors) away from topping this list. There’s a lot to like, after all: YouTube is the dominant force in teen media consumption, Waymo’s expanding while top rival Cruise is in free fall, its cloud division is an underrated force, and its AI offerings are making loud footsteps right behind OpenAI.

4. Amazon ($143.08B revenue; $1.59T cap)

It’s got a strong lead in the cloud-computing sphere and it’s put up $1m+ in revenue per minute this year. And still, Amazon lands fourth? This feels unjust, but that’s the nature of power rankings for you. There are few demerits; it’s just hard to gauge vibes for a company doing so many things all at once.

5. Meta ($34.15B revenue; $902.18B cap)

There are other reasons behind this bottom-dwelling placement — like Meta’s Reality Labs unit losing $3.7B last quarter as the metaverse chase continues for some reason — but if you want to believe that this is our retribution for Mark Zuckerberg simply entertaining the notion of a cage match with Elon Musk earlier this year, all we’re going to do is shrug.