Rhino lands $21m in funding to free renters from security deposit purgatory

Rhino, a company that wants to put the billions of rental deposit dollars back into the hands of the renter, just raised a $21m Series A.

Published:

Updated:

Related Articles

-

-

What the heck is going on with Airbnb in NYC?

-

Why tech workers are sleeping in expensive boxes

-

Branded residences aren’t just for hotels anymore

-

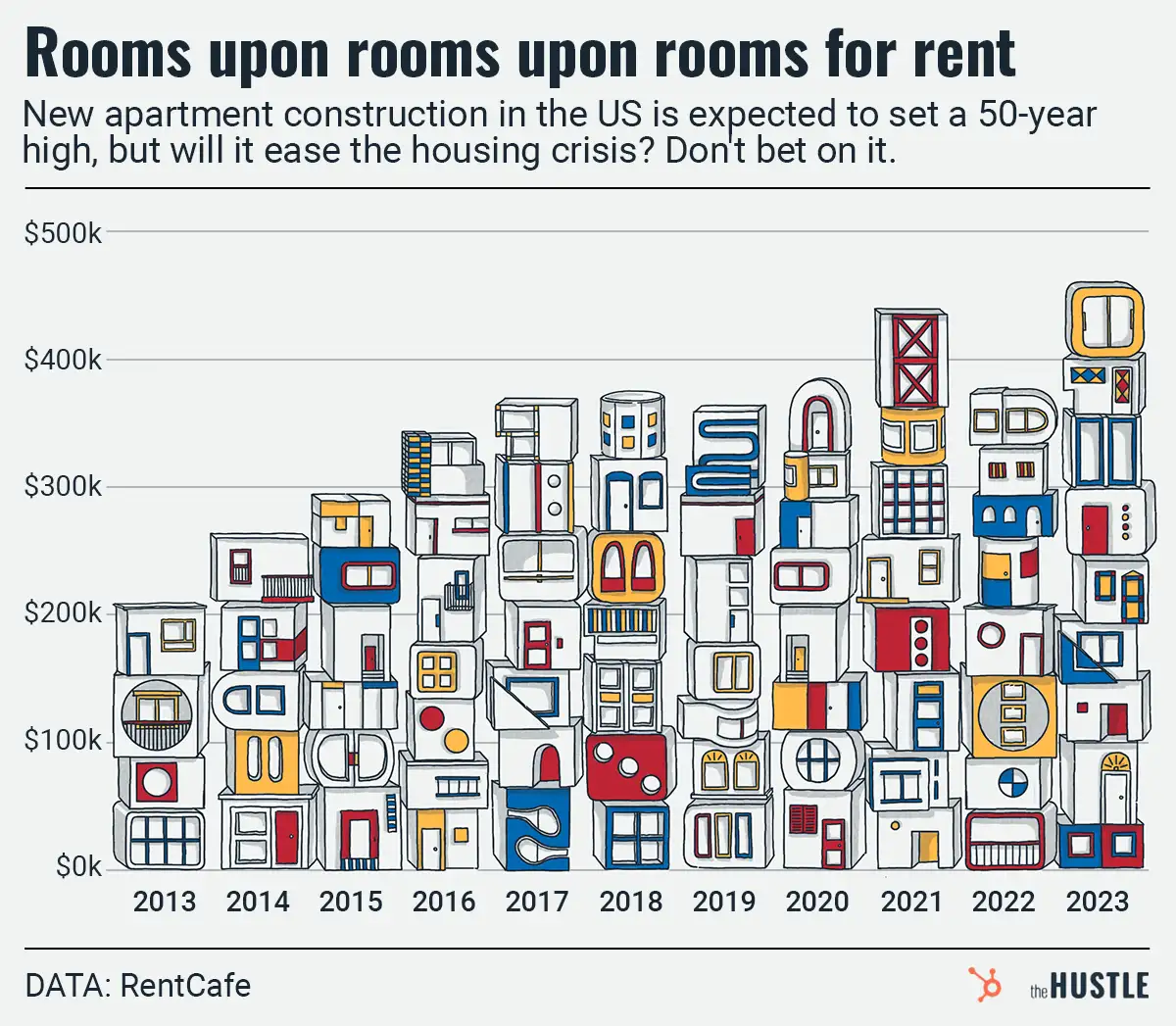

Apartments are getting built at a record clip — it’s too bad they aren’t the right kind

-

Will the Bay Area get a new city?

-

Looking for an edge in attracting talent? Give ’em a reasonable place to live

-

The answer to sky-high housing prices may also be sky-high

-

Does your apartment come with junk fees?

-

Can fewer stairs improve housing?