Over the last year, the nation’s largest airlines managed to land a $15.5B profit — $4.6B of which came straight outta your baggage fees and $2.9B of which came from your flight change fees, according to the US Bureau of Transportation Statistics.

As labor and fuel costs increase, airlines get creative — and often downright manipulative — to create profits out of thin air.

Costs are climbing faster than airlines can grow

Fuel costs have risen more than 23% from 2016 to 2017, and labor costs increased 9% — shaving the money airlines make off each customer down to just $17.75 per flight.

Industry profits are down 41.3% from their 2015 high of $26.4B — but airlines still squeezed out an after-tax profit for the 5th year. So with 4.5% to 16.5% margins, how did airlines still manage to add 450 planes to their fleets?

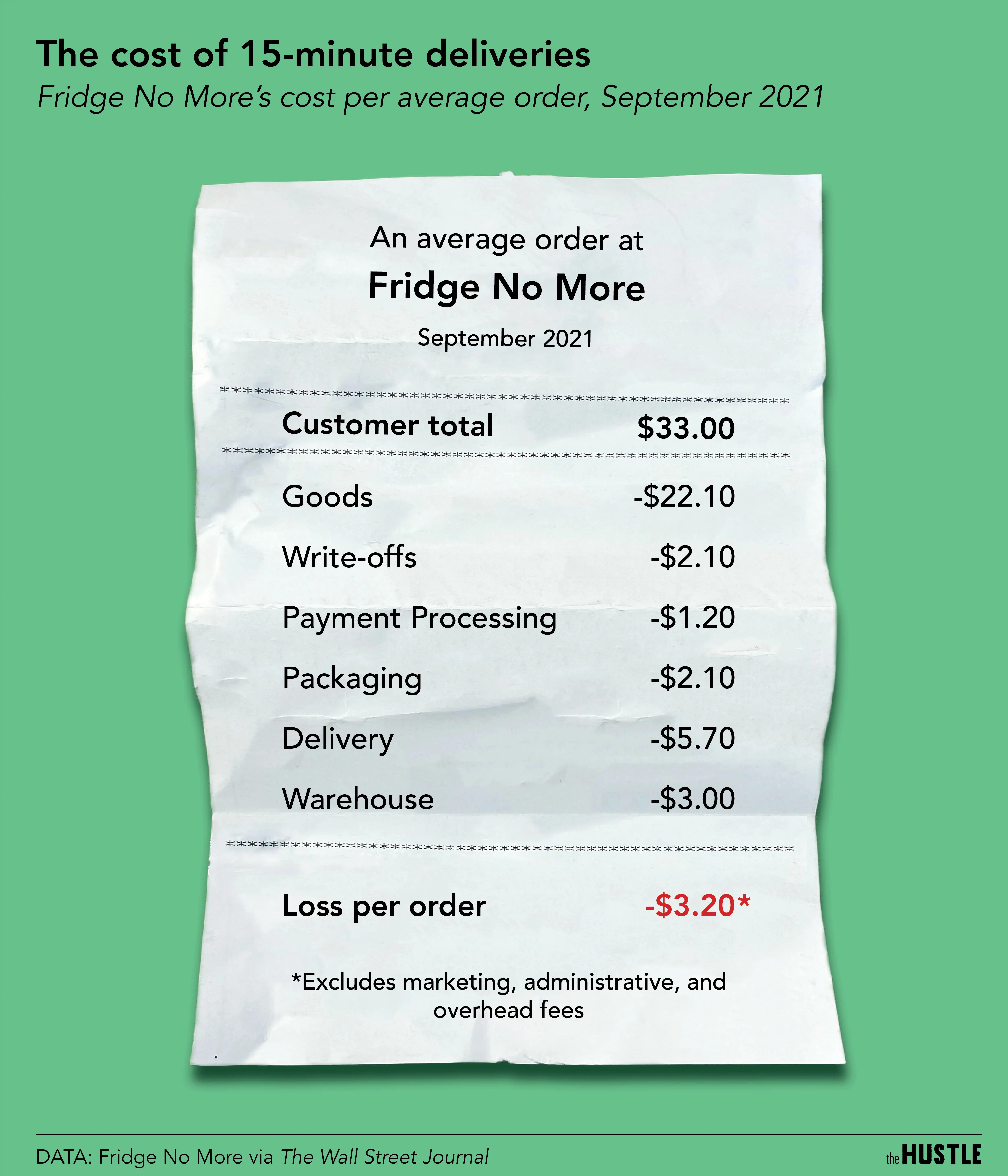

Fees are the fuel keeping profits in the air

Airlines are happy to break even on ticket prices — as long as they can charge extra for everything from extra baggage to a glass of water.

Baggage and change fees alone account for $7.5B of airlines’ $15.5B profit, but the USBLS doesn’t collect statistics on other in-flight charges (food, movies, legroom) — meaning fees probably account for more than 50% of overall profit.

While reliance on fees over ticket sales reduces profit when fuel prices spike (like now) — when costs decrease, profits are ready to take off.