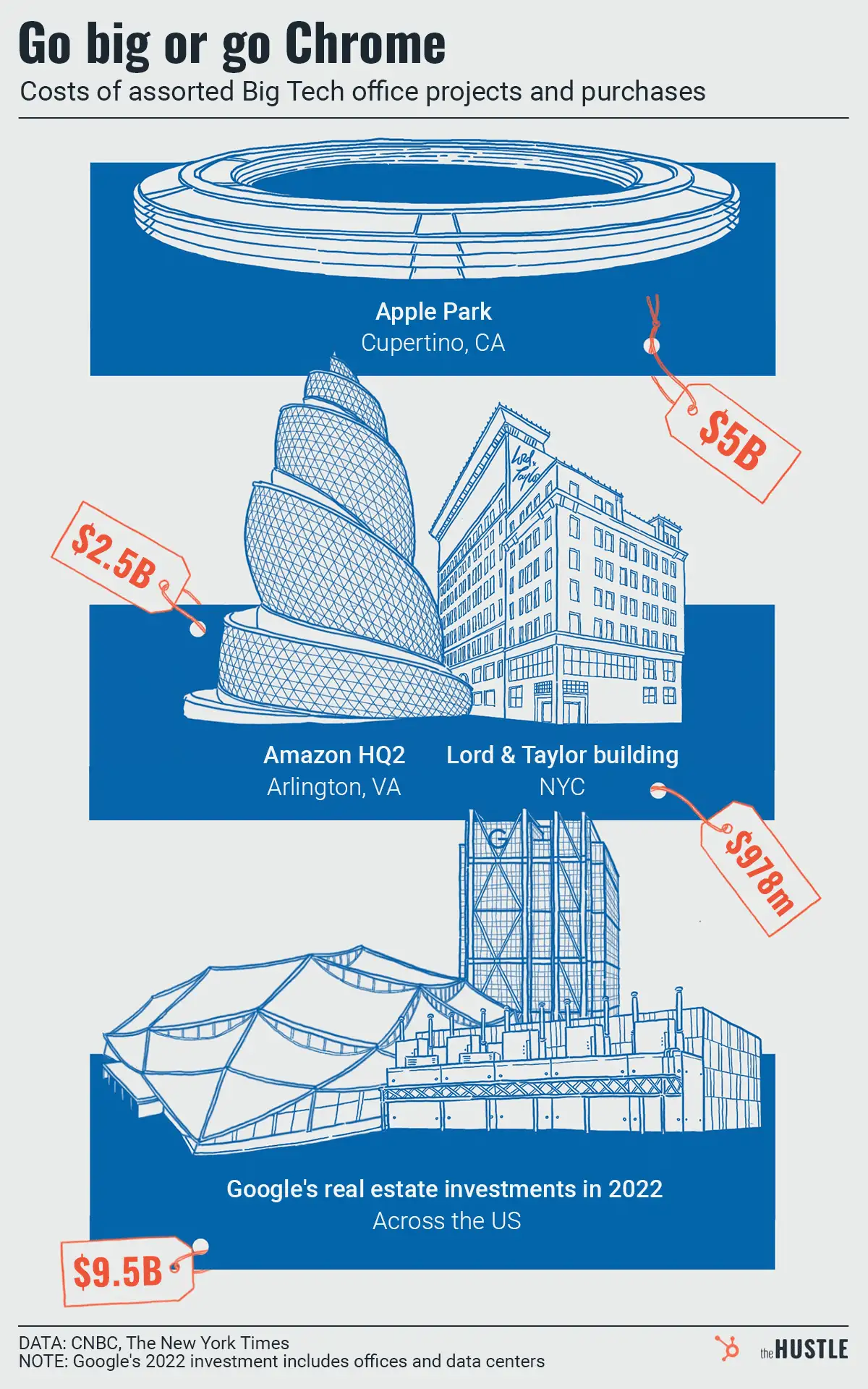

The moniker “Big Tech” refers to Amazon, Apple, Google, Microsoft, and the artist formerly known as Facebook, Meta.

Collectively, these companies are facing anti-monopoly cases brought on by regulators around the world (i.e., Australia, EU, India, UK, US).

Despite the antitrust pressure…

… Big Tech is having a massive year, with the Fab 5 on pace for $1.4T (yes, trillion) in 2021 revenue, per MarketWatch.

More astonishingly, their cumulative profit since the start of the pandemic may reach $500B by year-end.

The pandemic forced the world to go digital

And Big Tech provided crucial services through cloud infrastructure, communication, ecommerce, and remote work tools. The 5 companies now make up 7 of the world’s most valuable firms:

- Apple — $2.94T market cap

- Microsoft — $2.56T

- Alphabet (Google) — $1.94T

- Saudi Aramco — $1.89T

- Amazon — $1.73T

- Tesla — $1.09T

- Meta — $963B

Add it all up and the Big Tech firms make up 20%+ of the entire S&P 500.

Who was the biggest Big Tech winner?

From an investment perspective, it was Alphabet (GOOGL), which has returned ~70% this year. Here’s what drove the performance, per CNBC:

- Search dominated: Alphabet’s core ad search business grew 43% YoY last quarter, which is wild when you consider that it’s already a massive $200B+/yr. business.

- Android to the rescue: Apple’s iOS privacy changes hurt many digital ad firms (e.g., Meta, Snap, Pinterest), but Alphabet’s search business has been largely immune. Owning the Android mobile OS def helps.

- YouTube on the rise: Alphabet’s video platform is now on a $28B+ annual revenue rate (putting it on par with Netflix).

- Cloud growth: While smaller than Microsoft Azure or Amazon Web Services, Alphabet’s cloud infrastructure business is benefiting from the shift to remote work.

Looking forward, we have only one certain Big Tech prediction for 2022: Meta won’t change its name.