Source: Getty Images

Ah, Christmas Eve.

For children who celebrate, it’s a day to patiently wait for a bearded man to deliver not lumps of coal.

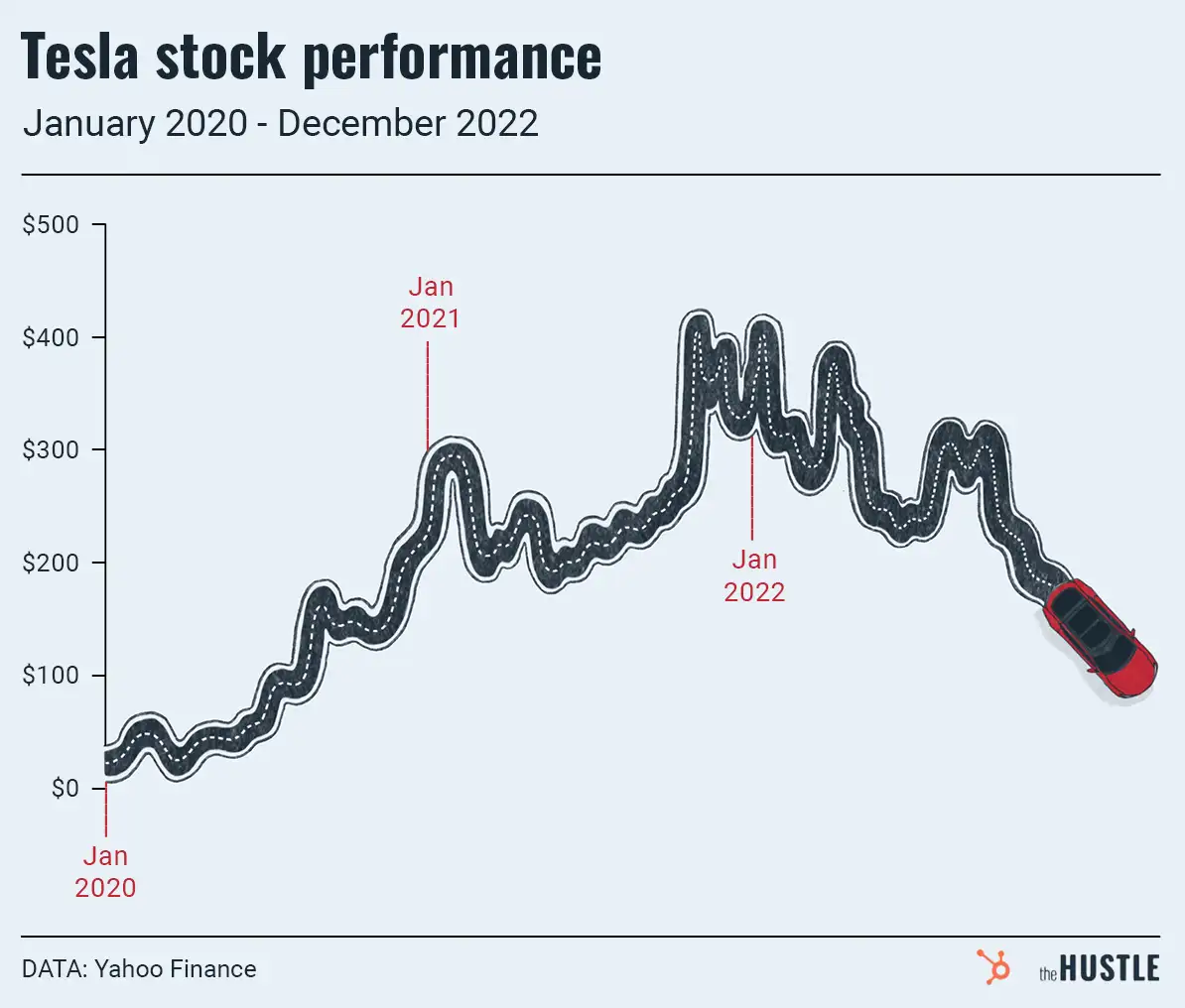

Another group that gets excited is investors: Since 1950, the S&P 500 has gained an average of 1.3% across the 4 trading days after Christmas and through the first 2 days of January.

Wall Street calls it the ‘Santa Claus Rally’

While there is no concrete explanation for the results, there are many theories, per Investopedia:

- Positive mood: Investors are “happy and optimistic” during the holidays

- Tax planning: People sort out their tax-loss harvesting strategies in early December, leaving room to splurge at the end of the month

- Extra cash: People put their year-end bonuses into the market

- Easier to move markets up: Institutional investors (pensions, hedge funds, endowments) are more bearish than retail participants. During the holidays, these professionals are less active and — with lower trading volumes — bullish retail investors can push markets up

Rally or not, the S&P 500 has had a strong year: up ~28% year-to-date (YTD), despite the recent wave of Omicron fears.

‘Correlation does not equal causation’

A few years back, a Harvard law student went viral with charts showing spurious correlations (e.g., margarine consumption is related to divorce rates in Maine).

The “Santa Claus Rally” could def be a random occurrence. But the anomaly does line up with another well-known stock trend: the January Effect, a seasonal tendency for stocks to rise at the start of a new year.

So, will a rally happen this year? We don’t know. But, what we do know for sure is that if Santa doesn’t hook up a Spider-Man Lego set for my kid tomorrow… there’s gonna be problems.