Intel has taken a number of Ls in recent decades.

The chipmaker’s main competitors — Nvidia ($810B market cap) and TSMC ($630B) — have passed it ($213B) in size. More recently, Apple dropped it like a bad habit as a chip supplier.

However, the company is amid a turnaround under CEO Pat Gelsinger and just announced a big move:

Intel is spinning off…

… Mobileye — its self-driving unit — at a projected valuation of $50B, per The Wall Street Journal. If the deal is completed by mid-2022 as planned, Intel will retain a majority stake.

Founded in Israel in 1999, Mobileye initially sought to reduce car accidents with collision-avoidance systems. Today, it develops chip-based cameras to “see” the road, guiding a car’s steering and braking mechanisms.

Mobileye previously went public in 2014, before Intel acquired it for $15.3B in 2017.

Why another IPO?

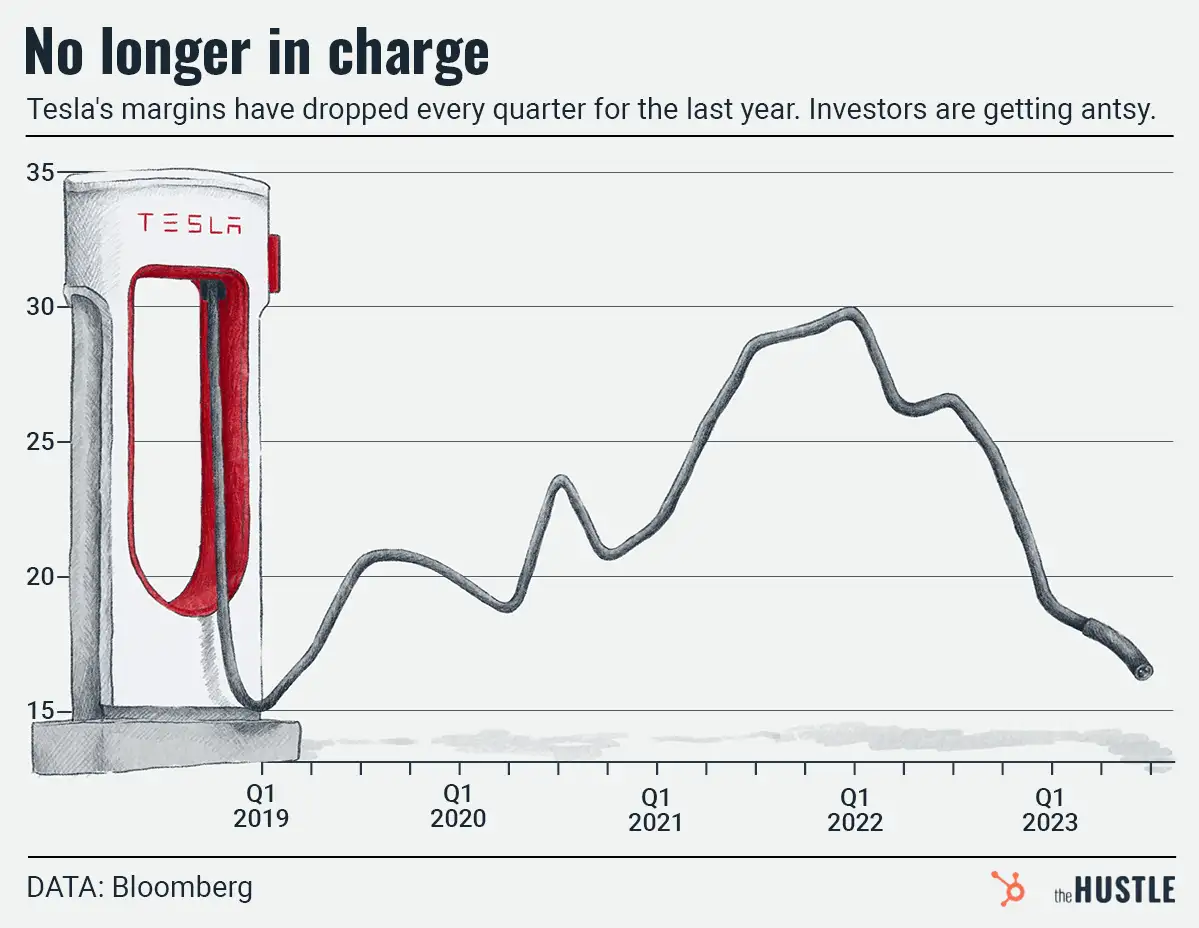

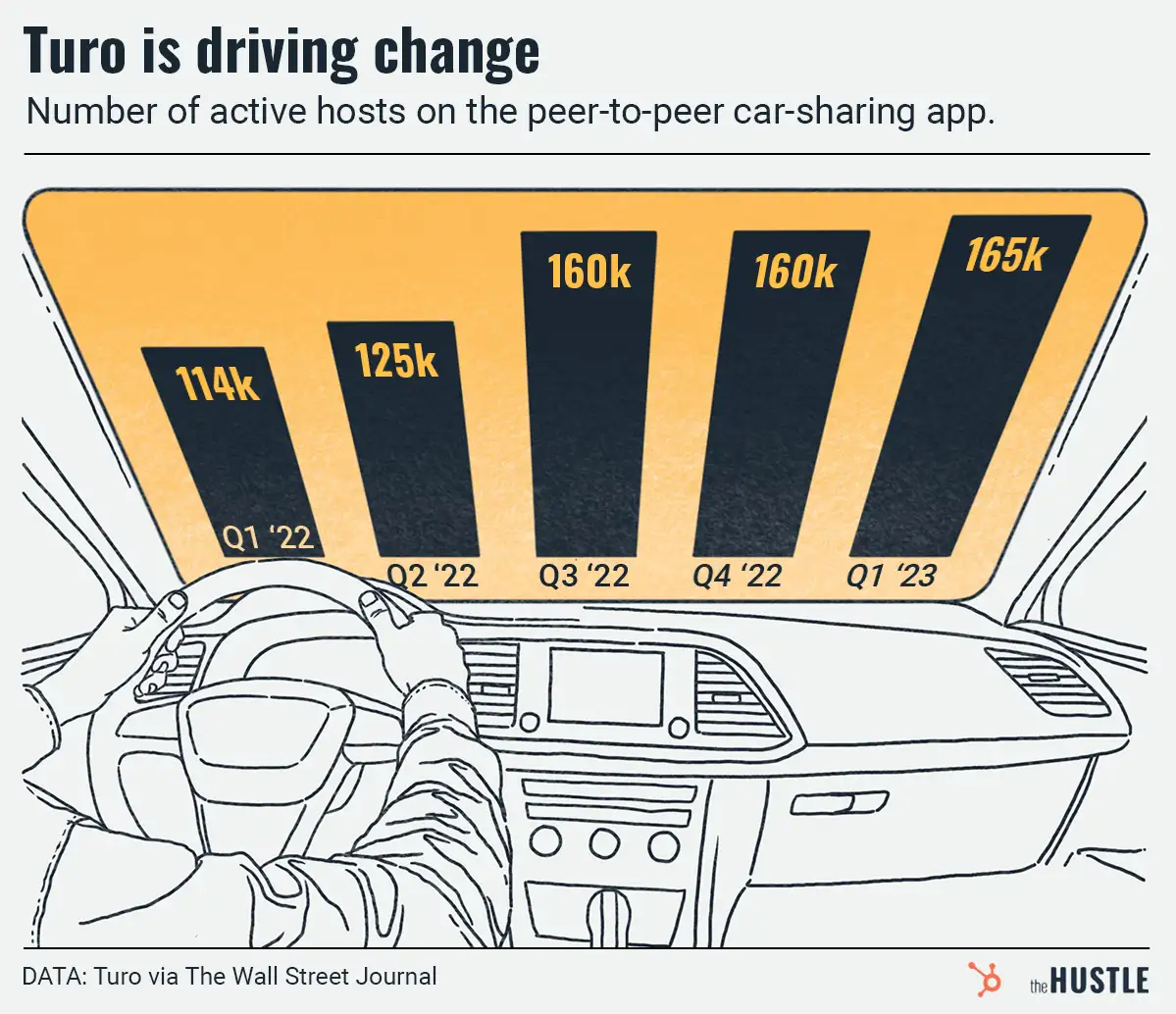

Public markets have shown significant appetite for next-gen auto stocks. Tesla is a $1T+ company while Rivian went public at $100B with zero (as in $0) revenue.

Mobileye notched $326m in sales in the latest quarter. Meanwhile, semiconductor chips are estimated to rise from 4% of a car’s material costs in 2019 to 20% by 2030, per WSJ.

Intel could use the cash

It’s committing $100B to build semiconductor plants in the coming years.

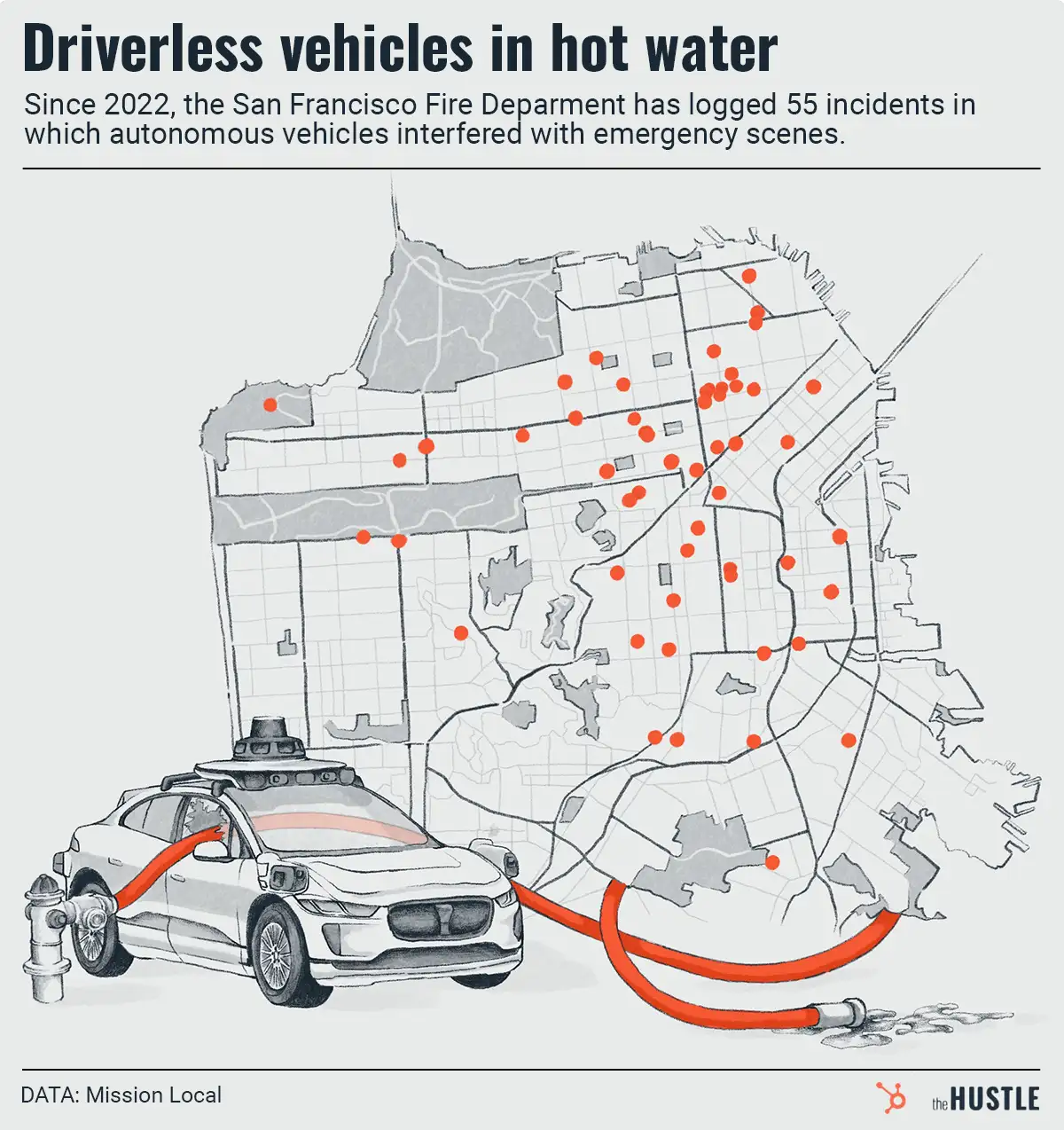

A Mobileye listing may spur a rush for other autonomous vehicle tech IPOs. Two potential spinoffs come to mind: Cruise (owned by GM) and Waymo (owned by Alphabet).

For the 1st time in a long time, Intel looks to be a trailblazer.