With food delivery down from its pandemic highs, it might be surprising to hear that DoorDash shares are up 28% in the last month.

One reason investors are bullish: the company has proven it has a viable grocery and convenience delivery business, per The Wall Street Journal.

This pins the company against new competitors…

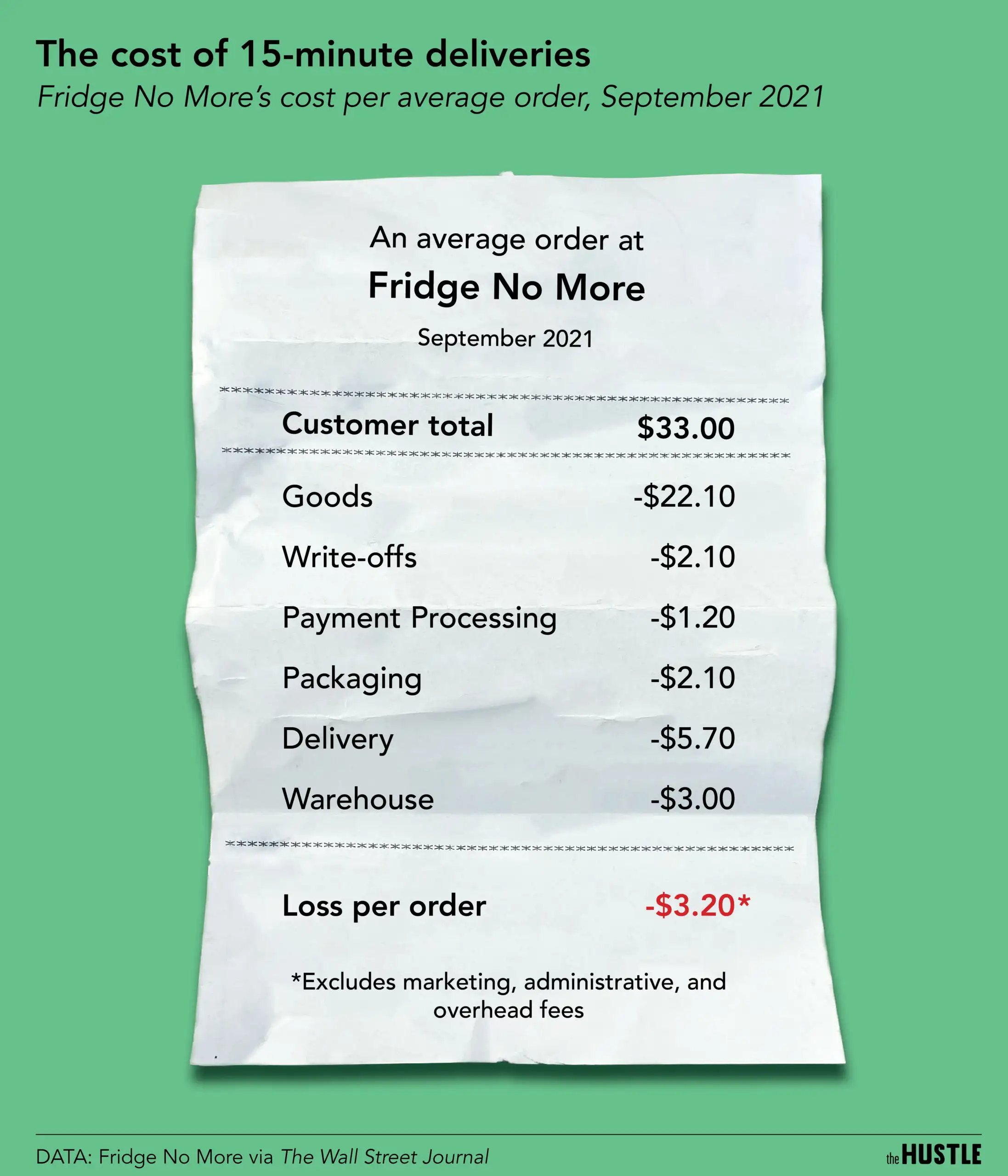

… some of which are struggling:

- Instacart cut its valuation to ~$13B last month, down from $39B in early 2021, and reportedly plans to push its IPO to next year.

- Gopuff recently laid off ~2k employees, and pushed its IPO plans to next year as well.

While its competitors struggle, DoorDash has reportedly doubled its grocery delivery business since last year.

So what makes DoorDash different?

Users seem to be using DoorDash in a different way from its pure-play competitors:

- The average DoorDash order is under $50, compared to $100+ for Instacart.

- These smaller volumes suggest customers are likely using DoorDash to supplement in-store grocery shopping, rather than replace it, ordering “top-off” items to avoid extra in-store trips.

This use case could prove to be more sustainable than relying on delivery for all groceries in the long run.

DoorDash is relatively new to grocery and convenience…

… So is Uber, one of its top rivals in general delivery. Both companies are trying to hook customers with a $10/mo. subscription, setting up a battle for wallet share.

With ~40% of its 25m monthly users subscribed to DashPass, DoorDash seems to have a head start.