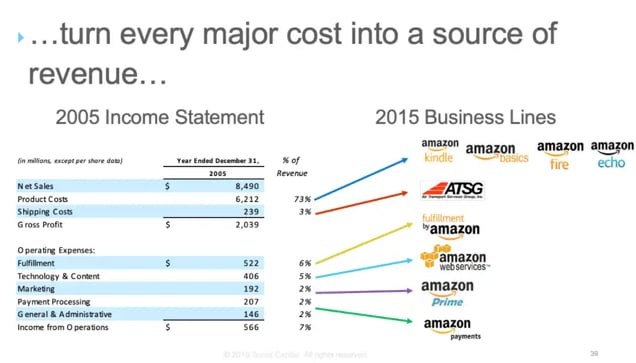

In a viral presentation slide, venture firm Social Capital shared an incredible insight about Amazon. Over the years, it has turned each of its main cost centers into a source of revenue.

To wit, it transformed:

- book inventory into digital assets with the Kindle

- backend tech expenses into cloud giant Amazon Web Services

- fulfillment costs into Fulfillment by Amazon

According to The Information, Mr. Burns Jeff Bezos’ logistics and shipping business is shaping up to do the same.

Shipping is currently an insane expense for Amazon

Through the first 9 months of 2020, Amazon’s shipping cost amounted to ~$40B (for reference, Fedex’s 2019 revenue was ~$70B).

But underneath this spend there’s a big change happening at the company.

By the end of 2019, ⅔ of Amazon’s “middle-mile” delivery — which moves a product between distribution facilities in preparation for delivery — was done in-house.

Amazon Transportation Services (ATS) is the new sheriff in town

Launched in 2015, ATS’s goal was to reduce Amazon’s dependency on 3rd party freight brokers like C.H. Robinson and XPO Logistics.

The shipping army that ATS put together is impressive:

- 30k branded 53-foot trailers

- 80 leased cargo jets

- 69 US package sorting centers

While Amazon hasn’t fully given up on 3rd party providers (particularly during the pandemic), XPO Logistics said in early 2019 that $600m of its revenue was at risk from its “largest customer” (AKA the ‘Zon) leaving.

East Coast shippers started using ATS in April 2019

In a move familiar to Amazon’s other competitors, ATS offered trucking rates far below market prices.

Amazon has also built an “Uber-like” platform to match independent commercial truck drivers (called Relay) and launched a program to entice drivers to effectively lease an Amazon-branded truck.

ATS is rolling out the freight trucking program nationwide, aggressively expanding its sales team and has ambitions to be a “top 5 US freight broker.”

While certainly terrifying for shipping competitors, ATS is not guaranteed victory. The trucking industry is undermanned and sees high driver churn while Amazon’s current pay scale is way below market rates.

If Mr. Burns Bezos wants to make trucking work, he’ll have to adjust the playbook.