Sometime this week, Mark Zuckerberg is expected to rebrand Facebook to reflect the company’s ambitions as a metaverse company.

In line with this news, FB announced in its earnings that it will break out revenue from its VR/AR business line (Facebook Reality Labs).

These changes come in the midst of the latest round of The Facebook Papers — a series of damning internal documents provided by whistleblower Frances Haugen.

The Facebook Papers takeaways:

- Storming of the Capitol: During the 2020 US presidential election, Facebook put in place 22 measures to stop the spread of speech that incited violence. Many of these safety measures were set aside in the lead-up to the Jan. 6 Capitol riots.

- Hate speech in India: Facebook’s content moderation system in India is failing to stymie incendiary content. Some of these issues have to do with its algorithm’s failure to handle non-English languages.

- Losing young users: Teen engagement on Facebook and Instagram is slowing. While most social networks eventually deal with users aging out, there are questions around how Facebook is tweaking its tool to keep them onboard.

Facebook rebuts that it spends significant resources — 40k+ employees and $13B — to keep its platform safe and “does not put profits over people’s well-being.”

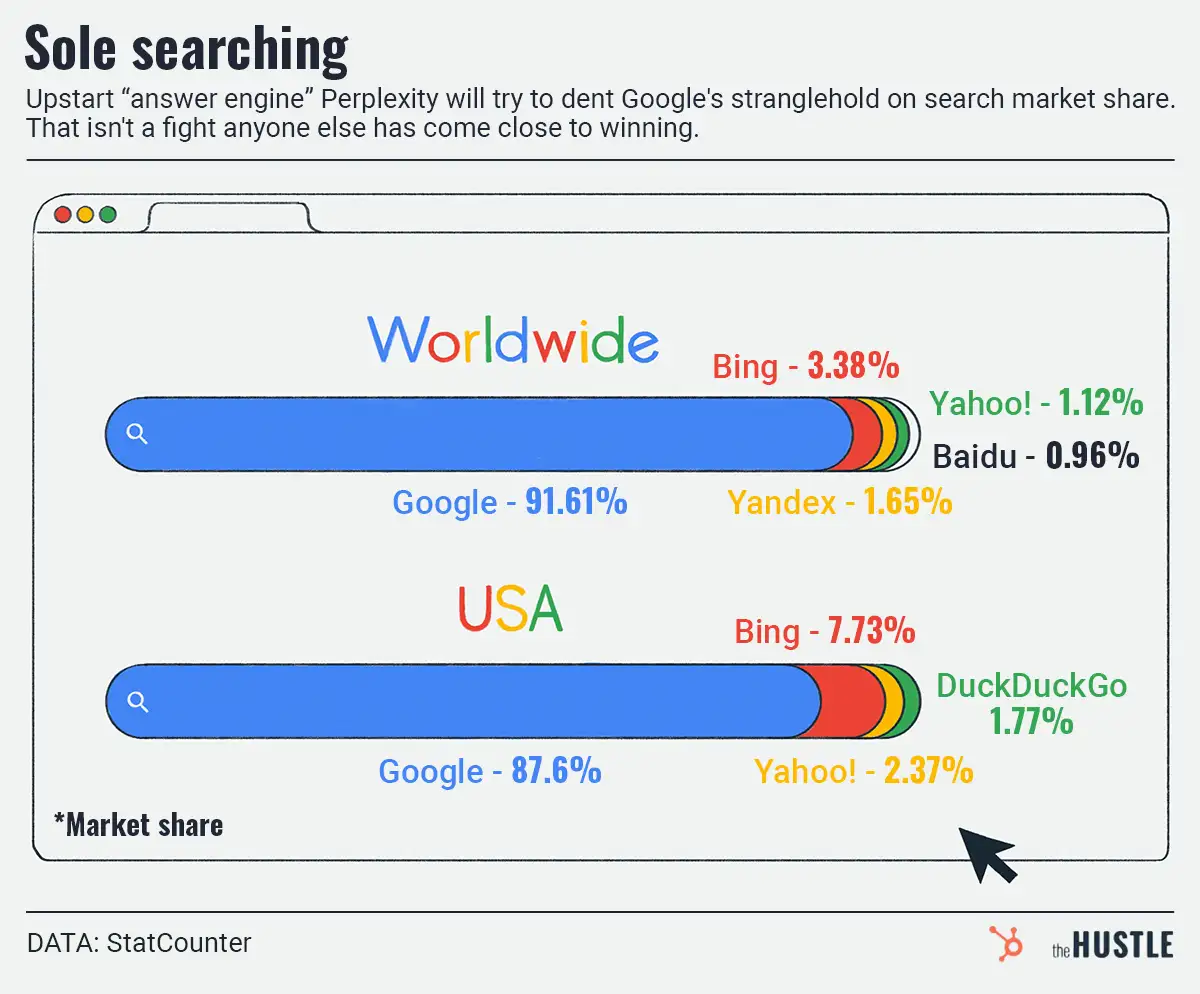

Google’s antitrust headache

Meanwhile, Facebook’s main competitor is facing big questions over its business model. Per The Wall Street Journal, an unredacted lawsuit from state attorneys general shows that Google takes a 22%-42% of transactions on its ad network (2-4x competing digital exchanges).

A viral Twitter thread highlights other allegations from the lawsuit:

- Google had an ad deal with Facebook that was “so illegal” that the documents have “a whole section describing how they’ll cover for each other if anyone finds out”

- Google’s ad exchanges are rigged “so that Google wins on bids where they aren’t the highest bidder”

- Google’s attempt to turn the web into a walled garden by forcing logins with the Chrome browser

Google’s dominant position in the ad business is described by one employee like this: “The analogy would be if Goldman [Sachs] owned the NYSE [New York Stock Exchange].”

If these allegations are true, it raises the likelihood of strong antitrust action against the search giant. Having already rebranded itself as Alphabet in 2015, Google will have to find another tactic to deflect attention away.