A below-the-radar winner in the streaming wars: Roku

Roku is a minnow compared to giants in the streaming space (AT&T, Amazon, Apple, Disney Netflix). How did it become a content gatekeeper?

Published:

Updated:

Related Articles

-

-

Disney will buy Comcast out of Hulu as streaming looks more like regular old TV

-

Netflix is turning up the volume on its merch business

-

No, we do not want Amazon Music Unlimited

-

Is the ‘Big One’ about to drop on Amazon?

-

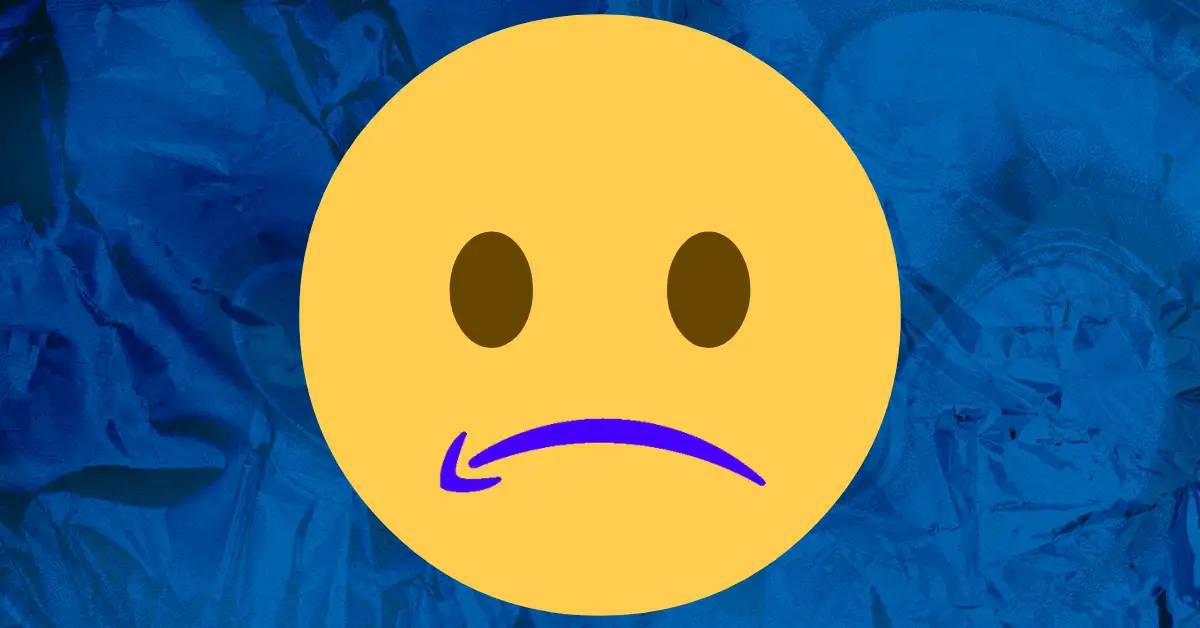

On Bob Iger’s to-do list: Fix ESPN, TV, Pixar, and more

-

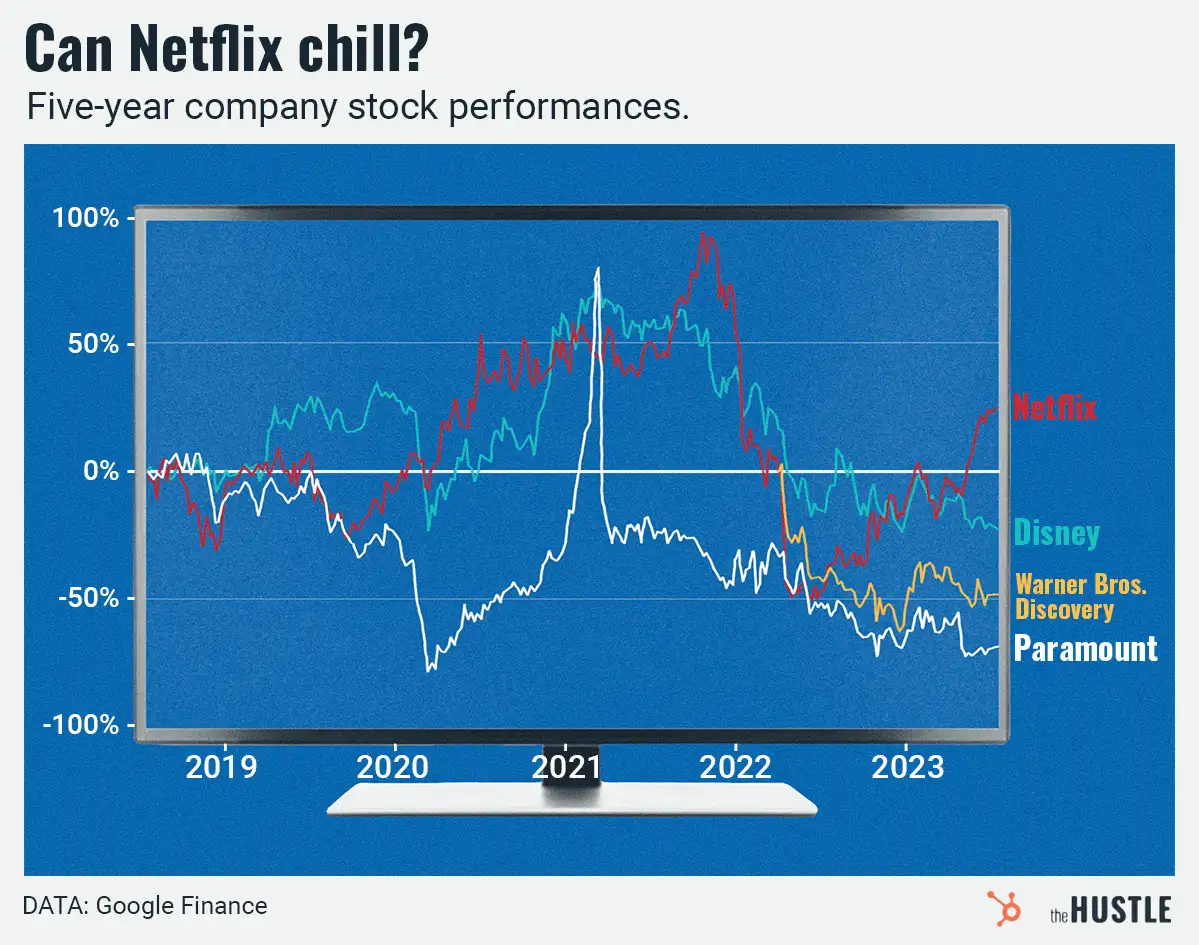

So, can we stop calling it ‘the streaming wars’ now?

-

Apple vs. apples

-

Mac made a big change for gamers

-

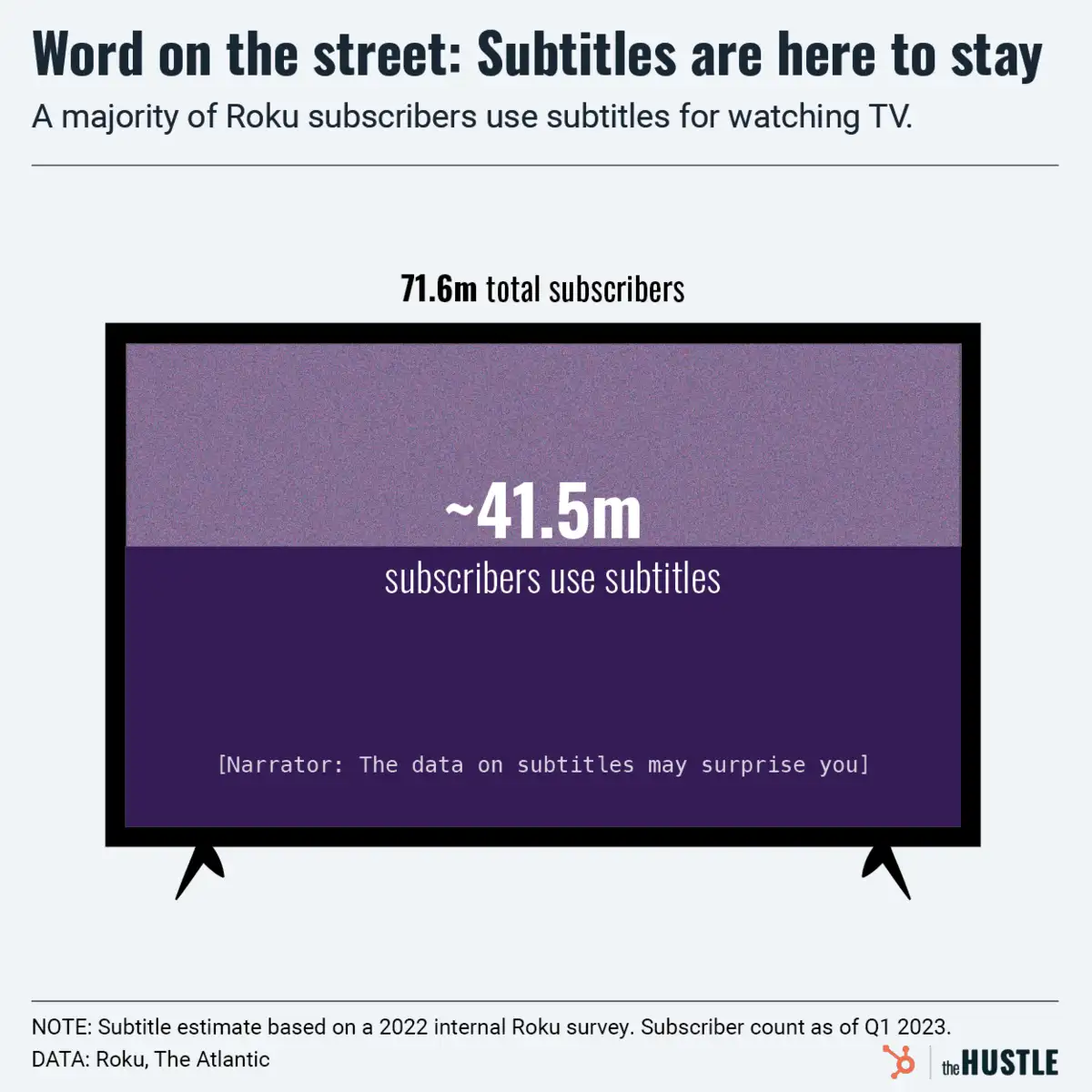

The world’s subtitle use is speaking volumes