Photo: DAVID MCNEW/AFP via Getty Images)

Remember Al Gore’s documentary on global warming, “An Inconvenient Truth”?

It was released in 2006, coinciding with a period of rising interest in climate change and huge funding into clean tech.

According to The Economist, VCs put $25B into the industry between 2006 and 2011…

… but lost more than half of that investment

While this experience left scar tissue for many investors, the industry is booming again. From 2013 to 2020, climate tech investing outpaced all startup funding by 5x.

This year alone, US climate tech funding may reach $60B, up significantly from $36B in 2020, per The Economist.

Public market success stories are bringing investors back

- Tesla, the EV maker, went public in 2010 at a $1.7B valuation (now worth $700B)

- Beyond Meat, which produces faux meat, went public in 2019 at a $1.5B valuation (now worth ~$8B)

More broadly, the S&P Global Clean Energy Index has averaged annual returns of 40%+ over the past 3 years (2x the benchmark S&P 500 index).

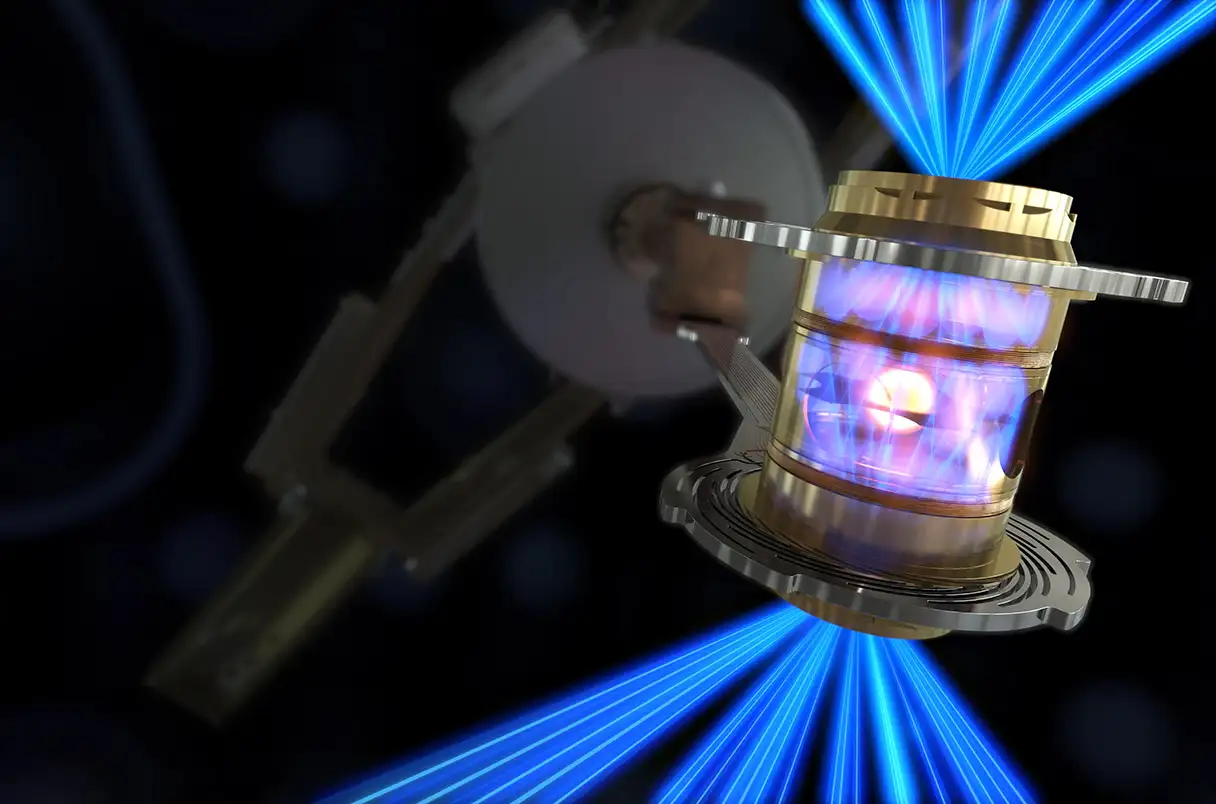

Recognizing the urgency of the climate situation…

… clean tech investing now has significant support from:

- US government: The Department of Energy partnered with Bill Gates’ Breakthrough Energy Catalyst on a $1.5B initiative

- EU government: The European Commision has also partnered with Gates to spend $1B building large-scale clean tech “demonstration projects”

- Family offices: Uber-rich families are chipping in 10% of climate tech venture capital (2x the rate 10 years ago)

- Wall Street: JPMorgan Chase — America’s biggest bank — says it will “commit $2.5T to sustainable investing over 10 years”

- Big Tech: Microsoft ($1B) and Amazon ($2B) each have 9-figure climate tech funds

While money is important, increased cooperation between private and public players makes tackling climate change a bit more convenient and more likely to succeed.