Everything was canceled. But good luck getting that insurance money.

Canceled flights, business losses: Your insurance probably can’t help you.

Published:

Updated:

Related Articles

-

-

Private jets have a pilot problem

-

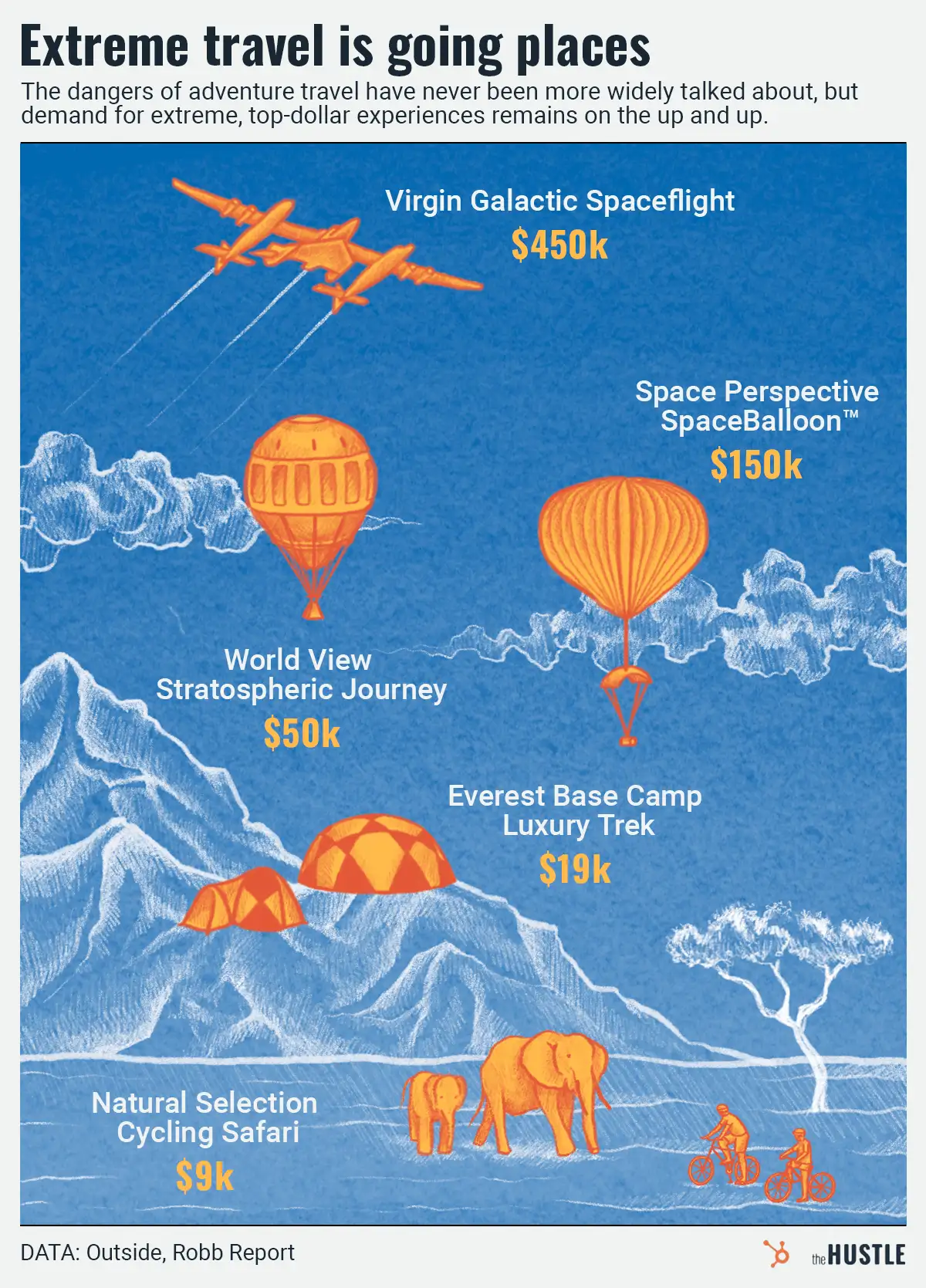

Months after the sub tragedy, extreme tourism is… more popular than ever?

-

The next big travel destination might be the airport itself

-

Ready for a trip? Psychedelic retreats are going mainstream

-

Check into the future: Hotels are getting an upgrade

-

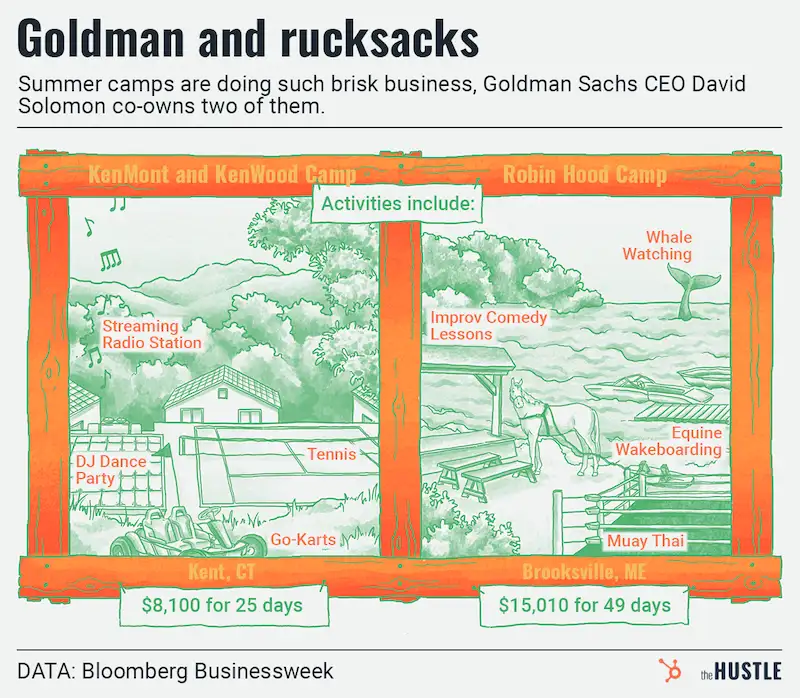

At the elite’s summer camp, the workers allegedly get bunk

-

This summer, at band camp, we got a reverse mortgage

-

How many zeros would you shell out to feel less zeroed out?

-

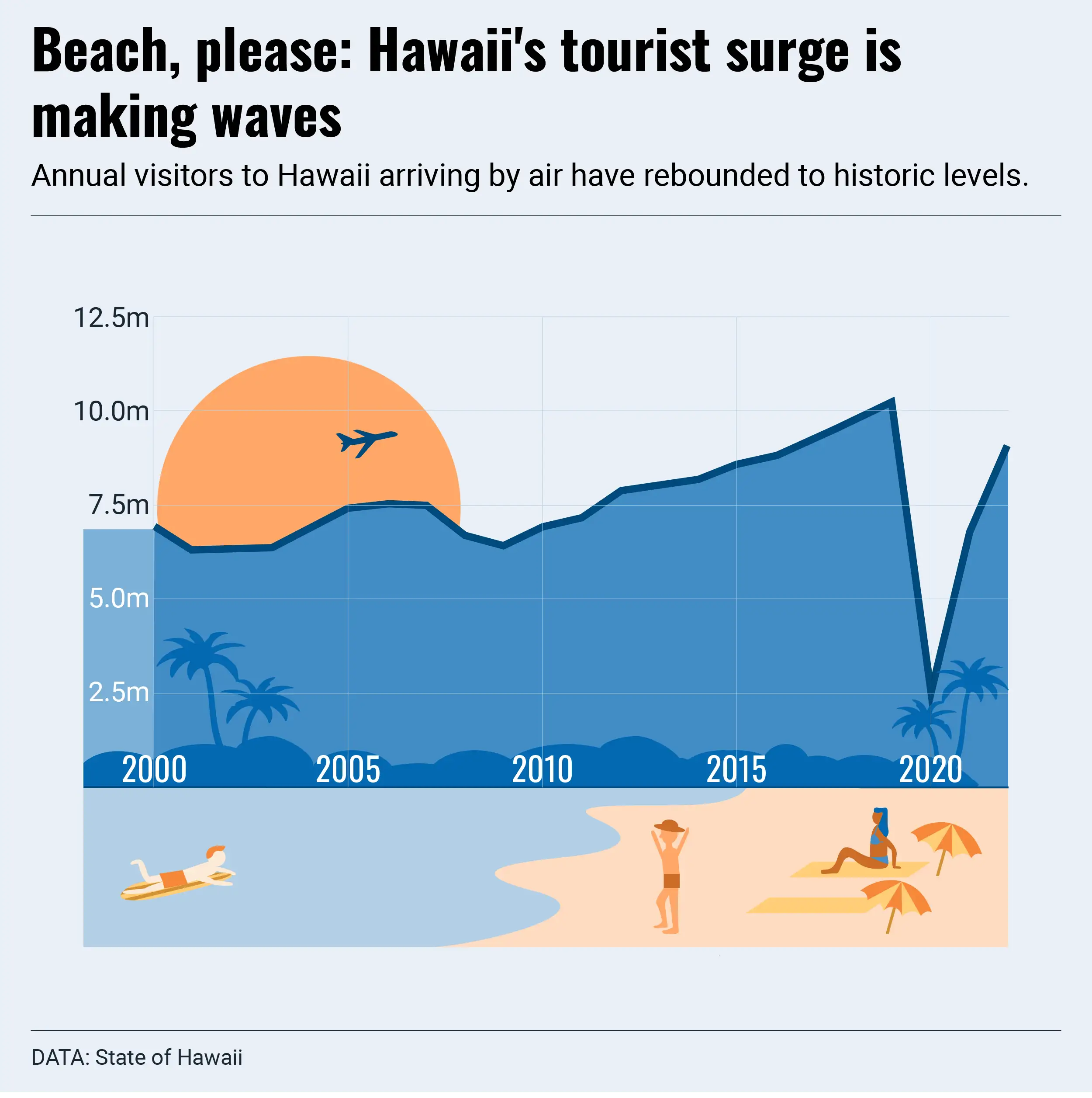

Planning a summer trip? Maybe skip Hawaii, says Hawaii