More than 40m Americans have student loans, owing an average of $37k per borrower — or a total of $1.6T, per new stats from the Department of Education.

During the pandemic, Americans with federal student loans have been able to avoid making monthly payments and accruing interest.

But that freeze is set to end on September 30.

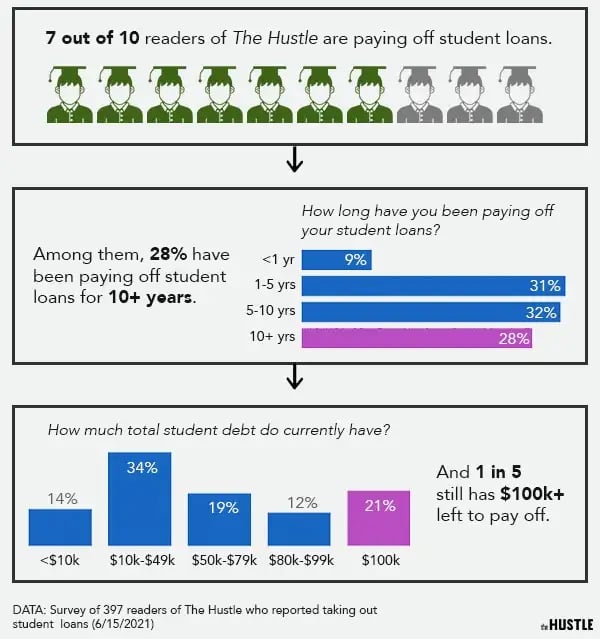

In anticipation of potential policy changes, we surveyed 384 readers of The Hustle who reported taking on student loans at some point.

Among the results:

Betsy Mayotte, president and founder of The Institute of Student Loan Advisors (TISLA), says loans have caused many borrowers to delay homeownership, marriage, children, and retirement. (Some people even worry about marrying people with debt.)

For some borrowers, student debt lasts for decades…

In the early 2000s, many borrowers consolidated loans to take advantage of low interest rates. Many also signed up for income-based repayment plans that match their payments to their salaries, but can extend terms by 20+ years.

Mayotte spends a lot of time on Reddit forums, where many people say they would prefer a permanent reduction in interest — which can be 8% or more for some borrowers — over student loan forgiveness.

“There’s an emotional toll in making payments every month and still seeing your balance go up,” she says.

The freeze has helped

One Hustle reader who couldn’t save before banked $7k, while another paid down $18k on their principal. Another said they finally have a savings account and “feel relatively prepared if a larger expense were to come up.”

Others are less well-off: “With interest being put on hold, I’ve finally been able to put a dent in my loan while also saving a couple hundred for myself. My loan payments are something I dread and I am close to just giving up on them altogether.”

Mayotte is worried we’ll see more delinquencies. Her advice?

- “The faster you pay the loans off — unless you’re pursuing a forgiveness program — the cheaper the loans are gonna be in the long run.” And there’s never a prepayment penalty.

- Get in the habit of regularly reevaluating how you pay your student loans.

- If you think you might need a lower repayment option or advice, start lining things up in August and be prepared for longer wait times.

If you need help, ask. But don’t pay for it. Scams are abundant, but the Department of Education website and groups like TISLA are available to help for free.