Last week, Swedish fintech wunderkind Klarna announced a monster $639m funding round, bringing its valuation to a Scrooge McDuck-sized $45.6B and cementing its status as Europe’s biggest startup.

The round was led by SoftBank’s Vision Fund 2 (AKA Masayoshi’s moneybag), marking its value up 4x from just 8 months ago.

The king of ‘Buy Now, Pay Later’ (BNPL)

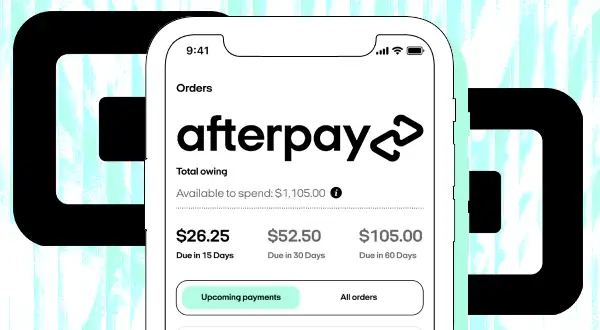

Klarna provides retail customers with an interest-free finance option to make large purchases — BNPL services occupy a space between traditional layaway and purchasing with a credit card.

In an exclusive interview with TechCrunch, Klarna’s CEO and founder Sebastian Siemiatkowski points to the company’s growth in the US as a driver of Klarna’s recent success.

The stats don’t lie:

- 18m+ US customers are using Klarna

- 24 of the top 100 US retailers offer financing through Klarna

- 90m+ global active users, w/ 2m+ daily transactions processed

- In 2020, Klarna processed $53B in volume, compared to competitor Affirm’s (womp womp womp) $8B

Rumors are circulating that Klarna may be preparing for a public listing within the year.

But is BNPL bad for consumers?

Recent reports from Citizens Advice highlight the risk of BNPL present to general consumers. BNPL companies use what are called “soft” credit checks, which do not always uncover other outstanding debt.

Citizens Advice found that 4 in 10 of consumers who used BNPL in the last 12 months are now struggling to make payments.

Which raises the question that may cloud Klarna’s prospects: Whose responsibility is it? The consumers’? Or the company issuing credit?