Photo: Hertz, via Twitter

Last week, an unusual bit of Wall Street news sent a flotilla of financial scribblers scrambling to pick up their pens: A bankruptcy court approved a plan by the rental-car mainstay Hertz to sell $1B in stock.

Everyone’s got the hotz for Hertz

But only here in Bizarro World does the company’s market bounce make any sense.

A refresher:

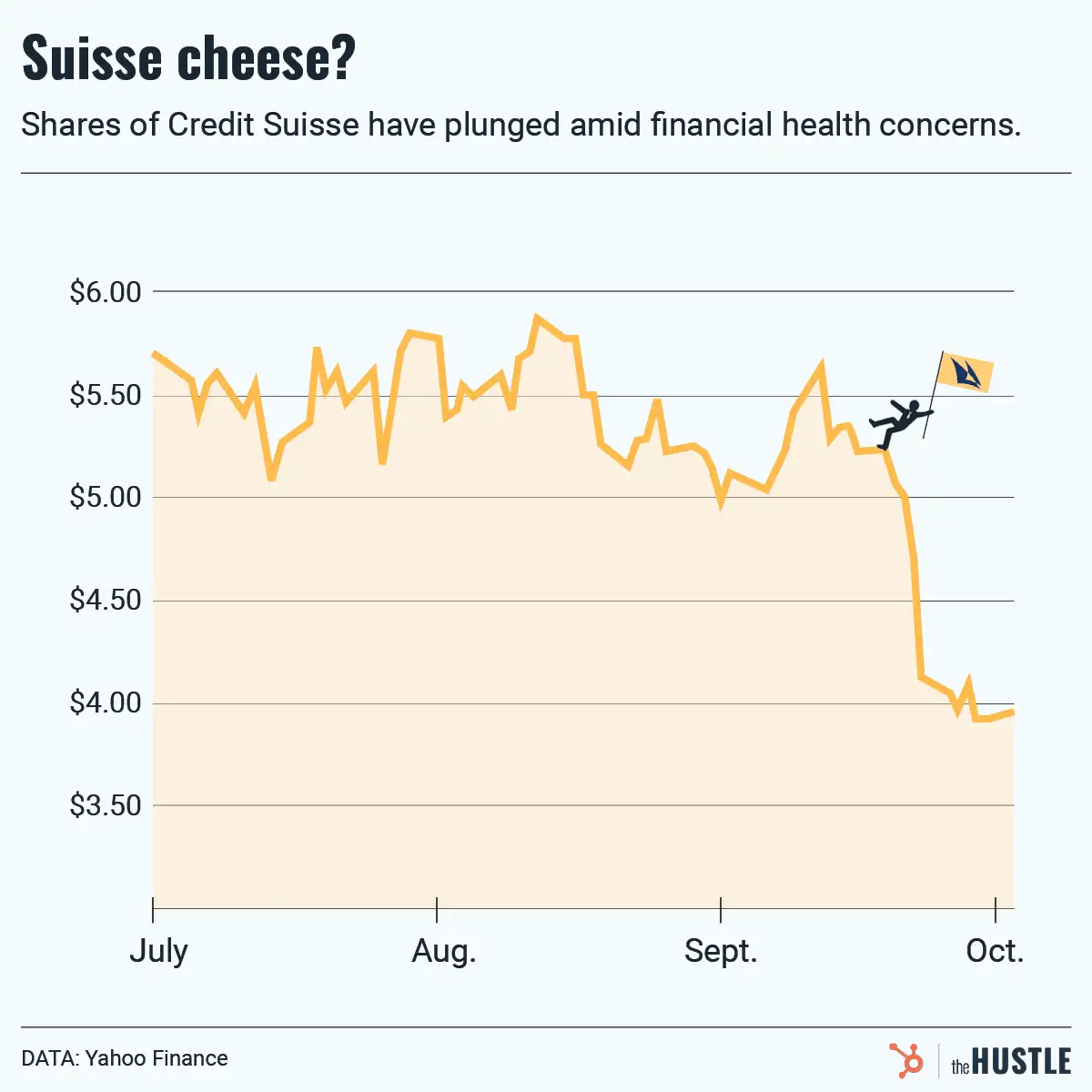

- Hertz filed for bankruptcy on May 22nd, and the company’s stock tanked, to ~$0.56 a share on May 26th.

- Then came the rebound — the stock closed higher than $5.50 at one point last week.

- Hertz trading volume has surged this month, up 63x over last year.

It’s one of several companies to file for bankruptcy recently — and then see monster gains.

So… what the heck is going on?

Day traders are back, baby.

Specifically: Amateur investors/bored sports gamblers. They’re armed with the Robinhood app and inspired by Dave “Davey Day Trader” Portnoy, the founder of Barstool Sports.

Portnoy has been dishing out investing advice on Twitter, capturing the zeitgeist in a single phrase: “Stocks only go up.” For a full analysis of Portnoy’s prodigious quaran-tweets, check out this post from our Trung Phan.

Portnoy’s tweeting even made a fan of a certain outspoken CEO.

Here he is showing Elon Musk some love: “Thanks Elon. Oh I just followed you so feel free to shoot me a quick Dm next time before you say $tsla stock is too high. I’ve been daytrading to pass the time. Not going great. (Earmuffs SEC).”

What goes up must come down

Even Stonks Guy gets confused sometimes.

Amateur traders sent the Chinese real-estate company Fangdd Network Group soaring — because its name sounds like FAANG, the acronym for the exclusive club of tech mega stocks that includes Facebook and Amazon.

As Matt Levine put it for Bloomberg, the Hertz hot streak may not turn out so well for the company’s new investors:

“Hertz will raise a billion dollars from Robinhood, hand the money directly to its creditors, and tell its new shareholders ‘all your money vanished immediately, sorry, better luck next time.’”