This is, by some measures, the worst start of a year in the stock market since the Great Depression.

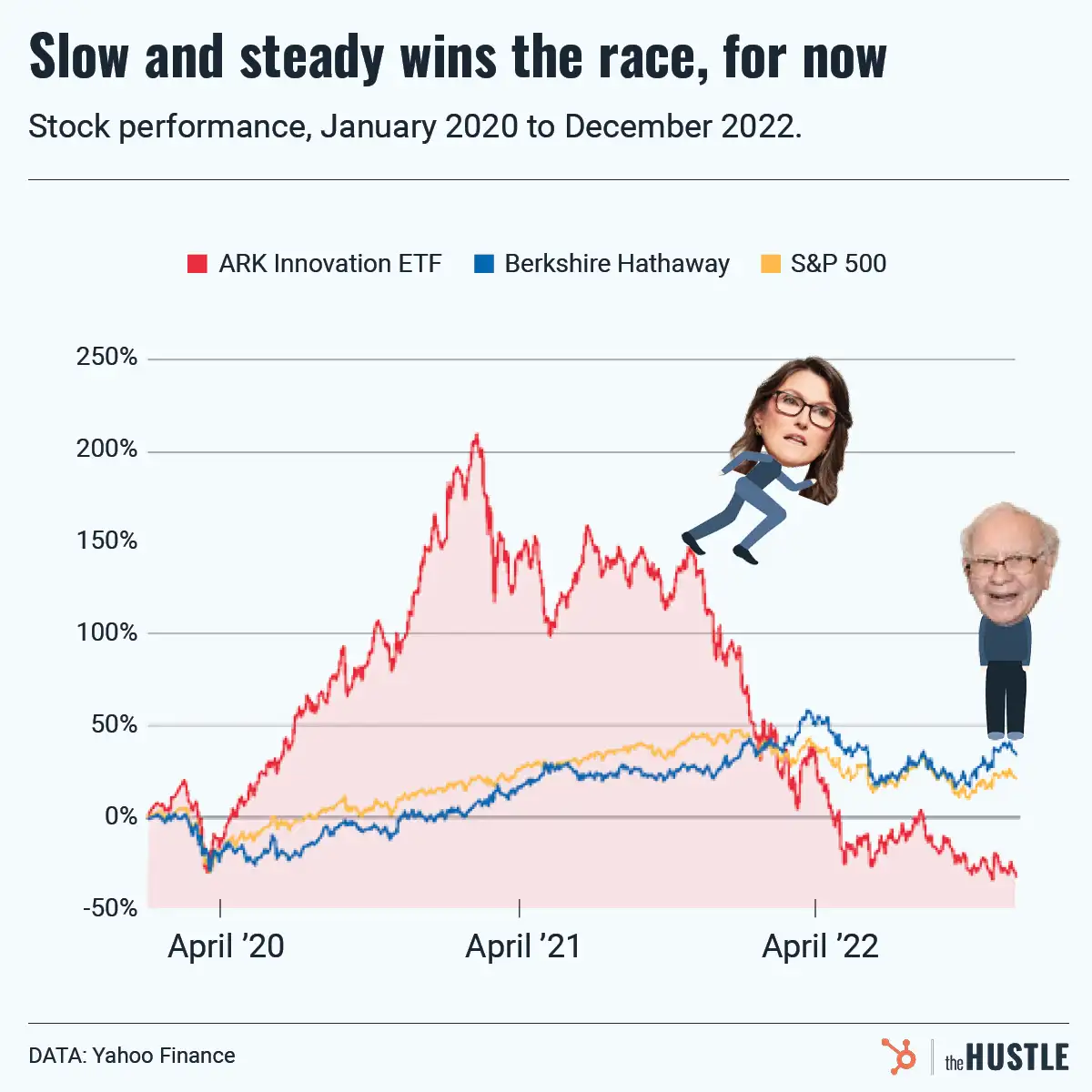

A big index like the S&P 500 is down ~20%, which is bad but not unprecedented. Plenty of tech stocks are down 50%-80%, which is calamitous.

A few things stick out in my mind to keep it in perspective:

- About once a decade, people forget that bubbles form and burst about once a decade. It’s always been like this and always will be. Optimism overshoots, bubbles burst, memories fade, and the process repeats.

- There are three legal investment strategies: You can be smarter than others. You can be luckier than others. Or you can be more patient than others. Know your edge and how hard it is to maintain.

- Few things are as valuable in investing as room for error. People who don’t have room for error in their investments may earn higher returns than you this year or next year. But they are more likely to be wiped out, or give up, when they come across an inevitable surprise.

- Your lifetime results as an investor will be mostly determined by what you do during wild times. Building wealth doesn’t require a lifetime of superior skill. It requires pretty mediocre skills — basic arithmetic and a grasp of investing fundamentals — practiced consistently throughout your entire lifetime, especially during times of mania and panic.

Easier said than done, but then again — so is everything in investing.

Topics:

Investing