An IPO in this economy? A used-car dealer is revving up for its big debut

It sounds crazy, but some other companies are forging ahead with plans to go public.

Published:

Updated:

Related Articles

-

-

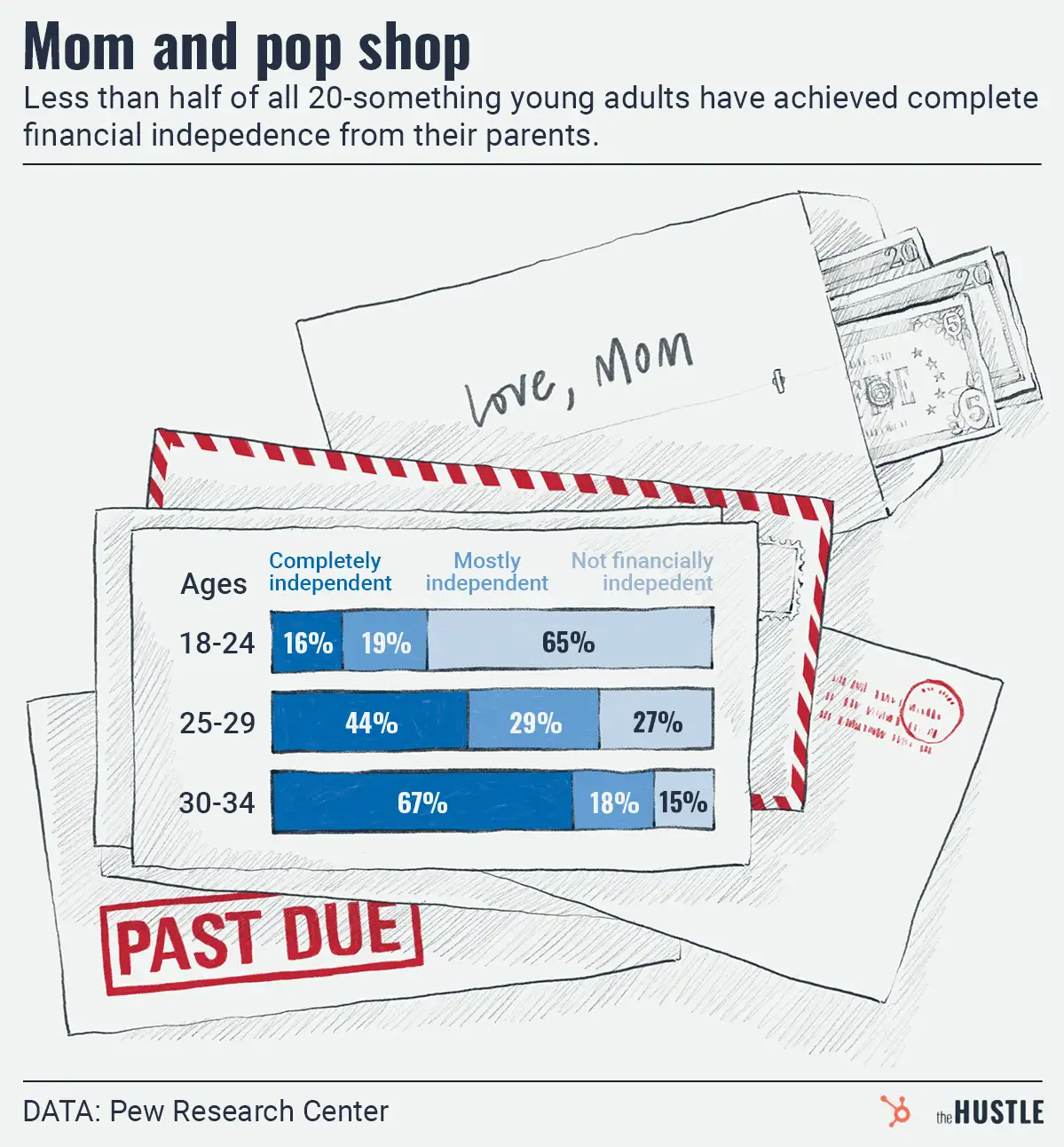

A bunch of young Americans are living on their parents’ tab

-

Federal traffic control updates are getting the green light

-

Electrified roads could be the tipping point for EV adoption

-

It’s not a great time to be GM’s Cruise

-

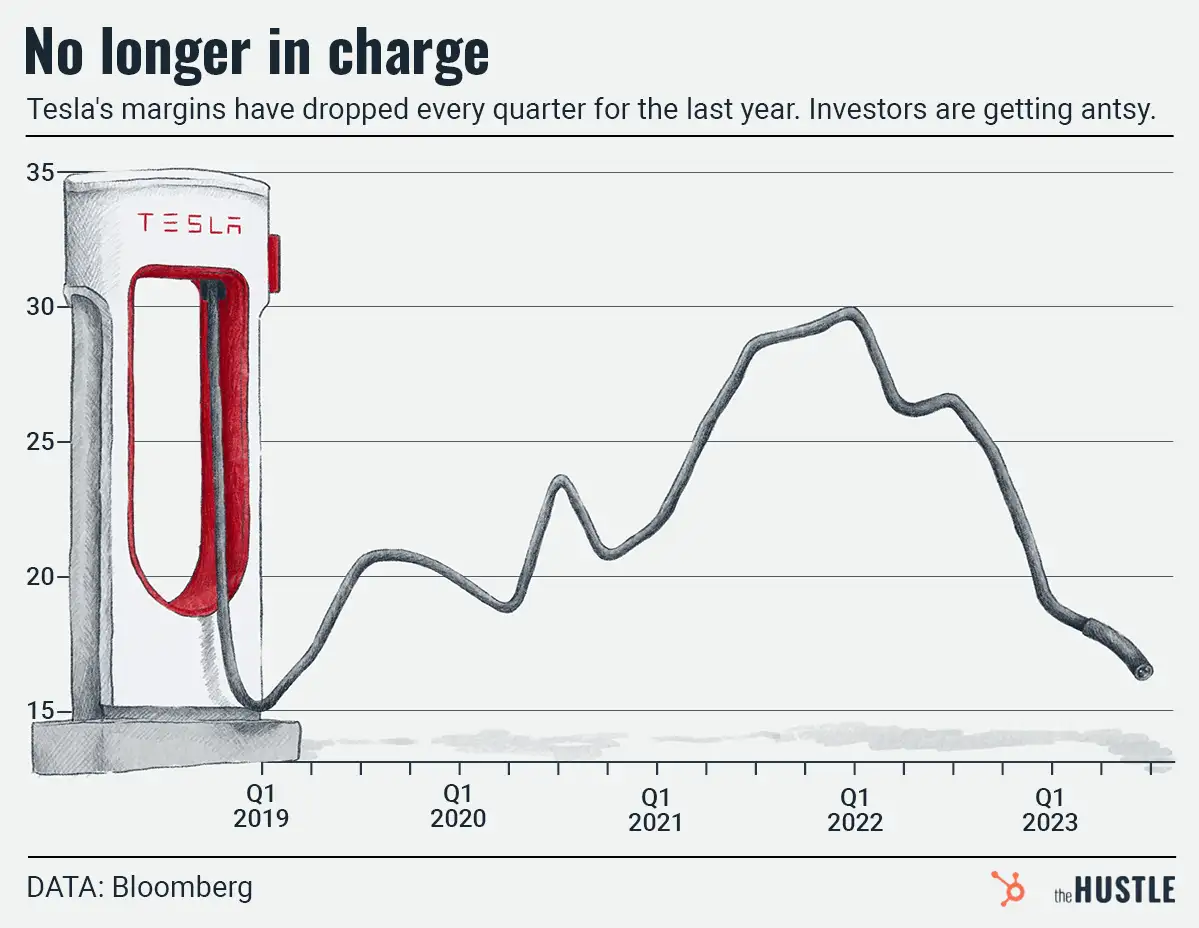

Tesla is struggling, and the outlook for improvement isn’t thrilling anyone either

-

If an auto industry exec tells you their job doesn’t suck, don’t believe them

-

Just because you can easily fly this new helicopter doesn’t mean you should

-

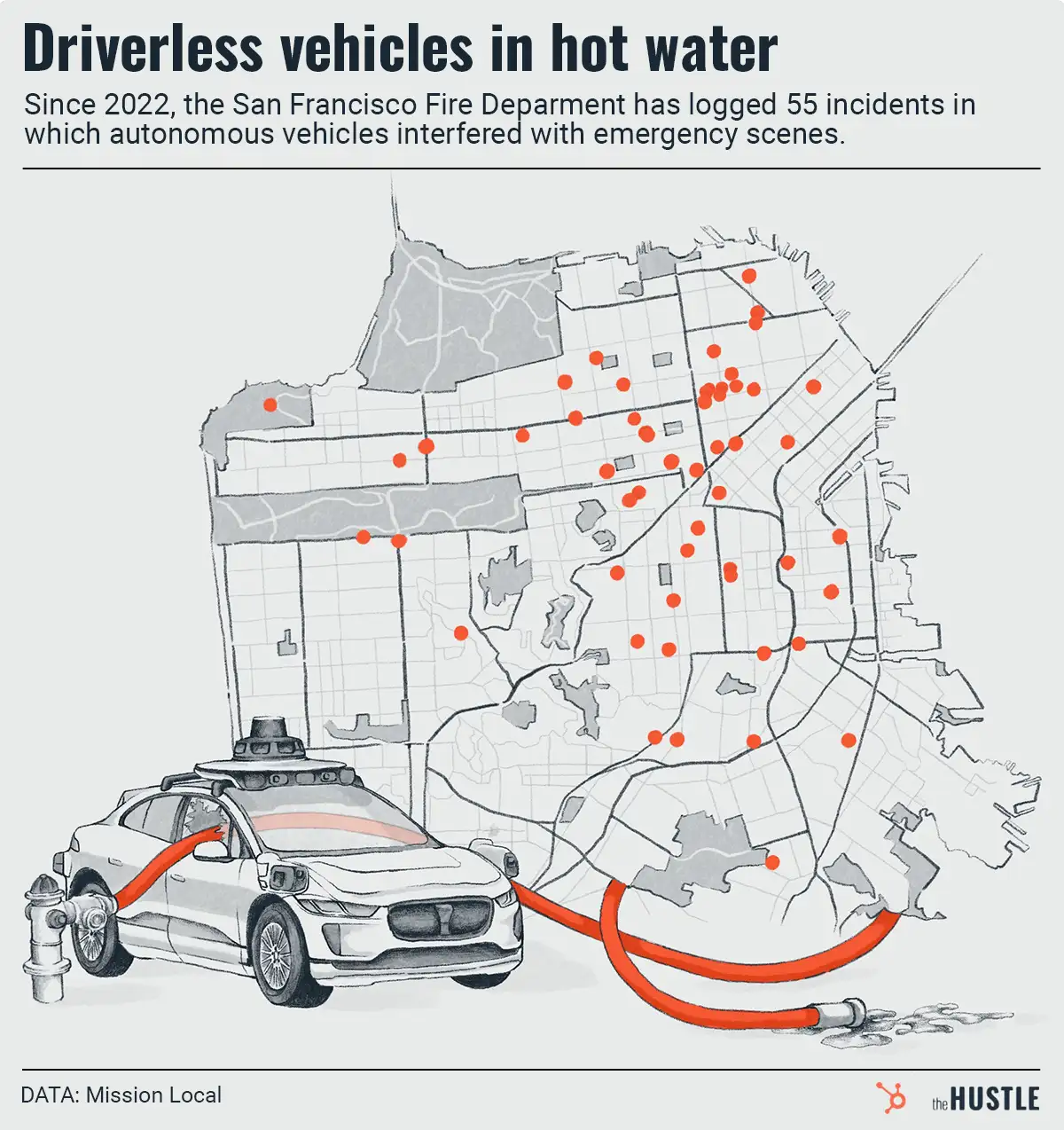

Where there’s smoke, there’s an autonomous vehicle blocking a fire

-

$750m reasons we’re getting ever closer to flying cars becoming a reality