Apple is known for its ironclad secrecy, particularly around new iPhone launches.

The same guiding principle informs the company’s mergers and acquisitions (M&A) practices.

As detailed by CNBC, the company is known for small and discreet deals.

Apple closed 100+ deals over the past 6 years…

… a pace of one about every 3 or 4 weeks.

While it did spend $3B on Beats by Dre in 2014 (its largest acquisition ever), Apple hasn’t made big headlines in a while.

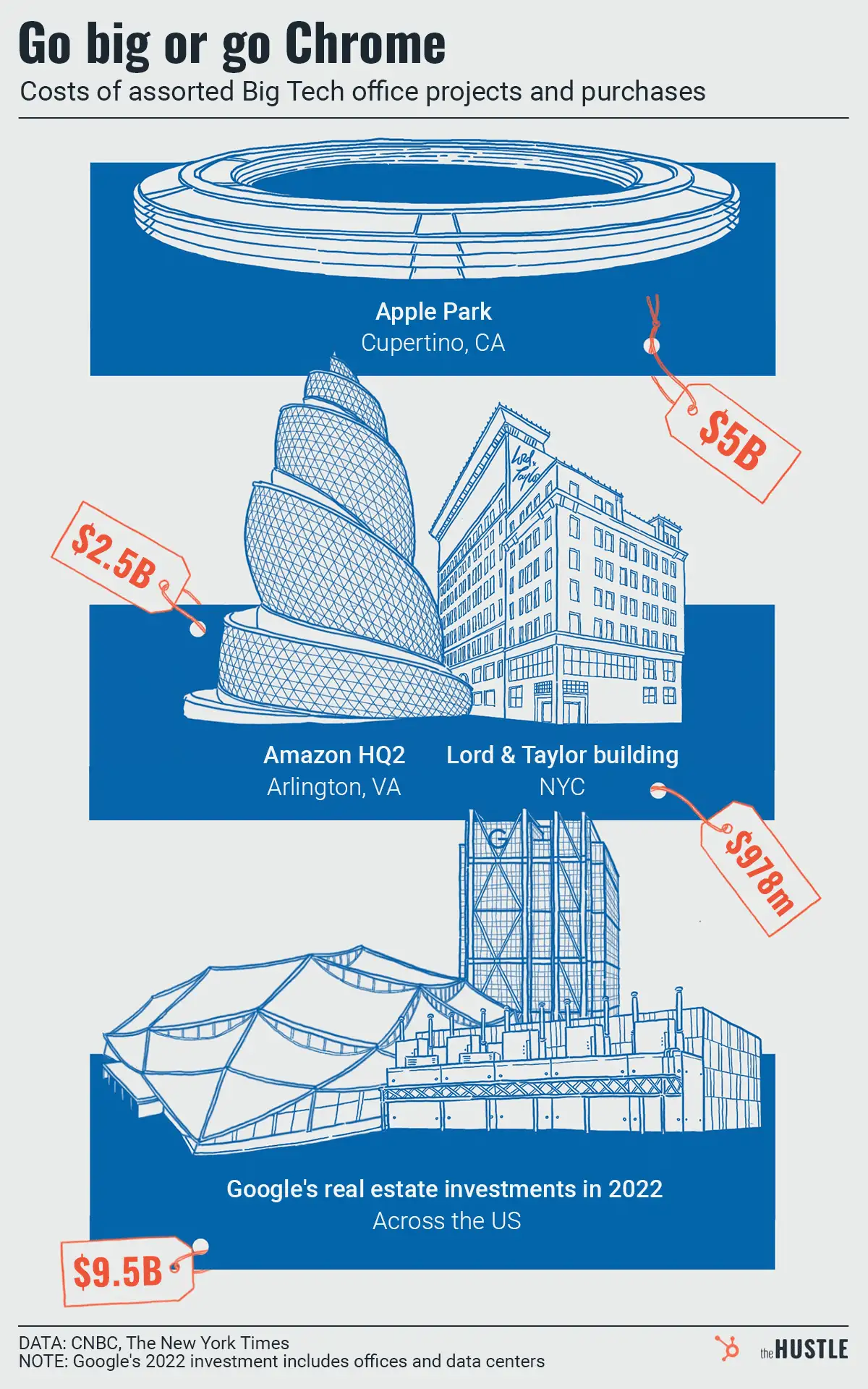

This is in contrast to its Big Tech frenemy Microsoft, which just dropped $19.7B on AI firm Nuance, its priciest deal since buying LinkedIn for $26B+ in 2016.

One reason we don’t hear about the deals: Apple has strict NDAs and advises acquired employees to not update their LinkedIn profiles.

What Apple looks for in a deal

The iPhone maker focuses on filling gaps in its tech stack: It acquired tech for fingerprint ID (AuthenTec), iPhone Shortcuts (Workflow), Apple News+ (Texture), voice assistance (Siri), and Apple Music (Beats).

When Apple wants expertise in a sector, it will buy up multiple firms.

Take semiconductors: It bought P.A. Semi in 2008 ($278m), Intrinsity in 2010 ($121m), and Passif Semiconductor in 2013 (undisclosed).

Once a firm is targeted, Apple requests a demo

If there’s interest, the tech giant sends in the deal team (no outside bank is used).

Since the deals are primarily to acquire talent (AKA acquihires) — and not brand or customers — Apple makes an offer based on the number of technical employees (~$3m per engineer). It largely ignores revenue or previous fundraising valuations.

These individuals are then offered “golden handcuffs,” which are plush deals that vest over 3-4 years… hopefully enough money to make up for the fact they can’t update their LinkedIn profiles.