MindMed’s product pipeline reads like a shopping list for 5 nights at Burning Man: LSD, MDMA, and psilocybin.

On Tuesday, the biotech company went public on the Nasdaq exchange under the ticker “MNMD.” The company was already trading shares on the lesser known Canadian NEO Exchange, but by “uplisting” to the Nasdaq, MindMed investors hope to garner more attention and $$$.

But in a public market where stocks-can-do-no-wrong, MindMed got torched by close, dropping as much as 30%.

MindMed believes tripping could be big business…

The company is focused on bringing psychedelic-inspired therapies and medicines to market.

MindMed is sponsoring several clinical trials using both hallucinogenic doses and non-hallucinogenic microdoses of psychedelic drugs to treat addiction, adult ADHD, depression, and anxiety.

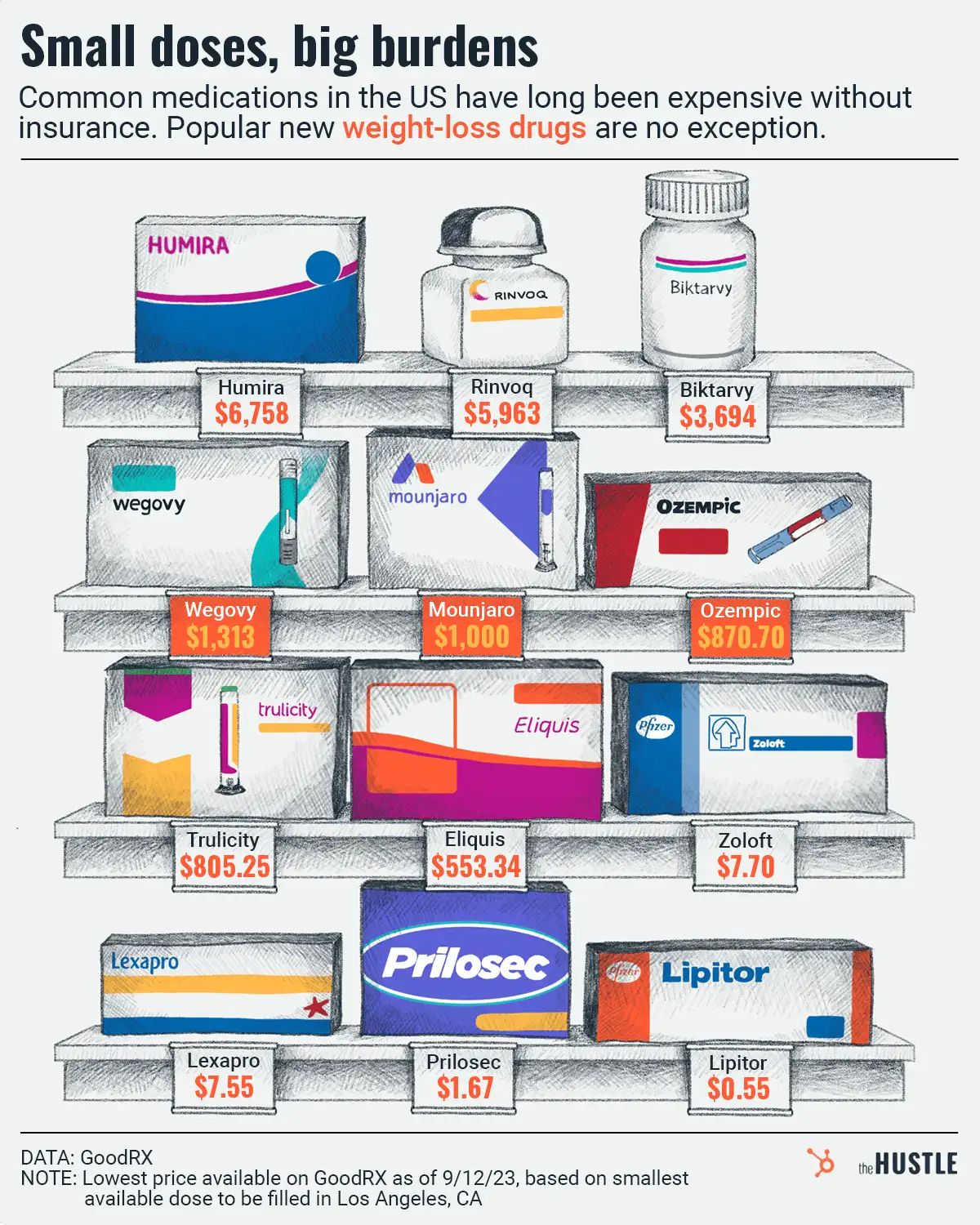

And according to an investor deck, industry stats are all caps-no stems:

- $4.7B/year global anxiety drug sales

- $9.5B/year global ADHD drug sales

- $9.6B/year global depression drug sales

- $5.8B/year global anti-addiction drug sales

MindMed hopes to capture shares of those markets with its alternative, psychedelic offerings.

‘I still think we’re in early innings here’

… MindMed co-founder and co-CEO JR Rahn said in a recent Forbes interview, referring to the company’s current concentration on clinical trials.

The company has a lot riding on those trials — and the arduous process to bring new drug therapies to the US market is the cop waiting in the bushes(FDA) — with a median cost of $985m.

Meanwhile, users on Reddit’s r/WallStreetBets have fixated on MindMed with several posts making its front page.

Next GME… Who’s tripping now?