You may know Lululemon for its pricey joggers and yoga pants, but soon, you may know it for much more.

The athleisure giant plans to double sales to $12.5B by 2026, per The Wall Street Journal, and is making big moves to get there.

What’s the plan?

Lululemon has aggressive goals across 3 core areas:

- Product: Double men’s sales and launch new categories

- Experience: Double online sales and strengthen its community

- Expansion: Quadruple international sales by growing in China, Europe, and APAC

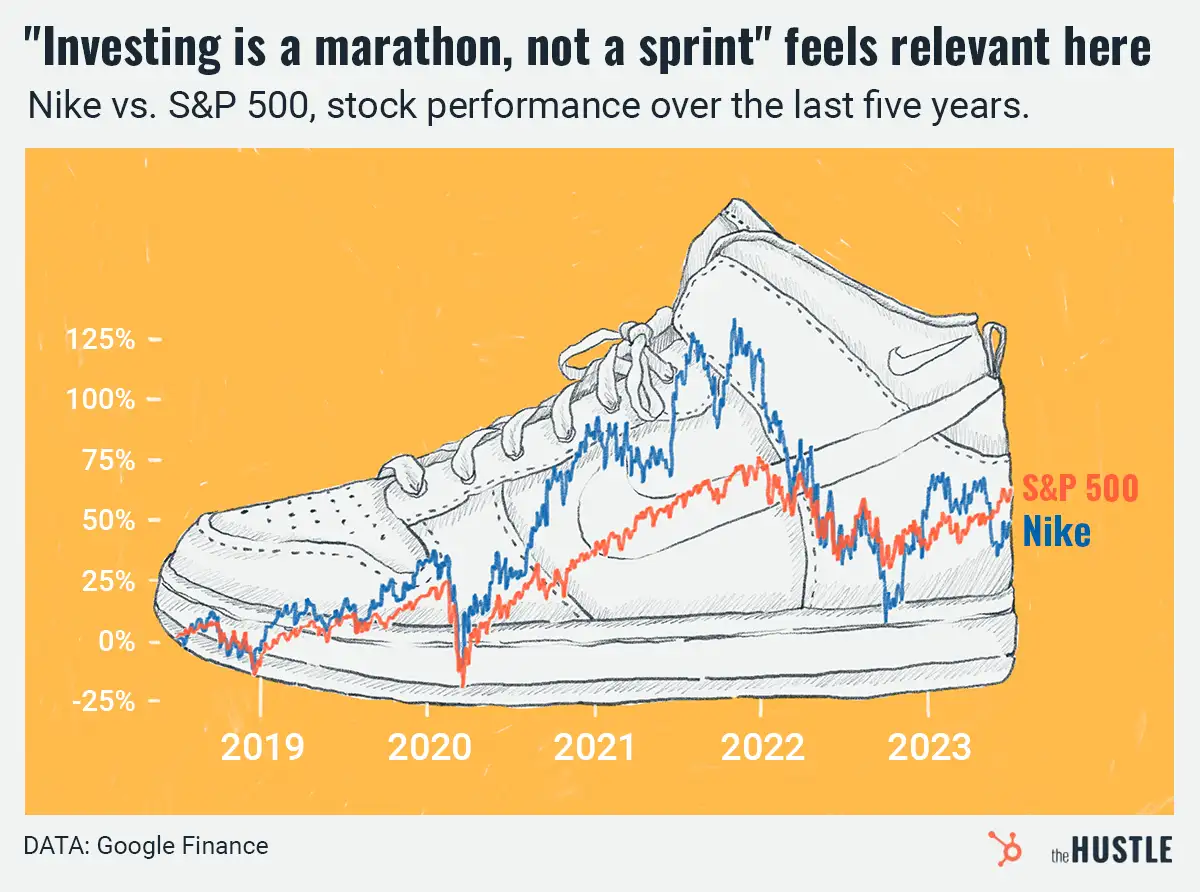

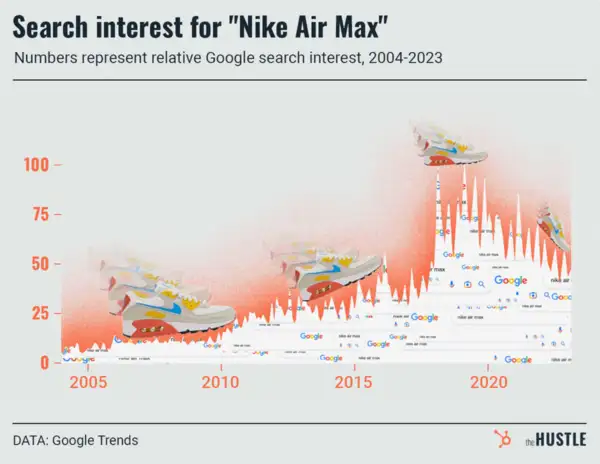

The brand has already pushed into Nike’s territory, launching a women’s footwear line this year, and is making moves to rival Nike’s digital strategy:

- In 2020, Lululemon acquired home fitness startup Mirror for $500m, arming itself with a competitor to Nike’s fitness offerings (e.g., Nike Training Club, Nike Run Club).

- Last week, Lululemon announced a new membership that includes fitness classes and early product access, evoking Nike’s membership strategy.

The brand has also moved into sports, launching golf and tennis lines and debuting in its 1st Olympics as Team Canada’s official outfitter.

But Nike is big…

… like, really big. In 2021, Nike pulled in $44.5B in sales, ~2x Adidas, and ~7x Lululemon. Nike also moved into Lululemon’s territory in 2019, launching its own yoga collection.

Lululemon’s new efforts could pay off in the long run, but for the foreseeable future, Mirror and shoe sales are only expected to make up ~5% of revenue.

Lulu does have one big thing going for it — the massive rise of remote work. With Google searches for “casual work clothes” as high as ever, more people will be working in “athleisure chic” for years to come.