Internet browser Netscape went public on Aug. 9, 1995.

In the decades since that date, the phrase “Netscape moment” has been used to signal the mainstreaming of a new industry.

Crypto-trading exchange Coinbase is going public today. With the NASDAQ setting a reference price of $65B+, it could be remembered as the crypto industry’s “Netscape moment.”

In the lead-up to this listing…

… Coinbase shared its Q1 2021 numbers; as detailed by VC Tanay Jaipuria, the results are staggering:

- Users: 56m retail accounts and 7k institutional accounts

- Revenue: $1.8B in Q1 2021, which was more than all their revenue in 2019 and 2020 combined

- Market share: 11% of the entire crypto-economy trades on Coinbase, up from <5% in 2018

How is Coinbase doing so well?

Jaipuria credits the exchange’s strong results to 2 things:

- High take rates: Coinbase gets 95% of its revenue from transactions, and its current take rate from retail investors is quite high (up to 1.5% vs. 0.05% for institutions).

- A crypto bull cycle: The take rate is being applied to increasing trading volumes as crypto is in its 4th bull cycle

“As the price of Bitcoin has increased from $7K to ~$60K, trading volumes have increased fourfold (16X when annualized) from $80B (2019) to $335B (Q1 2021),” he writes.

But such a juicy take rate brings competition

And Jaipuria notes that a bear case for Coinbase is that its fees will fall as more players — from consumer fintech (Square, PayPal), brokerages (Fidelity), crypto exchange (Gemini, Binance) — take share.

Crucially, the fintechs and brokerages can subsidize crypto trading with other business lines.

Coinbase’s potential moat is the trusted brand it’s built.

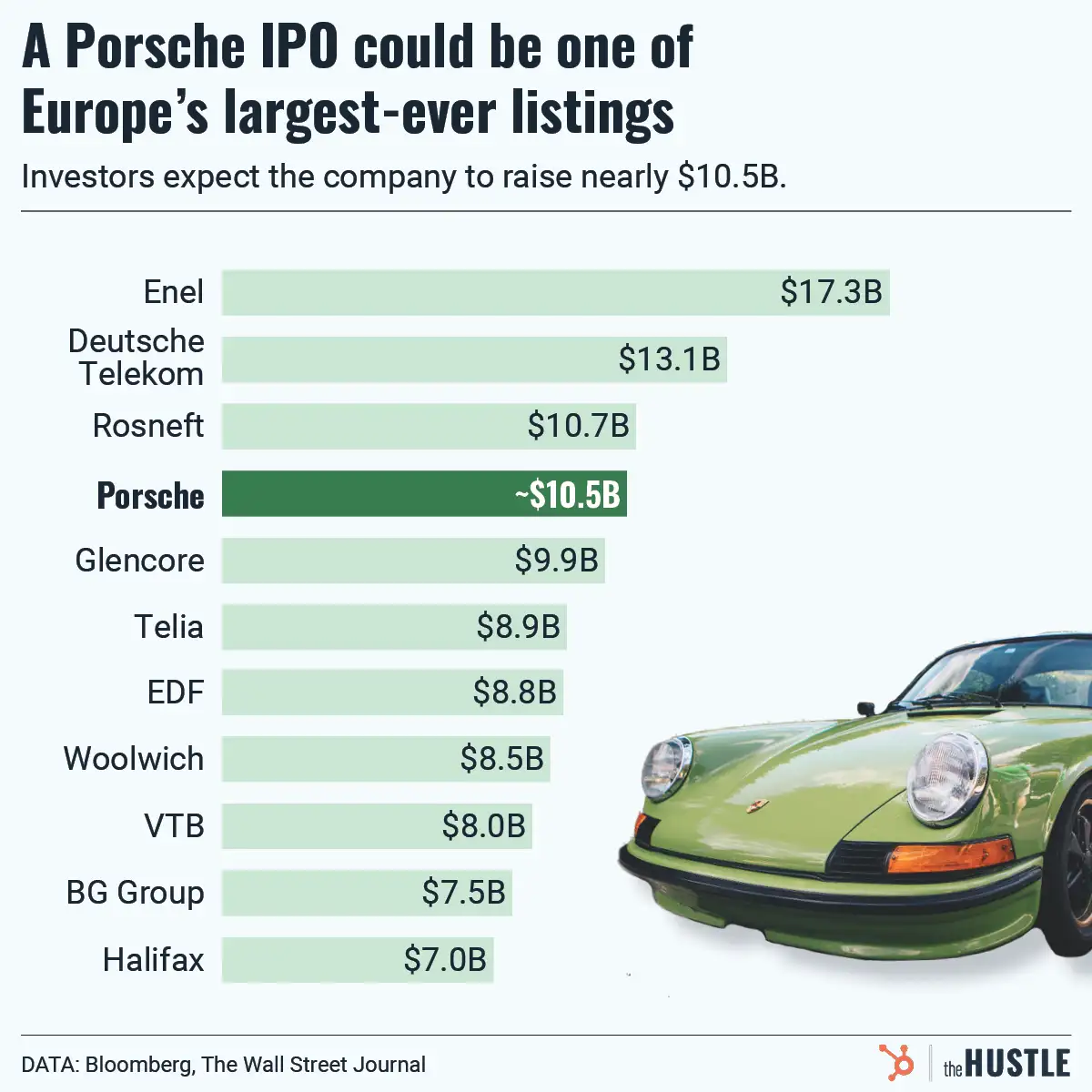

Either way, there will be countless Coinbase winners today from what could be the largest public debut since Facebook’s $104B bonanza in 2012.