On Monday, Shopify announced its plans for a 10-for-1 stock split to make share ownership more accessible. So, uh, what’s that?

For starters, the financial maneuver doesn’t change the market capitalization of a company — just its number of outstanding shares.

For example, say you own one share of a company’s stock at $1k per share. A 5-to-1 stock split would give you 5 shares at $200 per share. Math!

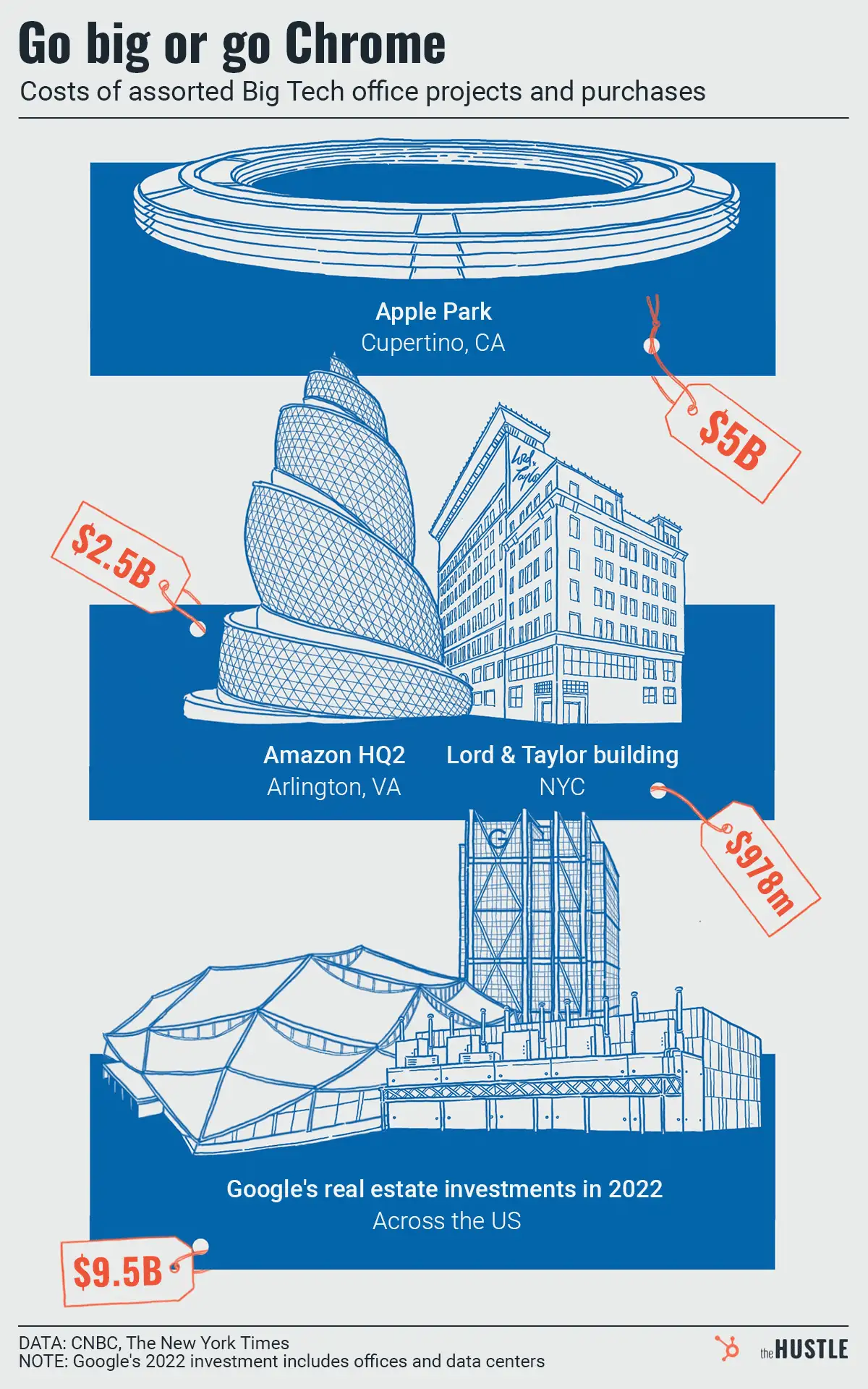

But why are companies like Tesla, Amazon, and Alphabet all doing it?

Historically…

… companies have issued stock splits to increase trading volume when their stock price has gotten too high. Examples include:

- Apple issuing a 4-to-1 split in 2020 ($500 to $125), leading to a spike in trading among retail investors (AKA regular people).

- Berkshire Hathaway issuing a 50-to-1 split for its Class B shares in 2010, resulting in a boost in liquidity (trading shares became cheaper and faster). This boost made it eligible for the S&P 500.

But these days, trading platforms like Robinhood allow investors to buy fractional shares of a stock (for example, ¼ of a share), making share price less important.

With that in mind, Virginia Tech finance professor Derek Klock says stock splits are a psychological play — a way for a company to tell the market it expects its stock to keep going up.

Warren Buffett once said…

… stock splits are irrelevant, comparing the move to cutting a pie into more pieces. But the data seems to prove it works:

- Tesla, Google, and Amazon all saw net purchases double after announcing splits.

- Plus, research from Nasdaq found that simply announcing a split leads to a 2.5% increase in share price, and companies that issue splits beat the market by ~5% in one year.

Bonus: Here’s a boppy old-school stock rap. “A company is kinda like a pie (pie!), a stock is a slice that you buy (buy!).”