The race is on for the government’s small-business rescue loans

The race is on for small businesses to get coronavirus relief, but chaos set in quickly.

Published:

Updated:

Related Articles

-

-

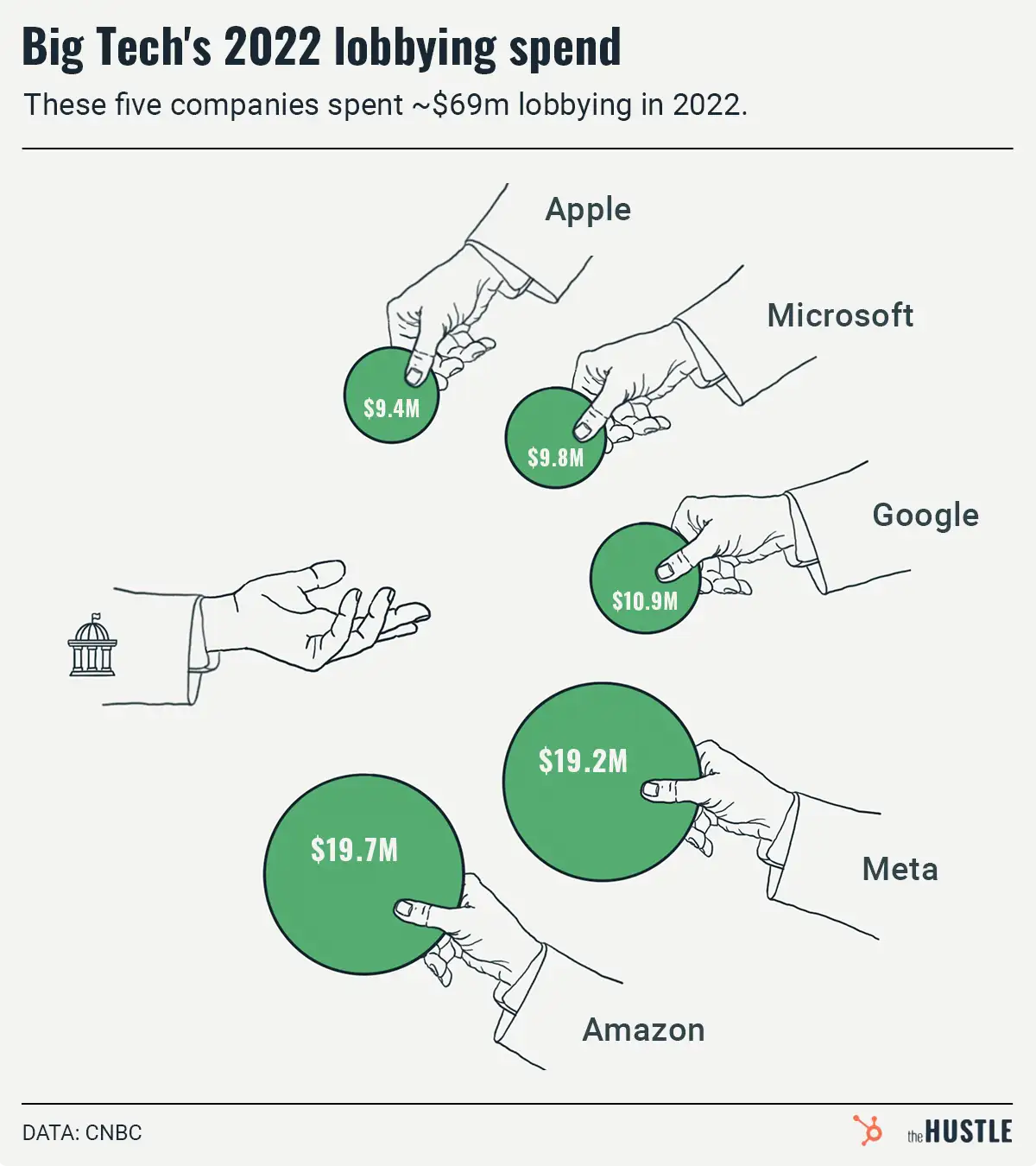

What the past year of tech lobbying looked like

-

The $1.4B prison phone call industry gets an overhaul

-

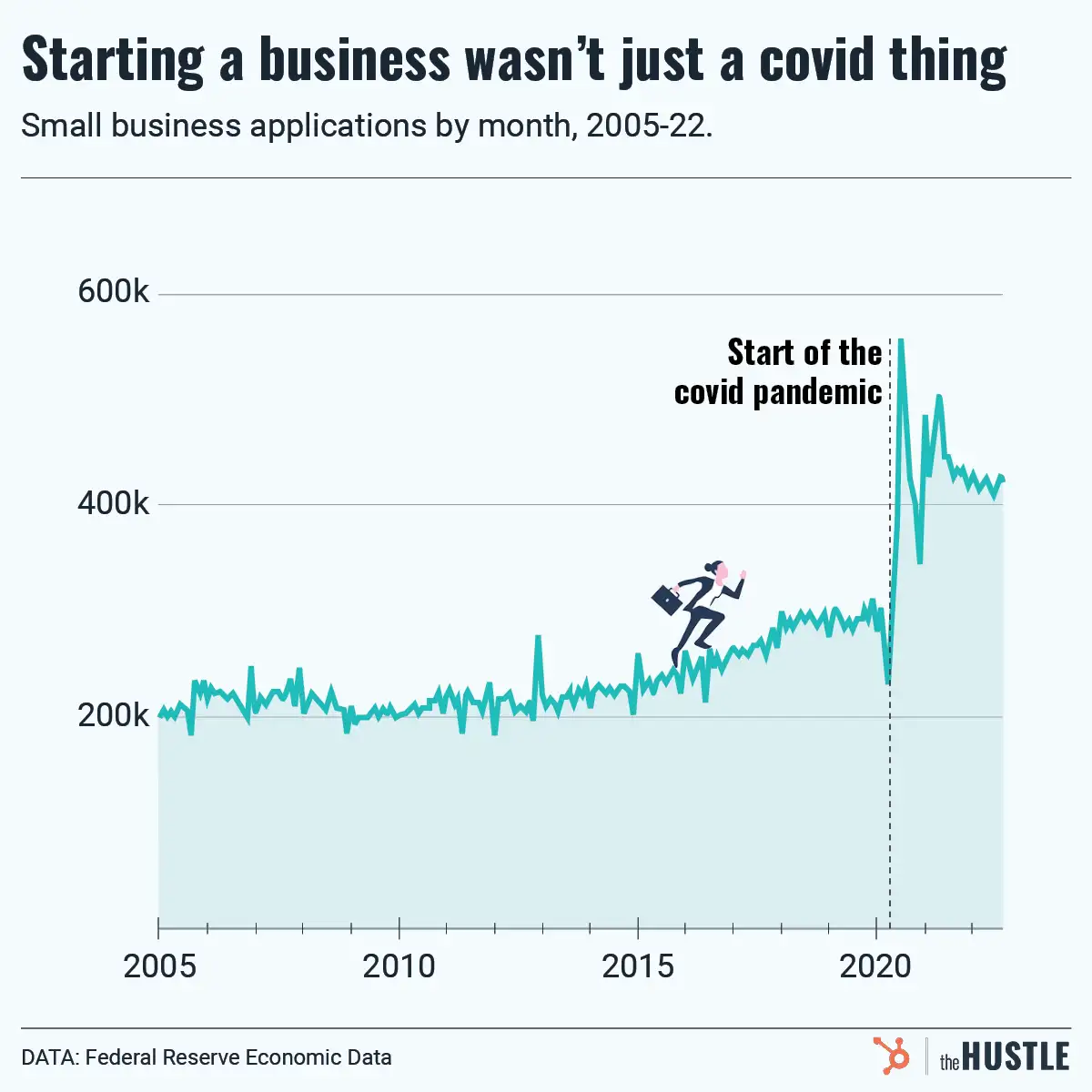

The small business boom ain’t over yet

-

California fast-food workers could get $22/hr.

-

Could the climate bill help you nab an EV?

-

Why small businesses should think like media companies

-

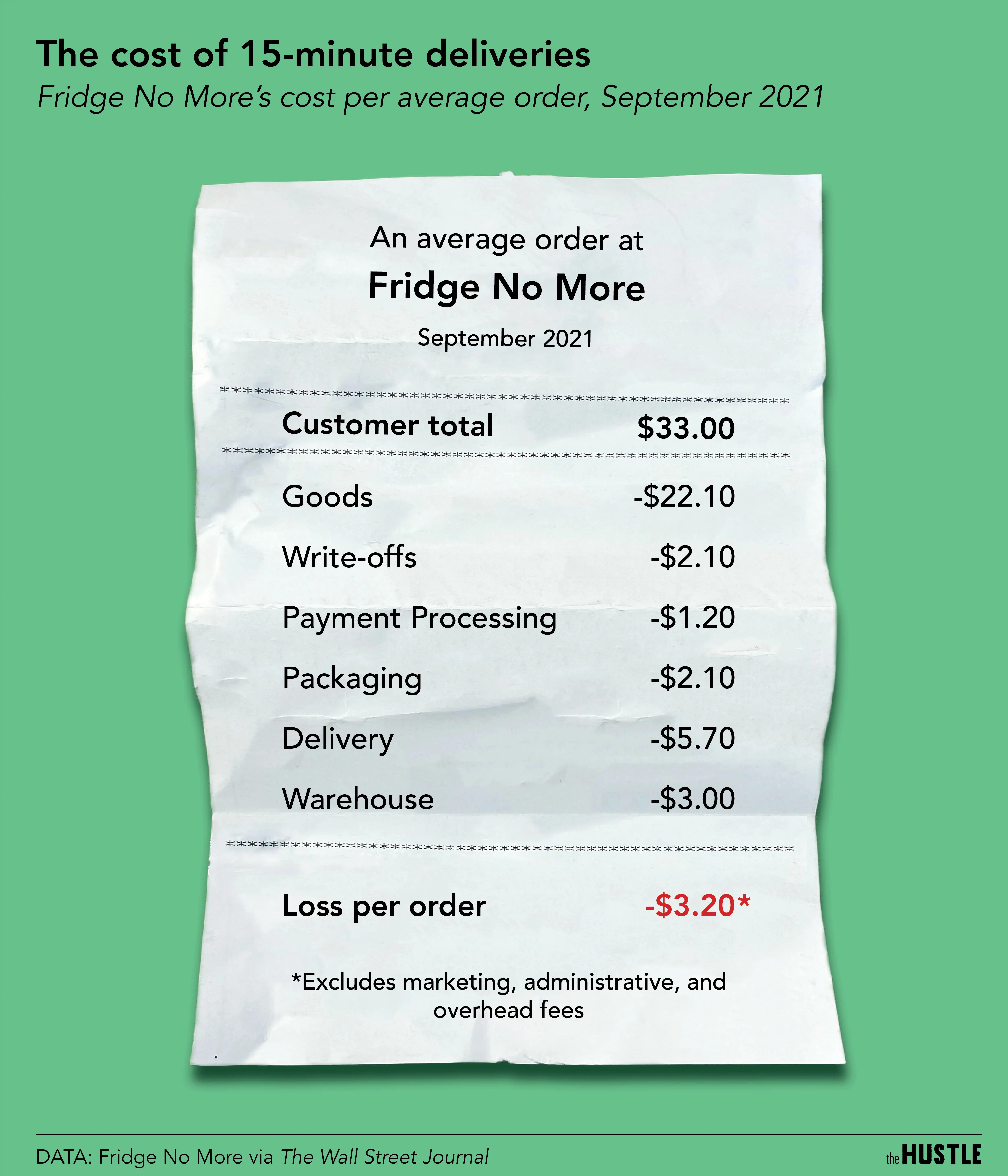

Digits: 15-minute delivery, Lightyear, and teacher shortages

-

Black-owned businesses are booming

-

Digits: Terrible gas mileage, Coca-Cola cocaine, and more wild numbers