Wishing you hadn’t splurged on that Peloton is one thing. Regretting purchasing your house, however, is about as bad as buyer’s remorse gets.

With interest rates at an all-time low, the pandemic sparked a home-buying frenzy, as people traded yardless urban rentals for space, stability, and a mortgage.

But now that the dust has settled, ~75% of recent buyers say they have regrets, according to The New York Times.

Calling the housing market “competitive”…

… would be a massive understatement. As buyers tried to find an edge, many made questionable decisions, including:

- Waiving inspections: Moving fast might speed up closing, but if you knew the foundation was cracking you might’ve offered less (or walked away).

- Buying sight unseen: It seems crazy to spend hundreds of thousands without seeing the home, right? Wrong, apparently — 63% of buyers in 2020 made offers without touring the place first, according to Redfin.

- Underestimating maintenance: 32% of buyers regret buying a home that needs more work than they anticipated.

Future buyers have a lot to learn

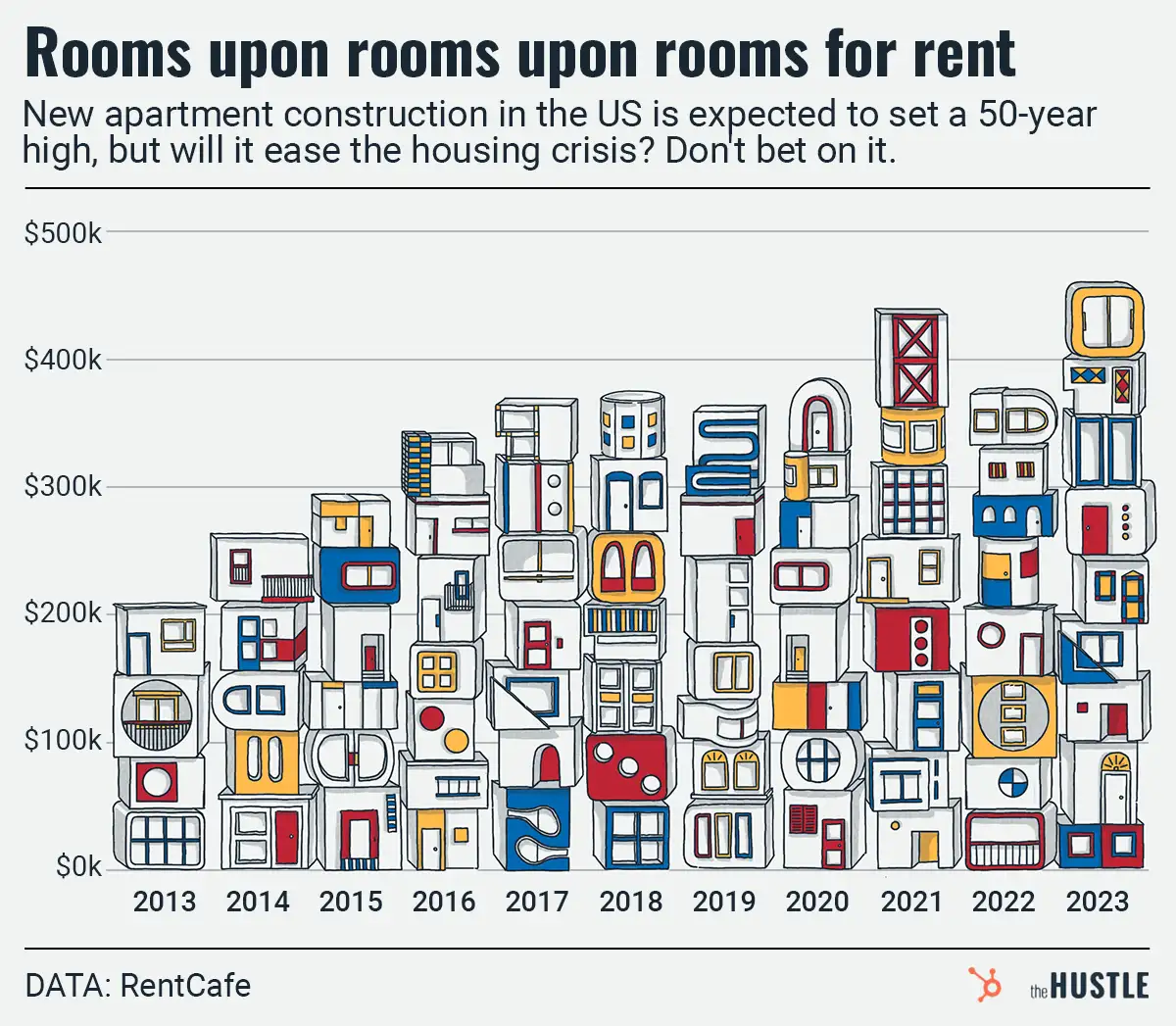

The housing market is still bananas. The typical US home is worth $330k+, and values are expected to increase 16.4% by year-end. The number of homes on the market has also been declining and is still much lower than pre-pandemic levels.

Although rising interest rates are expected to cool the market, they may also encourage people to stay put, keeping inventory low and fueling even more questionable decisions that lead to buyer’s remorse.