Meet Lex Greensill.

He founded Greensill Capital to disrupt supply-chain finance, an industry that supports $7T in global trade activity.

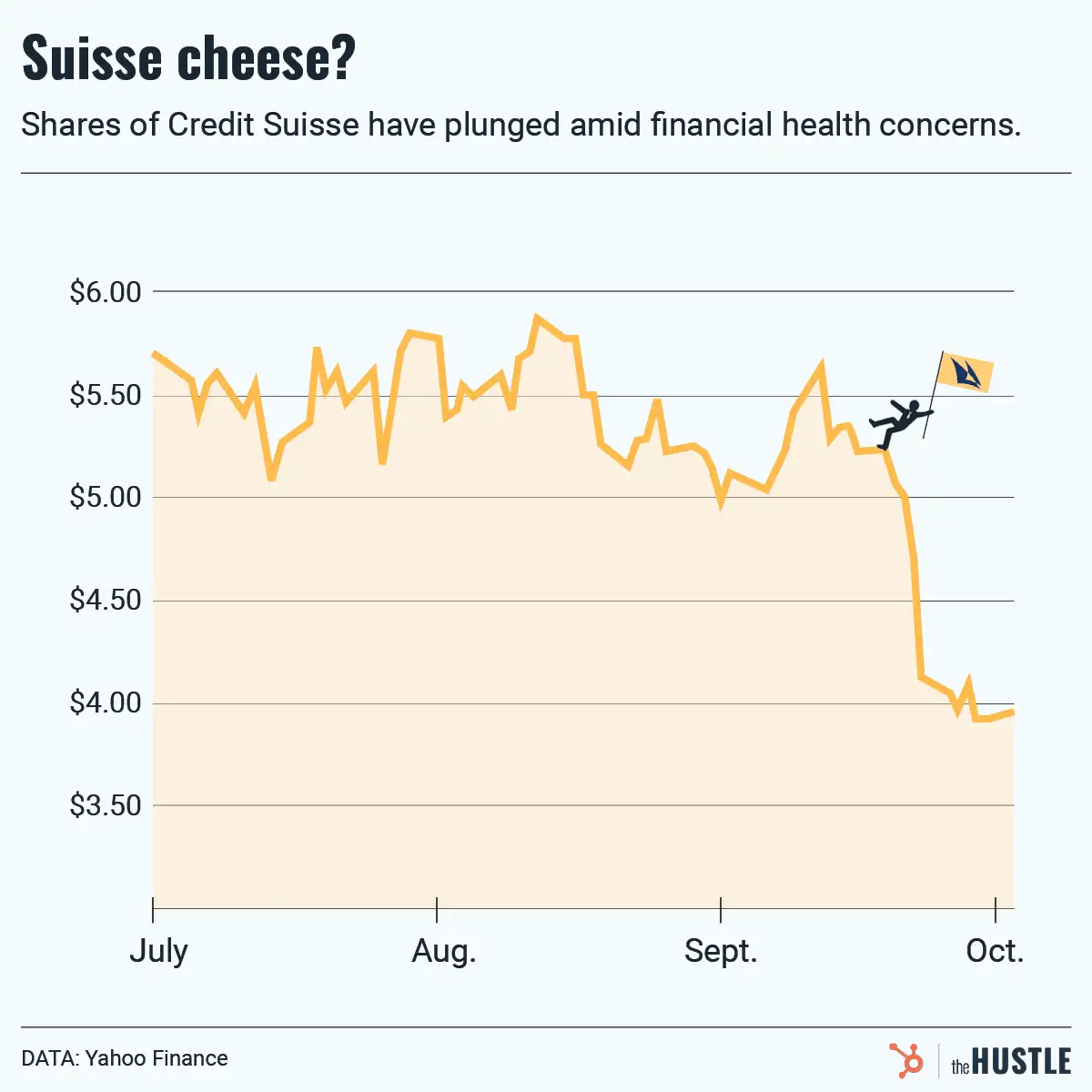

As reported by the Wall Street Journal, Greensill — with a big investment from SoftBank — was potentially headed for a $40B IPO last year. Instead, it just declared bankruptcy, sending shock waves through global finance.

First, what is supply-chain finance (SCF)?

Imagine you are a manufacturer that sells widgets to a car company (CarCo). Typically, you will give CarCo 90-120 days to pay off its goods invoice.

Waiting for money sucks, though.

Enter a supply-chain financier, usually big banks. Let’s say the invoice is $1k. The financier offers to buy it from you for $990 upfront and — when CarCo pays the bill later on — it profits $10.

This type of financing is low margin and reserved for big business

The JPMorgans of the world will do it as a way to upsell other services.

From a young age, Lex Greensill was obsessed with making SCF more accessible. He grew up on his family’s Australian melon farm and saw how long (sometimes 1yr+) it took his parents to turn crops into money.

After doing SCF lending at Morgan Stanley, he launched Greensill Capital in 2011 to create a platform that would make such financing available to more people.

To break into the industry, he cut corners…

… by giving lax lending terms and providing money to nontraditional clients (skyscraper builders, plane leasing companies).

His most controversial deals included:

- Opaque loans to UK steel magnate Sanjeev Gupta

- Self-dealing with other SoftBank portfolio companies

Greensill’s portfolio was filled with time bombs

It all imploded on March 1, when a required insurance policy lapsed and the insurer refused to renew it. A week later, Greensill declared the business insolvent.

Here are some of those taking the biggest Ls:

- German citizens: 26 towns across Germany linked to a Greensill-owned bank may lose $300m+ in deposits.

- SoftBank: After a scorching hot run of investments (Coupang, DoorDash), Masayoshi Son has another WeWork on his hands and will write down its $2B investment.

- Citi: The global bank has assets in a $10B supply-chain fund related to Greensill frozen.

Regulators, investors, and borrowers are only now starting to dig through the mess (a coal company owned by West Virginia’s governor just sued).

Keep an eye on this space… there’s sure to be more news to come.