Cloud companies are en fuego right now.

In its latest State of the Cloud report, Bessemer Venture Partners (BVP) relayed stats on how well cloud-based software firms have fared during the pandemic:

- $2T: The combined market value of 60+ publicly traded cloud companies tracked by the BVP Nasdaq Emerging Cloud Index.

- $186B: The amount of funding poured into private cloud companies in 2020.

- +70%: The increase in YoY value of the top 5 cloud companies (PayPal, Adobe, Salesforce, Shopify, Zoom), which are now worth $1T+ on their own.

Looking to 2021…

… here are BVP’s top cloud industry predictions:

- The unbundling of the office: Startups tackling office tasks continue to pop up: email (Superhuman), project management (Productboard), virtual office (Parsec), calendars (Calendly)

- Small business tech: More back-office solutions for small and medium-size businesses: customer success (Intercom), HR (Gusto), sales and marketing (Yotpo)

- DEI: Rollout of diversity, equity, and inclusion software: talent management (Diversio), training (Unpacking), recruiting (Jopwell)

Another key prediction is the rise of “vertical SAAS,” which is an A to Z solution for a single industry (e.g., how Squire provides all the tools a barbershop needs).

Cloud is the new growth engine

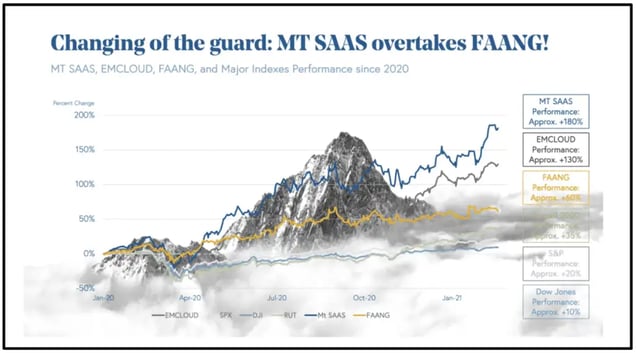

Prior to 2020, the major growth engine for the stock market had been FAANG stocks (Facebook, Amazon, Apple, Netflix, Google), heralded as the vanguard of the “new economy.”

BVP finds that a similar portfolio of cloud-focused stocks — hilariously dubbed MT SAAS (Micorosft, Twilio, Salesforce, Amazon, Adobe, Shopify) — outperformed FAANG by more than 3x in the last 4 years.

In case that wasn’t impressive enough, BVP created a chart which literally has a mountain in the background as a nod to their new acronym (MT SAAS):