The idea of Indie.vc began as a mysterious Tumblr site (Source: Medium / Bryce Roberts)

It sometimes feels like “venture capital” is just a synonym for “here’s a massive check, take over the world.”

For years, Bryce Roberts has worked to change that outlook.

A managing partner at OATV, Roberts launched Indie.vc in 2015 as a pilot fund focused almost entirely on helping bootstrapped companies reach profitability.

Indie’s investment thesis went something like this:

If today’s VCs are focused on Blitzscaling — what the Harvard Business Review describes as “throwing yourself off a cliff and assembling your airplane on the way down” — then Indie was the anti-VC VC.

Indie wanted to find the next Qualtrics, GitHub, Zapier, or Notion — all of which were laser-focused on serving customer needs and becoming profitable early on.

Indie first operated within OATV’s $85m 3rd fund and saw its investments increase revenues 100% in 12 months and 300% in 24 months, on average.

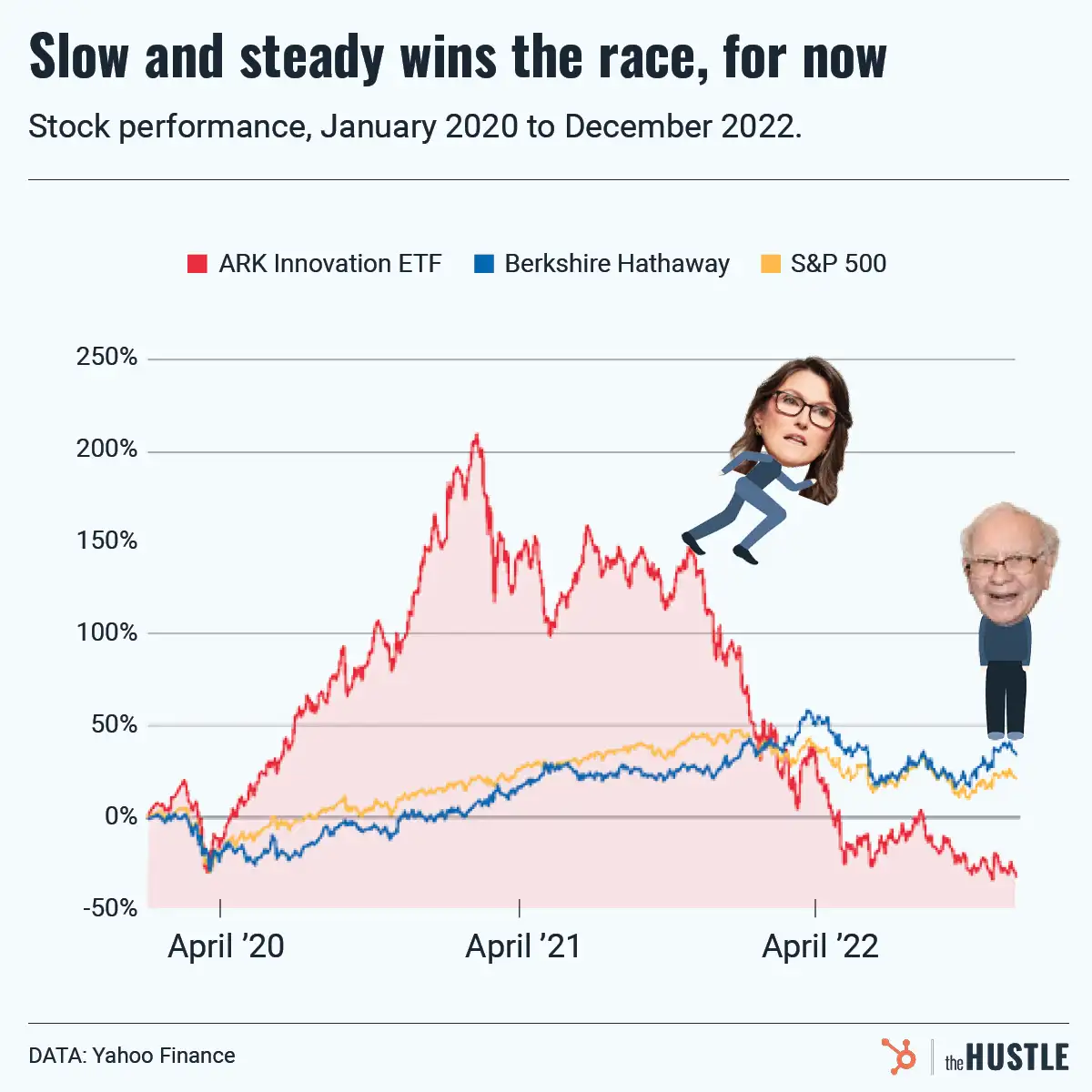

But we’re living in a world where unicorns are seemingly born overnight…

… and there weren’t any overnight unicorns in Indie’s portfolio because Indie was designed to be methodical, not fast.

So when OATV announced a 4th fund completely focused around the Indie model, 80% of its investor base dropped out — and that meant the end for Indie.

Last week, Roberts announced Indie was winding down operations. The firm has since seen an outpouring of support, and Roberts still expects many Indie investments to post 5x+ net multiples in 4-5 years.

If only those investors had some patience.