Well, if you’re somehow completely new to the GameStop story, read this.

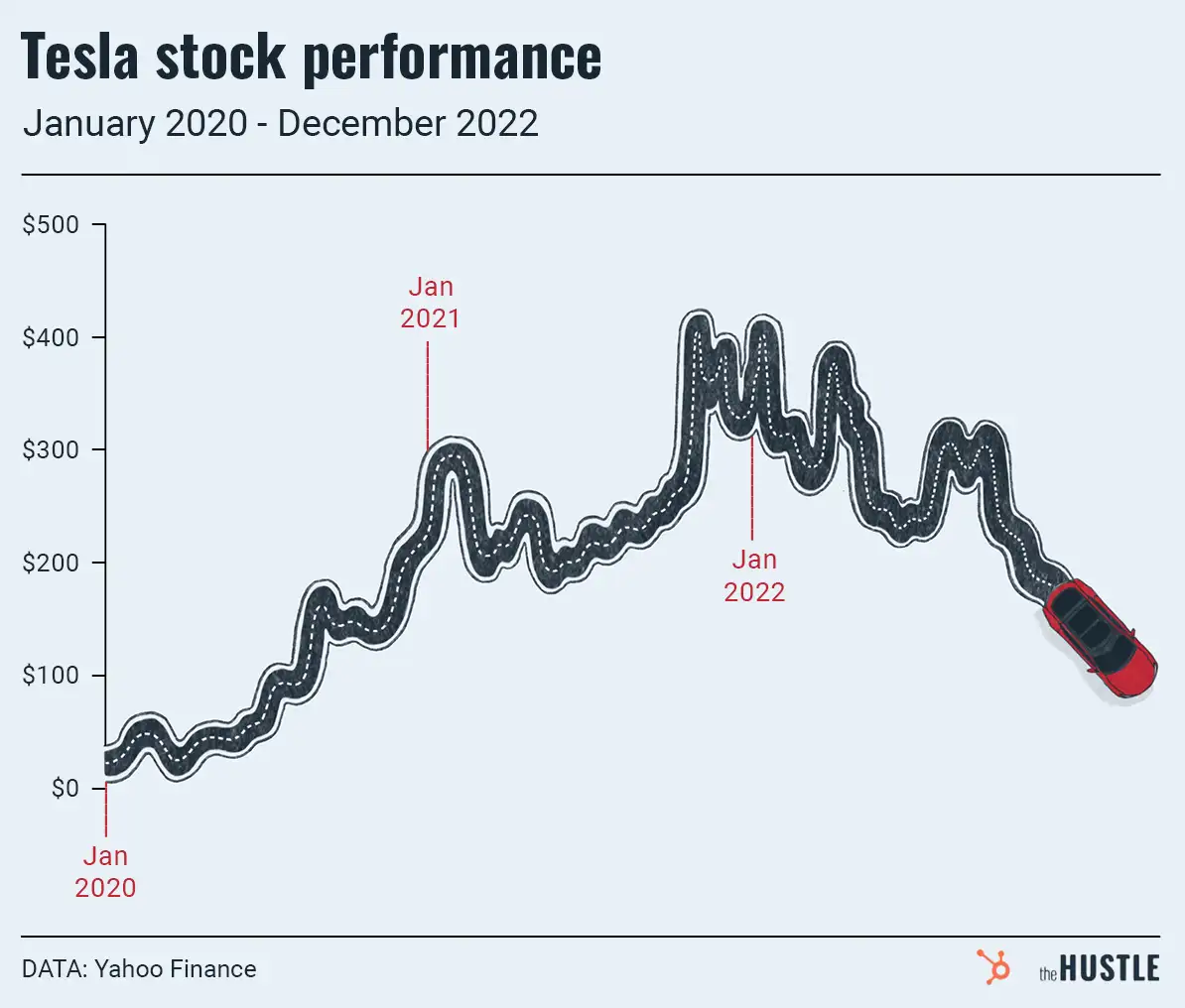

The video game retailer — which became the battleground for investors (from r/WallStreetBets day traders to hedge funds) — has seen its stock price plummet from a high of $483 down to $46 in a few weeks.

Congress has questions

And, tomorrow at 12pm EST, the US House Committee will hold a livestream hearing with many of the players involved, including:

- Vlad Tenev: The embattled CEO of trading app Robinhood

- Ken Griffin: The “richest person in Illinois” and CEO of market making firm Citadel

- Gabriel Plotkin: The CEO of Melvin Capital, the hedge fund that was shorting $GME and took a beating from Reddit traders

- Steve Huffman: CEO of Reddit, who has said that his moderation team looks for “daily active sh*theads” to make sure no communities “spiral out of control”

- Keith Gill: A Massachusetts-based financial advisor who was the most prominent Reddit trader (with the username u/DeepF*****Value). Gill turned a $50k bet on $GME into tens of millions of dollars.

Separately, Gill was hit with a lawsuit for securities fraud in Massachusetts on Tuesday. The charge: that he misrepresented himself as an amateur (when, in fact, he was a chartered financial analyst) while touting $GME.

The purpose of the hearing…

… is to talk about the “recent market volatility involving GameStop stock and other stocks” and — per Investopedia — will touch on these topics:

- Robinhood’s business model: The trading app has been accused of gamifying stock trading. Further, the company makes significant revenue from what is known as “payment for order flow,” where it gets paid to send trades to market makers like Citadel.

- Hedge fund short selling: Whether the practice of betting against stocks is abusive.

Absent from the hearing… anyone from the actual company GameStop because… it’s 2021, and meme stocks are often not even about the company.