Dwight Eisenhower liked to say that Napoleon’s definition of a military genius was “the man who can do the average thing when all those around him are going crazy.”

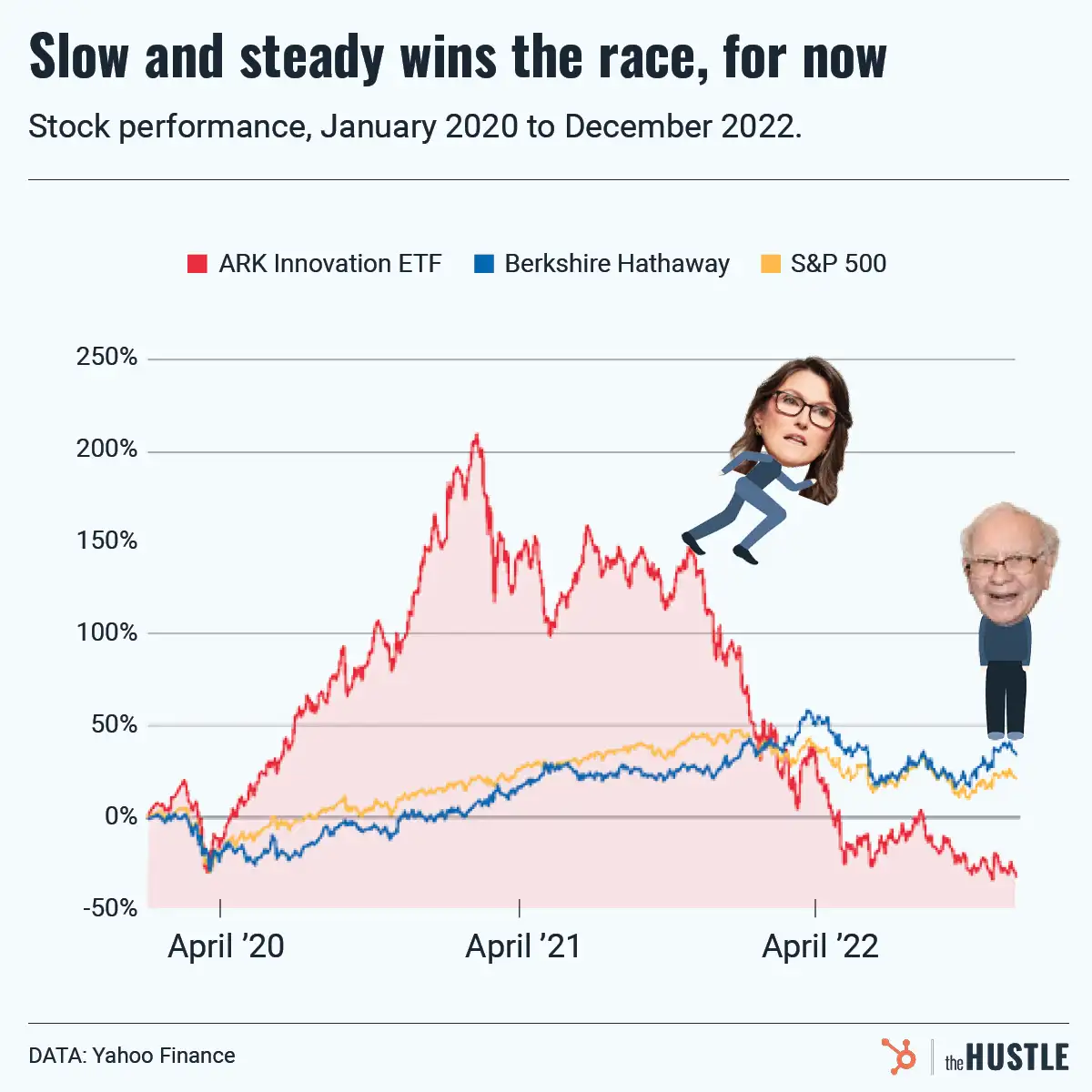

It’s the same in investing — especially as markets get wild, as they’ve been in recent weeks.

Doing well over time doesn’t require exceptional insight or complex strategies. What it requires is maintaining a level head during brief periods of upheaval.

The biggest secret in investing…

… is that average returns sustained for an above-average period of time lead to extraordinary returns.

Billionaire investor Howard Marks once talked about an investor whose annual results were never ranked in the top quartile, but over a 14-year period he was in the top 4% of all investors.

If he keeps those mediocre returns up for another 10 years, he may be in the top 1% of his peers — one of the greatest of his generation despite being unmentionable in any given year.

So much of the focus in investing…

… is on what people can do right now, this year, maybe next year.

“What are the best returns I can earn?” seems like such an intuitive question to ask.

But if you understand the math behind compounding, you realize the most important question is not “How can I earn the highest returns?” It’s this: “What are the best returns I can sustain for the longest period of time?” Just staying in the game, consistently, through chaos.

If you:

- Kept your head on straight when the market crashed in 2000, you’re an investing genius

- Remained calm during the crash of 2008, you’re an investing genius

- Haven’t panicked over the last few months of volatility, same thing

It doesn’t take much, but it makes all the difference in the world.