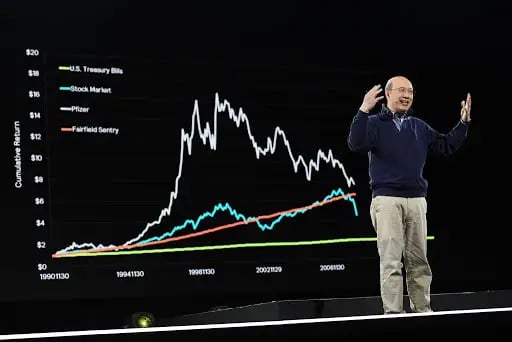

Andrew Lo is a legend in finance.

Named one of Time’s 100 most influential people in 2012 — with the magazine describing him as a cross between Charles Darwin and Adam Smith — the MIT finance professor has taught a generation of hedge fund quants.

While the term “financial engineering” often gets a bad association, Lo’s work in the field of biotech may lead to groundbreaking cures.

Nearly a decade ago, Lo lost his mother…

… and 5 other people close to him to cancer over a 4-year span, according to a Bloomberg report.

After these tragedies, Lo set out to see how financial engineering could help find cures for rare diseases. In his research, Lo found that many biotech startups can’t get funding because of what’s known as the “valley of death.”

A successful new drug might pay off $2B per year for a decade and only cost $200m to create… however, the chance of success is low (5%); even with that payoff, many investors balk at the risk.

What if you could pool the risk, though?

Lo proposed creating a $30B fund to fund 150 biotech startups ($200m each). The key insight was that each startup had to target a different (and unrelated) disease.

The reason: Lo wanted all of the startup bets to be completely uncorrelated, meaning failure by one would have zero effect or relation with another.

Using this model, his research showed that the odds of finding:

- One drug = 99%+

- Five drugs = 87%+

Effectively, this approach de-risked biotech funding for the most conservative (and largest) investors in the world.

Neil Kumar — one of Lo’s students — used the framework

And launched BridgeBio Pharma in 2015. Lo was a small investor while megafunds like PE giant KKR and VC fund Sequoia poured in hundreds of millions.

BridgeBio centralizes research and operations functions but spins out new drugs in separate subsidiaries (it’s called the “Andrew model”). Today, BridgeBio has 20 rare disease projects in the pipeline and 4 are in phase 3 trials, per Bloomberg.

The firm IPO’d in 2019 and is worth ~$9B.

For Lo, it’s positive news but there’s more to be done: “The more financing that comes into the industry,” he says, “the faster is the scientific progress we’re going to make.”