If it’s not nice to kick someone while they’re down, then COVID has been quite the car bully.

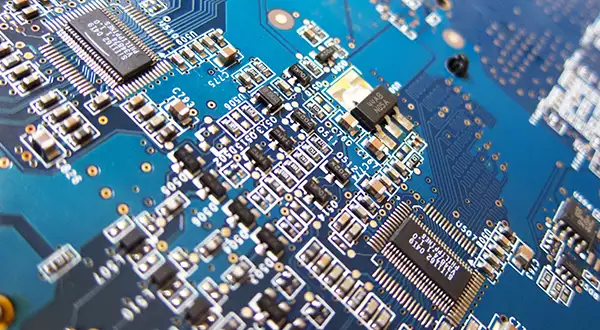

After US auto sales ended 2020 down 15%, the industry is now grappling with a global semiconductor shortage — the result of millions working, schooling, and entertaining themselves from home.

So manufacturers are slashing outputs…

… and making the assembly line industry look more like a dotted line as brands announce pauses in production:

- GM, Toyota, Honda, Volkswagen, Fiat Chrysler, Nissan, and Mazda, all announced Q1 production cuts

- Ford is reducing F-150 production shifts and is expected to drop output by 20% in Q1

Auto companies book revenue immediately after cars are shipped from the factory, so production cuts are less than ideal.

As a result, Ford’s bottom line is expected to trim $1-$2.5B while output across the industry could drop by nearly 1m vehicles this year.

The semiconductor industry is trying to keep up

As cars have modernized, they’ve become increasingly dependent on computing power and electronic tech (think: 17-inch touch screens, Wi-Fi, collision avoidance).

New cars can use 100+ semiconductors and, in 2019, auto manufacturers made up ~10% of the $429B semiconductor market.

Problem is, COVID means everything from PCs to iPhones to data centers to Xboxes (Xboxen?) became essential, leading to chip backlogs 40+ weeks.

But the situation should improve over time

Abroad, Volkswagen is pressuring leaders in Berlin and Brussels to improve local chip production to reduce European manufacturers’ reliance on Asia.

In America, Senators from auto hubs Michigan, Ohio, Tennessee, Wisconsin, Illinois, Indiana, and South Carolina urged the White House to help draw up a solution.

Down the road, companies are planning shifts to all-electric offerings. We’re not experts, but we’ll take a wild guess and say electric vehicles will need semiconductors.

An EV-only future would be cool, so let’s just figure out the chip problem first.