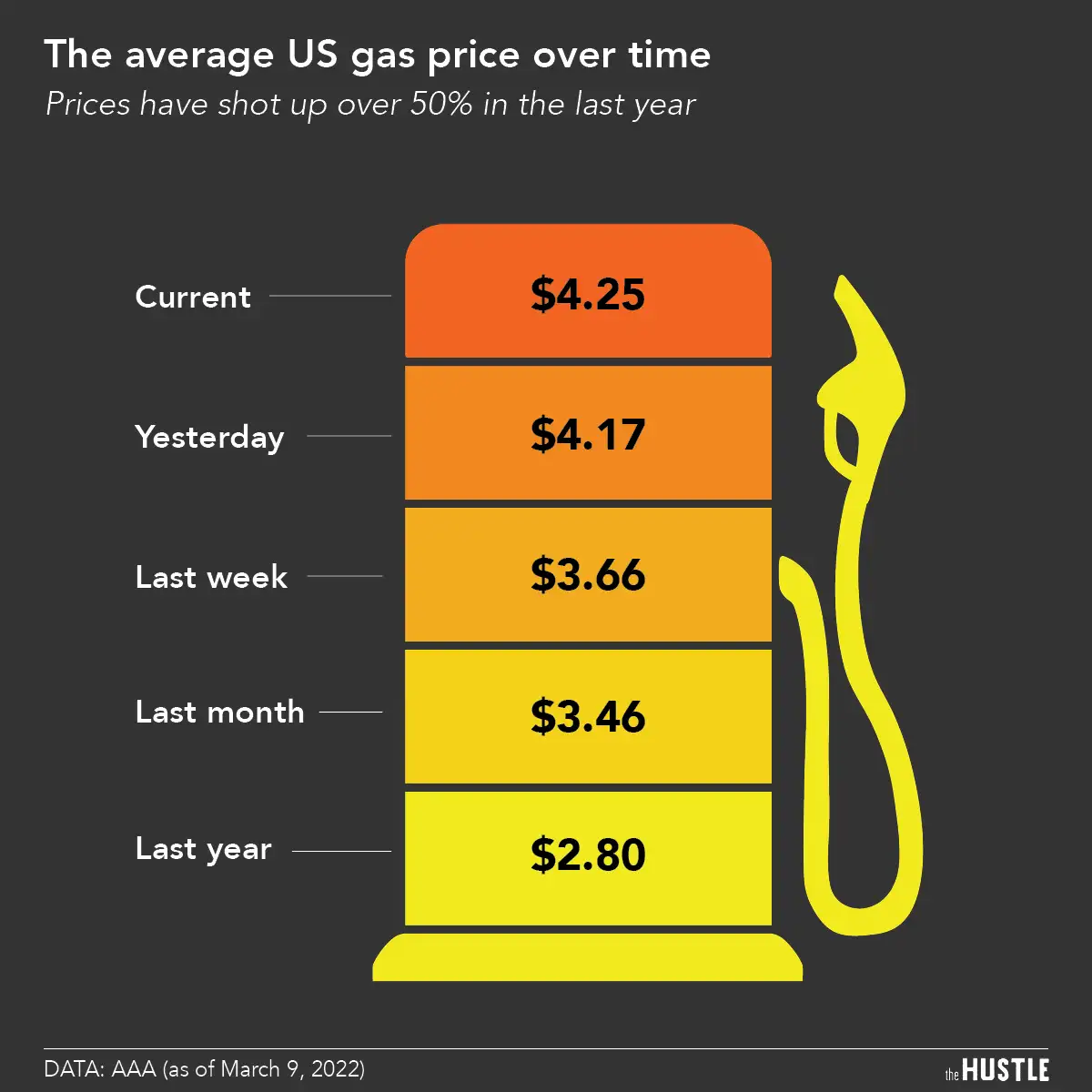

Last year, President Biden slammed Exxon Mobil for making “more money than God.”

That moment underlined a sharp turnaround from 2020, when the pandemic slashed oil prices and ground energy companies to a near-halt. That year, Exxon posted a $22B loss — its first in decades.

Last year, though — as global demand skyrocketed while supply remained tight, especially amid Russia’s invasion of Ukraine — the industry boomed.

Exxon Mobil generated $56B in profit, a record that equates to ~$6.3m every hour.

Here comes the scrutiny

The record profits have sparked renewed pressure on the industry, which has plowed ahead with tens of billions of dollars in dividends and stock buybacks, per NPR.

On Tuesday, the White House called out oil companies for this, and President Biden has previously threatened higher taxes on energy companies that don’t reinvest money into increasing supply.

Interestingly, Europe has imposed a 33% tax on “surplus profits” from energy firms to redistribute to consumers. Exxon sued to block that tax, which it estimates would cost ~$1.8B for 2022.

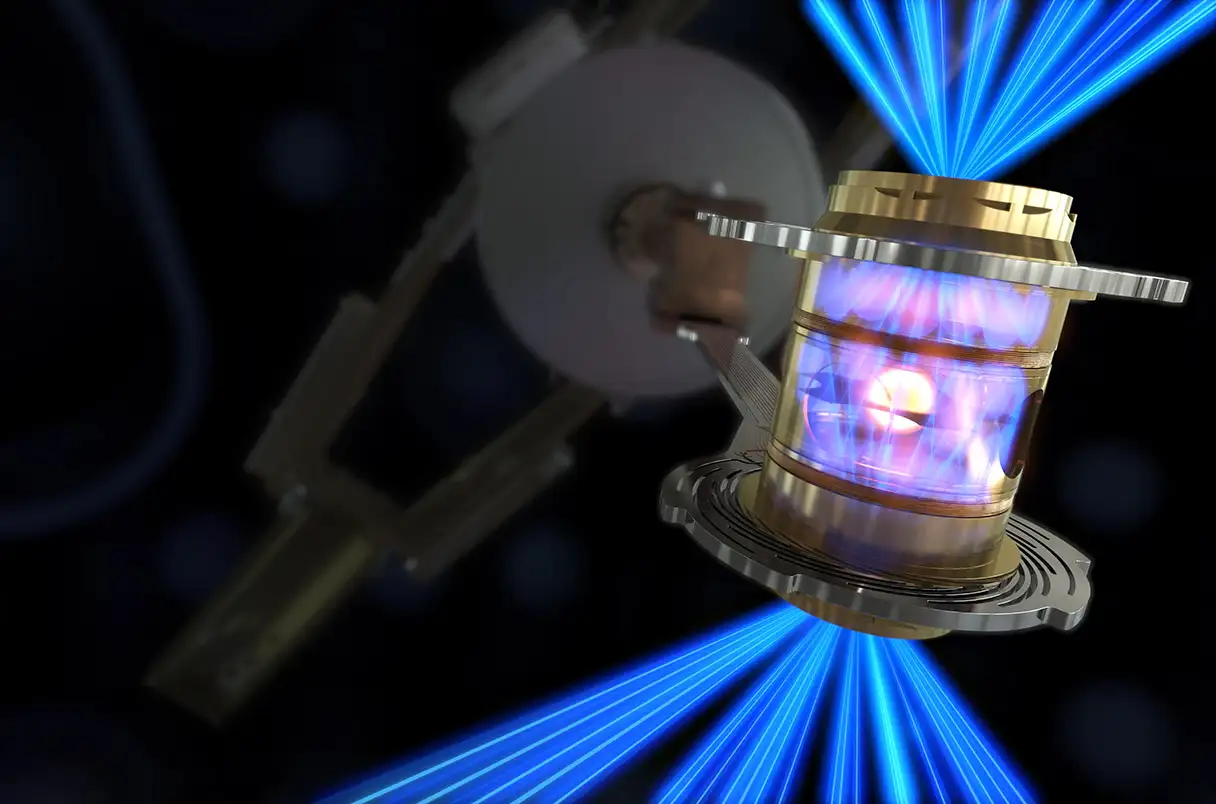

What about renewables?

Some oil giants are reportedly scaling back renewable energy plans as they look to maintain high-performing legacy oil-and-gas businesses, per The Wall Street Journal.

But that doesn’t mean companies aren’t transitioning away from gas in the long term. BP has said it plans to reduce fossil-fuel production by 40% from 2019 levels by 2030, though it’s also considering dialing back investments in solar and wind.

Along those lines, this week, Cathie Wood’s asset management firm Ark Invest released its popular “Big Ideas” report for 2023. The group forecasts that by 2030, with the rise of EVs, oil demand for cars could dip 30%.