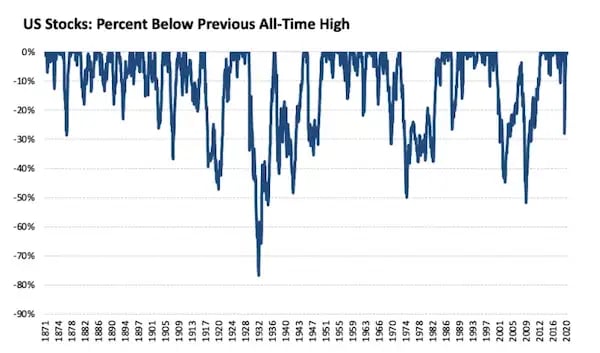

The US stock market has turned $1 into $748k over the last 130 years.

It’s amazing. The greatest wealth-generation machine of all time.

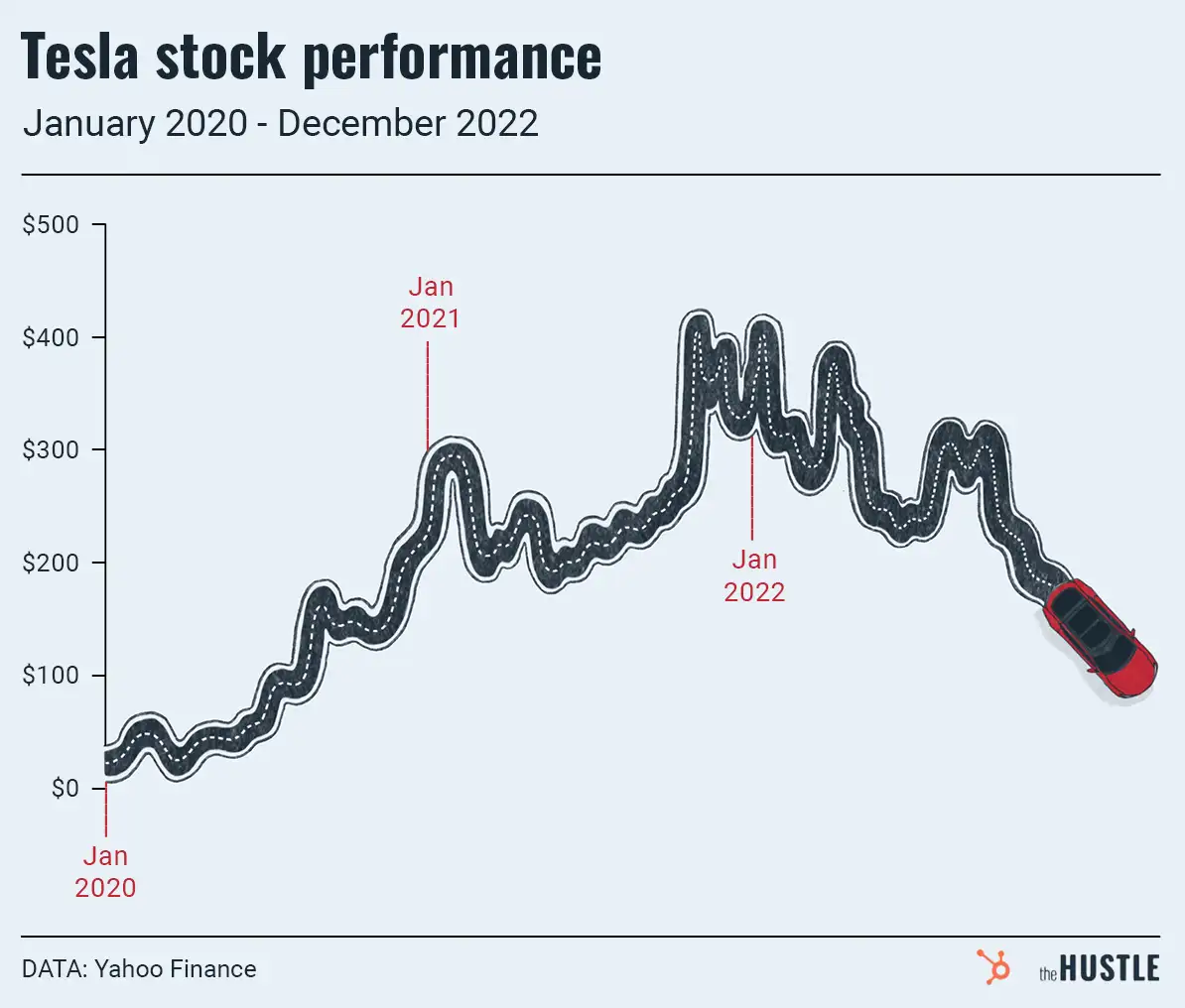

That’s an impractical time frame, but let me show the context of why this matters. Here’s what actually happened during those 130 years of amazing returns:

This is so important. During a period when market returns were extraordinary, it’s common, normal, constant, that stocks are way below their previous all-time high.

Big returns amid constant chaos and volatility is the entire history of the stock market.

But still…

… these declines hurt. They’re never fun.

Two things to keep in mind:

- Nothing is free: There’s a cost of admission that must be paid to do well over time. The world is not so kind that it’ll deliver big returns to people who sacrifice nothing. All durable long-term investing returns have to be earned, deserved.

- The highest cost investors pay is enduring volatility and uncertainty. A big decline doesn’t necessarily mean you did something wrong; most likely you’re just paying the cost of admission to earning good returns over a long period of time.

Your lifetime investing returns are overwhelmingly determined by how you behave when the market gets wild, like it is now. Napoleon’s definition of a military genius was “the man who can do the average thing when everyone else around him is losing his mind.”

It’s the same in investing

If you can remain calm and not dump everything in a panic when the market plunges, you don’t need to make many smart decisions to do well at investing over time.

And remember the ultimate market irony: All past market declines look like opportunities, all future market declines look like risks.