How much money did VCs drop in 2020?

VCs watering startups

Published:

Updated:

Related Articles

-

-

Cloudy with a chance of downfalls: The year ahead for startups

-

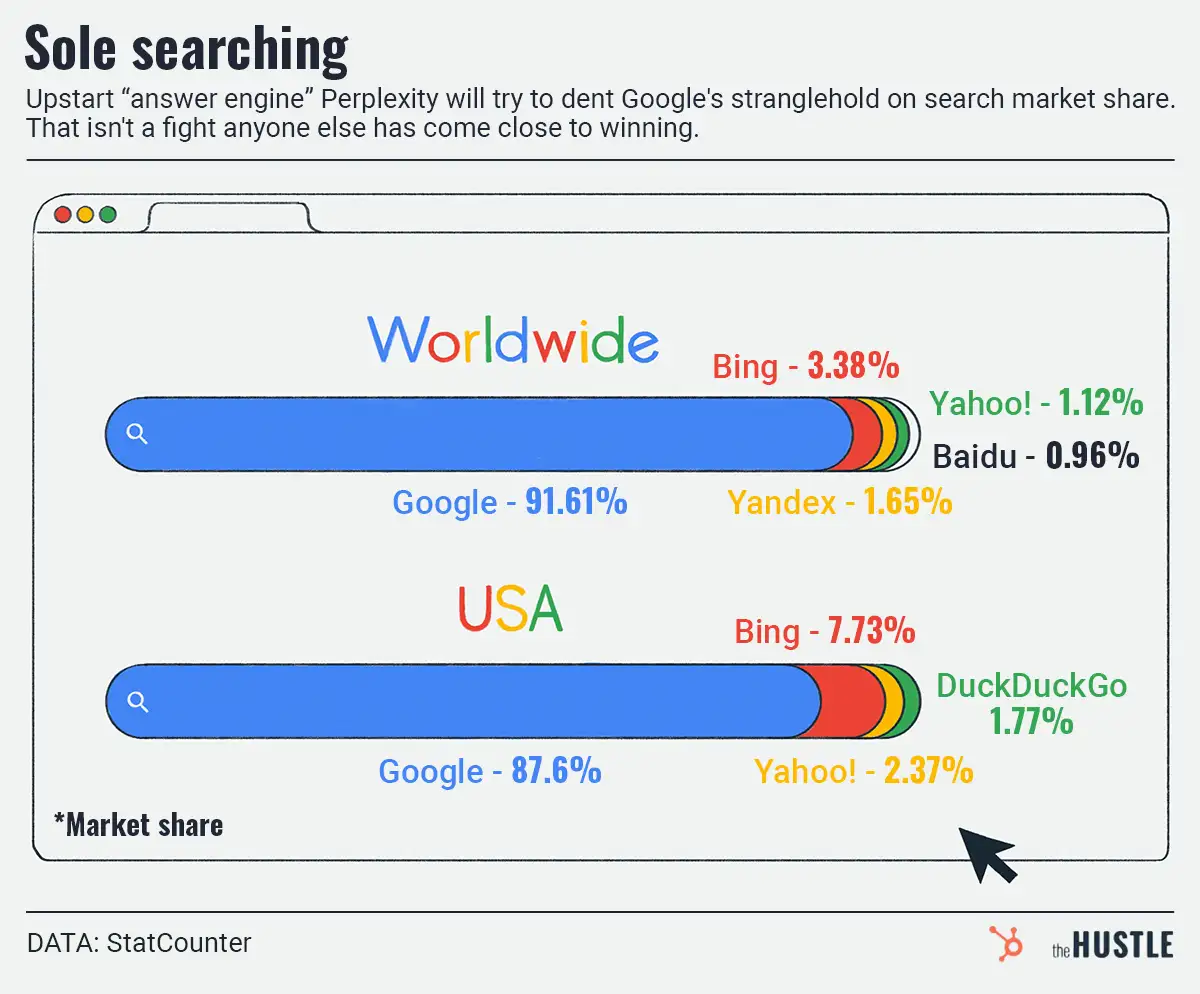

Could a Bezos-backed search startup kick Google’s crown off?

-

Adam Neumann’s apartment startup is here

-

Music you can really feel — no, really

-

After billions of years of the same ol’, same ol’, has water finally been disrupted?

-

Why ‘deaccessioning’ is an art museum controversy

-

What happened with HustleGPT

-

Don’t pretend you aren’t interested in the world’s largest passenger elevator

-

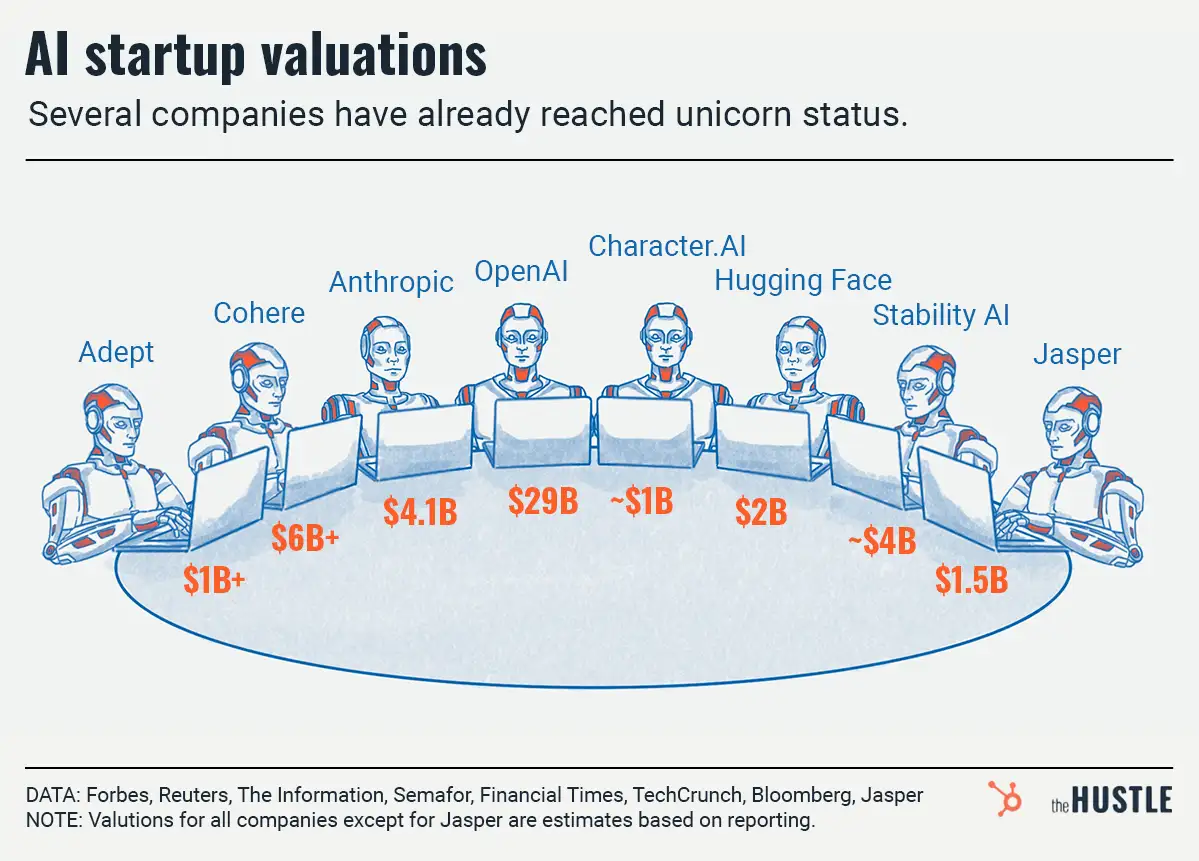

Hello there, AI gold rush