Data Source: Federal Reserve

Inflation is now at the highest level in 40 years.

Nowhere is that more apparent than in housing, where nationwide home prices are now nearly 50% above the levels seen during the 2006 housing bubble.

If you’re in the market for a new home, you know how crazy it’s gotten. Perhaps you’ve been outbid on a home to somebody offering double the asking price.

What’s happening?

All big problems like this are complicated, caused by dozens of different variables.

But here’s a big one, and it’s simple: We just don’t build enough homes.

- Millennials are now the largest cohort of working Americans. Many are now approaching 40 years old, and are eager to finally buy a home. When baby boomers were in a similar spot in the 1970s and 1980s, we were building, on average, about 60% more homes relative to the size of the population.

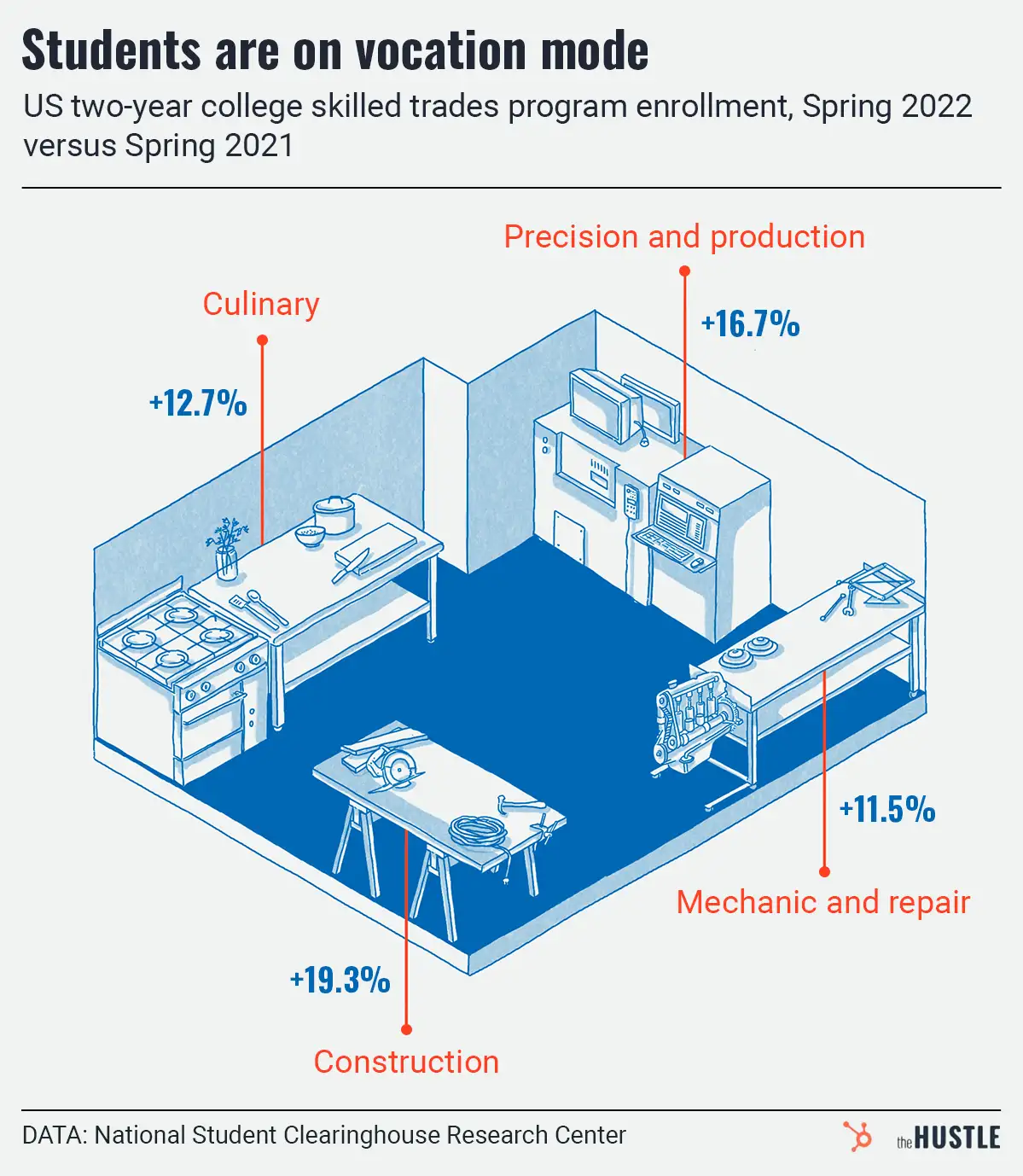

- The housing bust of the mid-2000s shattered the homebuilding industry, and it simply never recovered. There are a quarter fewer carpenters in America today than there were 20 years ago.

Here’s a quirk of surging housing prices that’s easy to overlook:

If you already own a home, the surge is probably a wash for you, because if you sell a house that’s gone up in value you probably use the proceeds to purchase another house that’s gone up in value.

But if you’re a 1st-time homebuyer, oof. It’s brutal. Rising home prices mean you have to come up with a higher and higher down payment — if you can find a house at all.

It’s time to build.