Photo Illustration by Omar Marques/SOPA Images/LightRocket via Getty Images

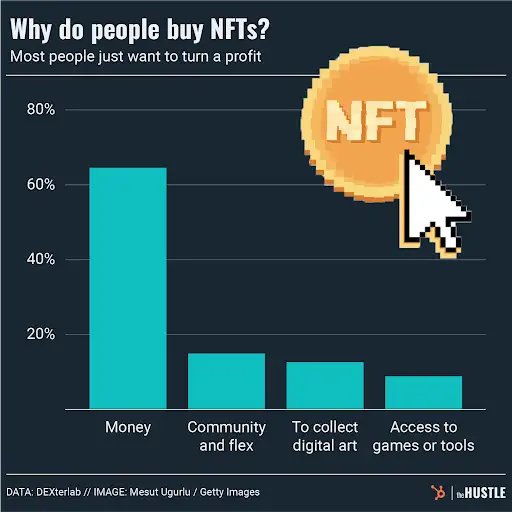

Non-fungible tokens (NFTs) were perhaps the biggest breakout crypto asset in 2021.

Based on a buzzy investment round earlier this week, the story looks to continue in 2022: OpenSea, an NFT marketplace, is now valued at $13.3B after raising $300m.

OpenSea was founded in 2017

It is now the go-to platform to buy and sell NFTs — unique digital assets linked to the blockchain.

The most prominent NFTs are digital art collections, like CryptoPunks and Bored Ape Yacht Club, which can start at 6 figures for a single image (owners often post them in their social profile pictures as a flex).

Countless other NFT projects — including basically any random cartoon animal you can think of — are much less valuable…

… but OpenSea’s trading volume is huge

Per Crypto Briefing, the company facilitated $14B of transactions in 2021, a 646x increase from ~$22m in 2020.

OpenSea charges a 2.5% transaction fee, which keeps piling up; trading volume has already passed $1B in 2022.

Not everyone is happy, though

Last week, OpenSea froze $2.2m worth of stolen NFTs. Adherents of crypto — who emphasize the value of decentralization — are wary of a central authority making a unilateral decision.

As tech analyst Ben Thompson points out, the stolen NFTs can still be transferred between individuals on the blockchain.

However, there is more demand for NFTs on OpenSea than off of it, which means the platform almost certainly offers sellers the highest price and best liquidity.

To Thompson, this is why OpenSea is valued at $13B+. Yes, the company is technically “centralized,” but that’s what most end users will want for their unique cartoon animals.