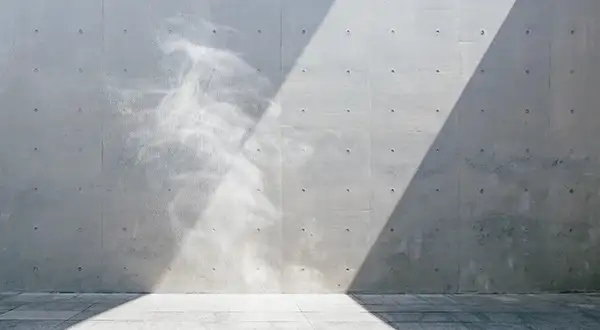

Photo source: GE

Back in 2000, General Electric (GE) had a massive market cap of $600B+ and was the most valuable firm in the world.

Today, after years of corporate misadventures and a slowing of innovation, the industrial conglomerate’s market cap has winnowed to $94B.

To reach its old heights, GE is betting big on offshore wind power with the creation of Haliade-X, the world’s most powerful turbine.

Capital investment in offshore wind is worth $26B…

… more than triple what it was 10 years ago, according to the New York Times.

In recent times, energy giants like BP and Shell have made huge investments to hedge against the decline of oil.

GE made its first foray into the industry in 2002 when it bought the land-based wind business from everyone’s favorite corporate punching bag, Enron.

In 2015, it made a huge splash into offshore wind by acquiring the power business of French conglomerate Alstom for $17B.

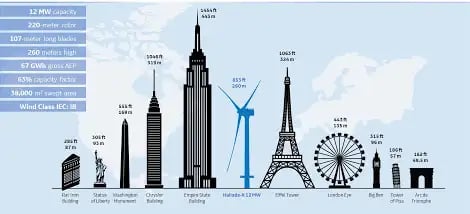

The Haliade-X project is comically big

According to the NYT, GE’s wind turbine:

- is ~80% the height of the Empire State Building

- has a turning diameter of 2+ football fields

- can power a home for 2 days with one rotation

It’s ⅓ more powerful than the current offshore wind turbine and can generate ~30x more energy than the first offshore wind project installed in Denmark in 1991.

Size matters in wind turbines

Large machines can better combat harsh marine weather environments. They also create more electricity, which means:

- More revenue

- Fewer turbines needed to be installed and maintained

With Haliade-X, GE has won an estimated $13B in contracts from Denmark to Massachusetts.At present, offshore only accounts for ~5% of wind power output. But GE’s bet has room for growth and could one day help it party like it’s 2000.