It’s a deal that would have broken the internet: Apple acquiring Tesla.

According to Elon Musk, the Tesla CEO reached out to Apple’s CEO Tim Cook in 2017-18 to discuss a possible deal, but — as they say in official M&A language — Cook ghosted.

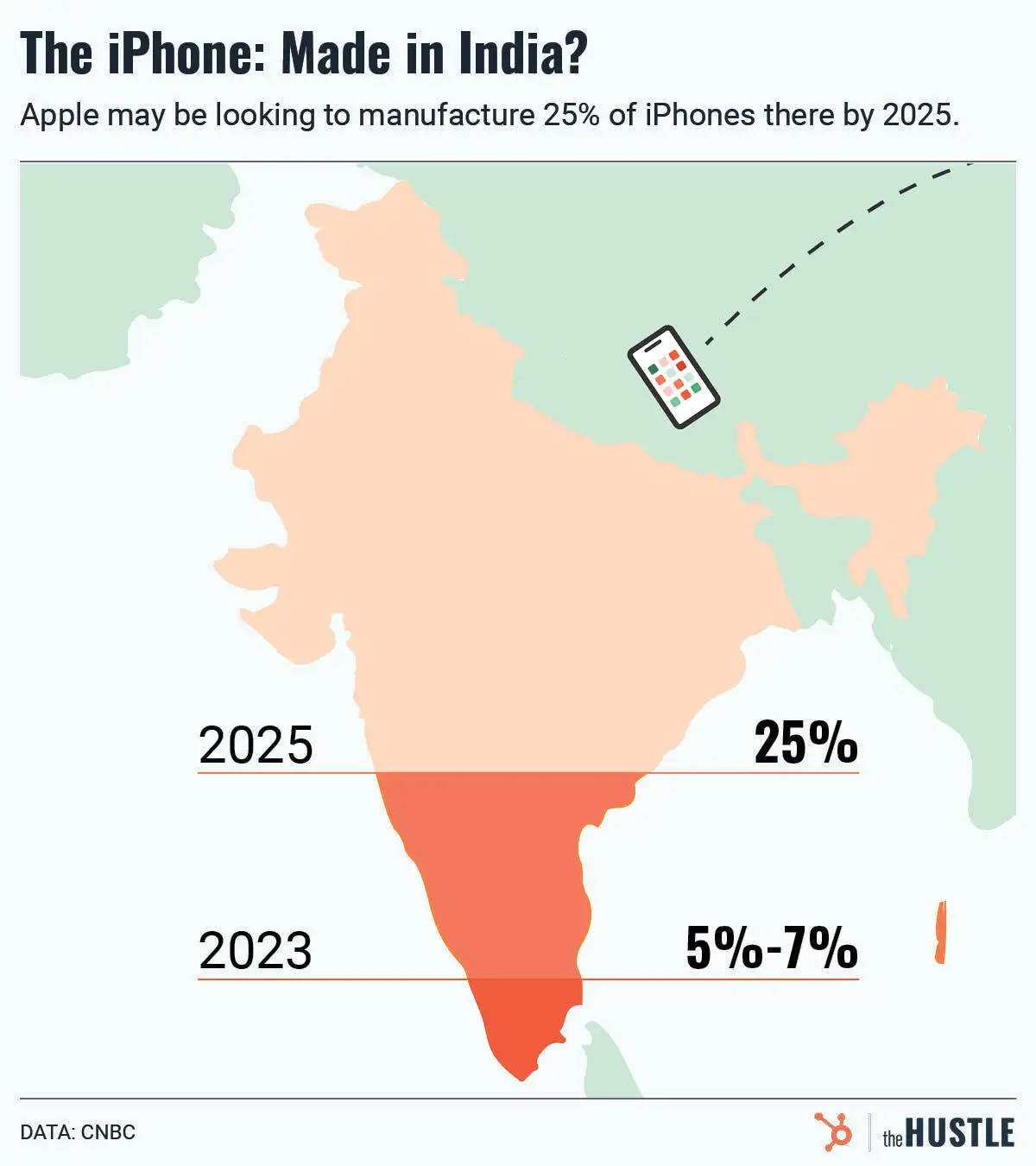

This revelation came a day after Reuters recently reported that Apple was aiming to have car production online by 2024.

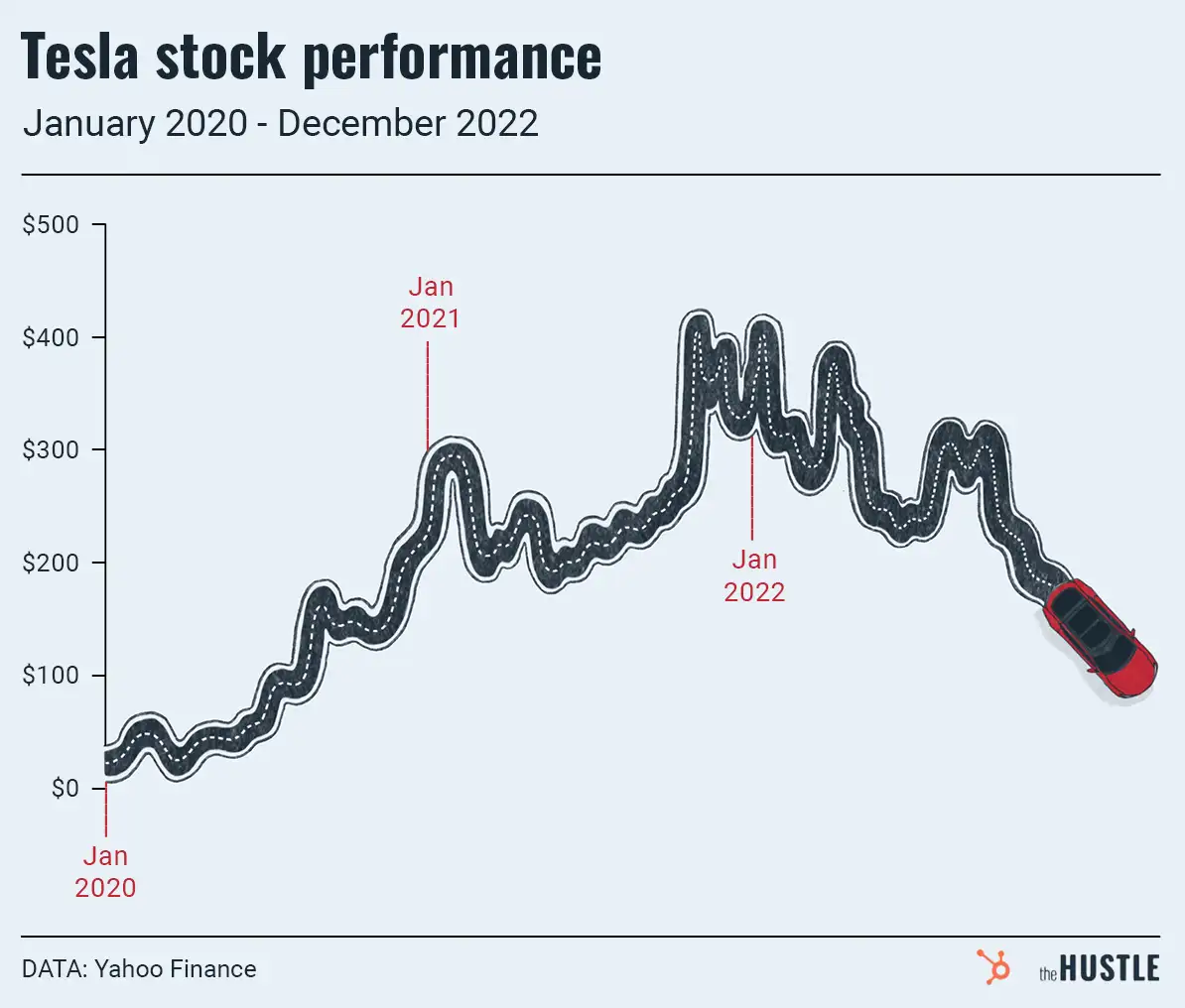

Tesla was worth ~$60B when Musk reached out…

…1/10th of its current market value. Apple did have the cash on hand at the time (~$120B) to make a deal at those eye-watering numbers.

However, such an acquisition simply doesn’t fit into Apple’s M&A playbook. According to Apple analyst Neil Cybart, there are 3 business components that Apple doesn’t look for in an acquisition:

- Brand: Apple already has the world’s leading brand.

- Revenue: It grows revenue through internal efforts, not acquisition.

- User base: Apple already has 1B+ users that will happily buy anything it sells.

Neither Tesla’s sterling brand nor its loyal fan base would have been much use to Apple.

What does Apple use M&A for?

According to Cybart, Apple typically acquires a company for technology or talent.

Consider Apple’s biggest acquisition: Beats Electronics for $3.2B in 2014. While the Beats brand was well-known, the lasting legacy from the acquisition is the underlying tech and know-how that has powered Apple Music and the expanding AirPods line.

Instead of spending tens of billions to acquire Tesla, Apple has gone the much cheaper route of selectively poaching talent.

The biggest name poached: Doug Field

He is a former Apple employee who left for Tesla in 2013. After 5 years working with Musk, Field was one of 46 employees who left Tesla for Apple in 2018.

He heads Apple’s car project (“Project Titan”) and — per Reuters — must now decide if Apple will manufacture its own car or license its auto software to a third party.

While Apple didn’t get to break the internet with a Tesla acquisition, we all know it’s gonna get cray when the iCar hits in the next few years.